Form Rrb 1099 R PDF

What is the Form RRB 1099 R?

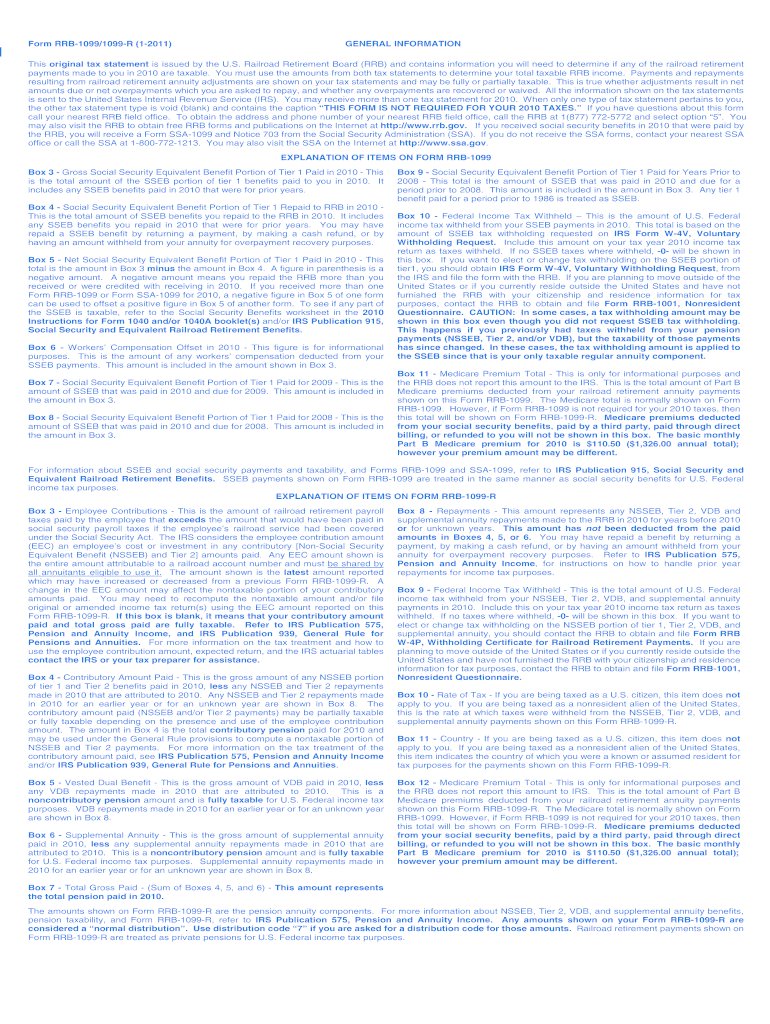

The Form RRB 1099 R is a tax document issued by the Railroad Retirement Board (RRB) to report distributions from pensions, annuities, and other retirement plans. This form is essential for individuals who receive retirement benefits under the Railroad Retirement Act. It provides crucial information regarding the total amount distributed during the tax year, which is necessary for accurate tax reporting. Understanding this form is vital for ensuring compliance with IRS regulations.

How to Use the Form RRB 1099 R

Using the Form RRB 1099 R involves several key steps. First, individuals must review the information provided on the form, including the total distribution amount and any federal income tax withheld. This information should be accurately reported on the individual's tax return. It is important to keep the form for personal records and refer to it when preparing taxes. If there are discrepancies, individuals should contact the RRB for clarification.

Steps to Complete the Form RRB 1099 R

Completing the Form RRB 1099 R requires careful attention to detail. Follow these steps:

- Gather necessary personal information, including your Social Security number and any relevant tax documents.

- Fill out the form with accurate distribution amounts as reported by the RRB.

- Ensure that any federal income tax withheld is correctly noted.

- Review the completed form for accuracy before submission.

- Keep a copy for your records and submit it with your tax return.

Legal Use of the Form RRB 1099 R

The legal use of the Form RRB 1099 R is governed by IRS regulations. This form serves as an official record of retirement distributions and must be used for tax reporting purposes. Failure to report the amounts accurately can lead to penalties or audits. It is essential to ensure that the information on the form aligns with IRS requirements to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form RRB 1099 R typically align with federal tax deadlines. Individuals should be aware that the form must be submitted along with their annual tax return, usually due by April fifteenth. It is advisable to review any updates from the IRS or the RRB regarding specific deadlines, as they may vary slightly from year to year.

