Virginia Form R 1 2011

What is the Virginia Form R 1

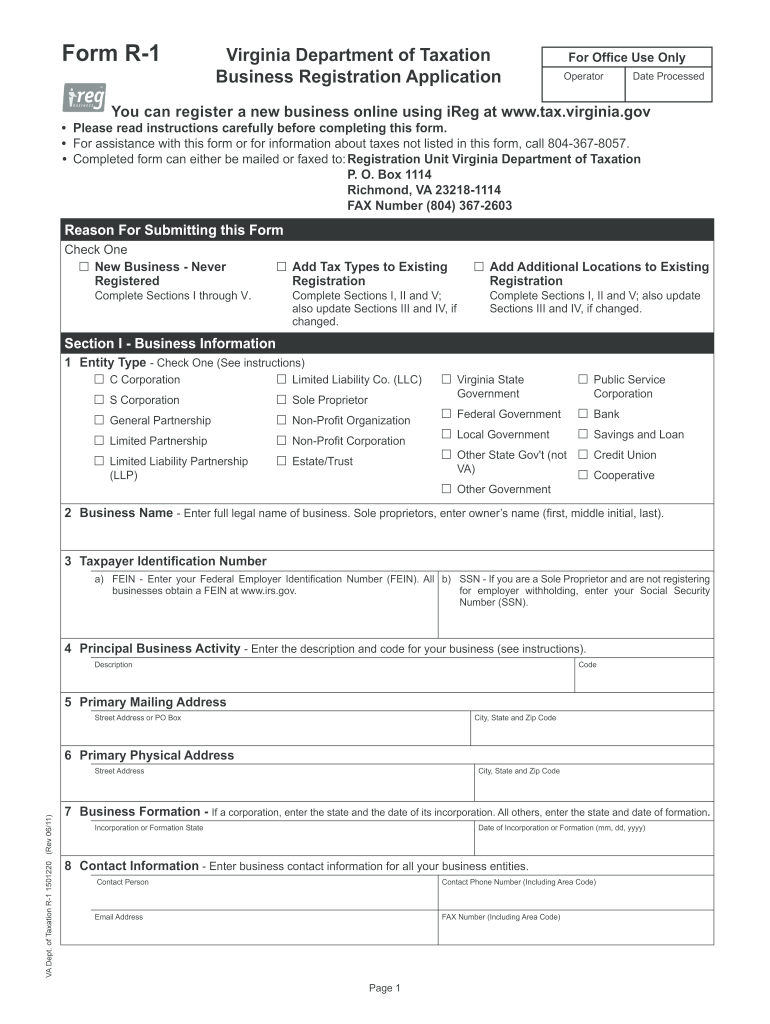

The Virginia Form R 1 is a tax document used by individuals and businesses to report income and calculate tax liabilities in the state of Virginia. This form is essential for ensuring compliance with state tax regulations and is specifically designed to capture various income sources, deductions, and credits applicable to Virginia taxpayers. Understanding the purpose and requirements of the Virginia Form R 1 is crucial for accurate tax reporting and timely submission.

How to use the Virginia Form R 1

Using the Virginia Form R 1 involves several steps to ensure that all necessary information is accurately reported. Taxpayers should begin by gathering all relevant financial documents, including W-2s, 1099s, and any other income statements. Once the required information is collected, taxpayers can fill out the form, ensuring that each section is completed according to the instructions provided. After completing the form, it must be signed and submitted to the appropriate Virginia tax authority.

Steps to complete the Virginia Form R 1

Completing the Virginia Form R 1 requires careful attention to detail. Follow these steps for accurate completion:

- Gather all income documents, including W-2s and 1099s.

- Fill out personal information, including name, address, and Social Security number.

- Report all income sources in the designated sections.

- Calculate deductions and credits applicable to your situation.

- Review the completed form for accuracy.

- Sign and date the form.

- Submit the form electronically or via mail to the Virginia Department of Taxation.

Key elements of the Virginia Form R 1

The Virginia Form R 1 contains several key elements that are vital for accurate tax reporting. These include:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Reporting: Taxpayers must report various income types, including wages, salaries, and self-employment income.

- Deductions and Credits: This part allows taxpayers to claim eligible deductions and credits that can reduce their overall tax liability.

- Signature Section: A signature is required to validate the form, confirming that the information provided is accurate.

Filing Deadlines / Important Dates

Filing deadlines for the Virginia Form R 1 are crucial for taxpayers to avoid penalties. Generally, the form must be submitted by May 1 for the previous tax year. If May 1 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to state regulations or special circumstances.