Who Issues the Form RRB 1099 R

The Form RRB 1099 R is issued by the Railroad Retirement Board, a federal agency that administers retirement benefits for railroad workers. The RRB is responsible for ensuring that individuals receive accurate information regarding their retirement distributions. If there are questions or concerns about the form, individuals should contact the RRB directly for assistance.

Quick guide on how to complete sample rrb 1099 r form

Complete Form Rrb 1099 R Pdf effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without issues. Manage Form Rrb 1099 R Pdf on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Form Rrb 1099 R Pdf with ease

- Locate Form Rrb 1099 R Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize necessary sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form Rrb 1099 R Pdf and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How many candidates applied for IBPS RRB 2018?

Fill rti you will come to know.

-

What is the last date to fill out the form of a technician post RRB?

Railway Recruitment Board invites online applications for the technical posts in Indian Railway.The Board has announced the notification for ALP & Technician posts.This notification has been released on 3 November 2018.Candidates can check the complete information for this notification from here – RRB ALP 2018.The last date to complete your registration is 31 March 2018.There are 26502 posts for RRB ALP & Technicians.So hurry up and fill the registration form.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

Create this form in 5 minutes!

How to create an eSignature for the sample rrb 1099 r form

How to generate an eSignature for the Sample Rrb 1099 R Form online

How to make an eSignature for your Sample Rrb 1099 R Form in Google Chrome

How to create an eSignature for putting it on the Sample Rrb 1099 R Form in Gmail

How to generate an eSignature for the Sample Rrb 1099 R Form straight from your smart phone

How to generate an eSignature for the Sample Rrb 1099 R Form on iOS

How to generate an electronic signature for the Sample Rrb 1099 R Form on Android OS

People also ask

-

What is the Form Rrb 1099 R Pdf and why do I need it?

The Form Rrb 1099 R Pdf is used for reporting retirement benefits from the Railroad Retirement Board. If you receive pension benefits or annuities, this form is essential for tax reporting purposes. Using airSlate SignNow, you can easily access, sign, and manage your Form Rrb 1099 R Pdf online.

-

How can I fill out the Form Rrb 1099 R Pdf using airSlate SignNow?

Filling out the Form Rrb 1099 R Pdf with airSlate SignNow is simple. You can upload the PDF, fill in the necessary fields, and eSign directly within the platform. This streamlines the process and ensures your form is completed accurately.

-

Is there a cost to use airSlate SignNow for Form Rrb 1099 R Pdf?

airSlate SignNow offers flexible pricing plans, allowing businesses to choose the best option for their needs. While there may be a nominal fee for premium features, signing and sending the Form Rrb 1099 R Pdf can often be done for free. Explore our pricing page to find the right plan for you.

-

Can I integrate airSlate SignNow with other applications for managing Form Rrb 1099 R Pdf?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow for managing the Form Rrb 1099 R Pdf. You can seamlessly connect with platforms like Google Drive, Dropbox, and more, allowing for efficient document management and storage.

-

What features does airSlate SignNow offer for signing the Form Rrb 1099 R Pdf?

airSlate SignNow provides a range of features tailored for signing the Form Rrb 1099 R Pdf, including customizable templates, secure eSignature options, and real-time tracking. These features ensure that your documents are signed quickly and securely, enhancing your overall efficiency.

-

Is the Form Rrb 1099 R Pdf secure when using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards to protect your Form Rrb 1099 R Pdf. You can rest assured that your sensitive information remains confidential and secure throughout the signing process.

-

Can I send the Form Rrb 1099 R Pdf to multiple recipients?

Yes, airSlate SignNow allows you to send the Form Rrb 1099 R Pdf to multiple recipients effortlessly. You can specify the order of signing and keep track of who has signed and who hasn’t, ensuring a smooth and organized workflow.

Get more for Form Rrb 1099 R Pdf

- Fill out fill out fill out fill out fill out fill out fill out fill out fill out fill out fill out fill out fill out fill out 416850860 form

- Maryland cds 2012 2019 form

- Cms 20031 transfer of appeal rights transfer of appeal rights cms 20031 acceptence of appeal rights form

- Peachcare application form

- Non employee payment request form infohub

- Obtain a site safety manager certification nycgov form

- If yes may we contact your present employer form

- Nonresident military nrm vehicle license fee exemption form

Find out other Form Rrb 1099 R Pdf

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online