Form Submission Methods

The Virginia Form R 1 can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online Submission: Taxpayers can file electronically through the Virginia Department of Taxation's online portal.

- Mail: The completed form can be printed and mailed to the appropriate tax office.

- In-Person: Taxpayers may also choose to submit the form in person at designated tax offices.

Quick guide on how to complete virginia form r 1

Your assistance manual on how to prepare your Virginia Form R 1

If you're curious about how to generate and submit your Virginia Form R 1, here are some brief guidelines to simplify tax submission.

To begin, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, generate, and complete your income tax paperwork effortlessly. Utilizing its editor, you can switch between text, checkboxes, and eSignatures and revert to amend details when necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the steps below to complete your Virginia Form R 1 in just a few minutes:

- Establish your account and start handling PDFs within moments.

- Utilize our directory to locate any IRS tax document; examine various versions and schedules.

- Select Get form to access your Virginia Form R 1 in our editor.

- Populate the mandatory fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any mistakes.

- Store changes, print your copy, dispatch it to your recipient, and download it to your device.

Make the most of this guide to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper can increase the chances of return errors and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct virginia form r 1

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out the regional centre code in IGNOU OpenMat Form 1?

IGNOU OPENMAT Entrance Application Forms & Procedureplease view this link

-

Need to fill out Form 10C and Form 19. Where can I get a 1 rupee revenue stamp in Bangalore?

I believe you are trying to withdraw PF. If that is correct, then I think its not a mandatory thing as I was able to submit these forms to my ex-employer without the stamp. I did receive the PF!

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the virginia form r 1

How to create an electronic signature for the Virginia Form R 1 in the online mode

How to create an eSignature for the Virginia Form R 1 in Chrome

How to make an eSignature for signing the Virginia Form R 1 in Gmail

How to create an eSignature for the Virginia Form R 1 straight from your smart phone

How to generate an eSignature for the Virginia Form R 1 on iOS

How to create an eSignature for the Virginia Form R 1 on Android OS

People also ask

-

What is the Virginia Form R 1 and why is it important?

The Virginia Form R 1 is a critical tax document used for reporting income and calculating tax liabilities in Virginia. Understanding and accurately completing this form is essential for compliance with state tax regulations, helping businesses avoid penalties and ensuring they benefit from any eligible deductions.

-

How does airSlate SignNow simplify the process of completing the Virginia Form R 1?

airSlate SignNow streamlines the completion of the Virginia Form R 1 by providing an intuitive eSigning platform that allows users to fill, sign, and send documents securely online. This eliminates the hassle of traditional paperwork, speeding up the process and reducing the likelihood of errors.

-

Is airSlate SignNow cost-effective for businesses needing the Virginia Form R 1?

Yes, airSlate SignNow offers a cost-effective solution for businesses that need to manage and sign documents like the Virginia Form R 1. With flexible pricing plans, companies can choose an option that aligns with their budget and document management needs, all while ensuring easy compliance with Virginia state requirements.

-

Can I integrate airSlate SignNow with other software when handling the Virginia Form R 1?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of software applications, making it easier to manage your documents, including the Virginia Form R 1. Popular integrations include CRM systems, accounting software, and cloud storage services, enhancing your overall workflow.

-

What security features does airSlate SignNow offer for the Virginia Form R 1?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the Virginia Form R 1. The platform employs advanced encryption protocols and complies with industry standards to ensure that all your documents are secure, protecting your sensitive information.

-

How do I get started with airSlate SignNow for the Virginia Form R 1?

Getting started with airSlate SignNow is simple! Just sign up for an account, and you can begin creating, sending, and eSigning documents like the Virginia Form R 1 in no time. The user-friendly interface and step-by-step guides make the onboarding process quick and efficient.

-

Can airSlate SignNow help me track the status of my Virginia Form R 1 submissions?

Yes, airSlate SignNow provides real-time tracking for your document submissions, including the Virginia Form R 1. You can easily monitor who has viewed, signed, or completed the document, giving you peace of mind that your submissions are being managed effectively.

Get more for Virginia Form R 1

- Authorization in a new state form

- Nj transit application fill online printable fillable blank pdffiller form

- Calculation of federal taxable income for s corporations 2018 form

- This form is available electronically nrcs usda

- Department of revenue south carolina form

- Multistate fixedadjustable rate note 1 year treasury index form 3522 single family fannie mae uniform instrument

- Tsp 3 designation of beneficiary form

- Cargo loss amp damage claim form

Find out other Virginia Form R 1

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now