Form 949

What is the Form 949

The Form 949 is a specific document used in the United States for various administrative purposes, particularly within the realm of tax and legal compliance. This form may be required by certain government agencies or organizations to gather essential information from individuals or businesses. Understanding the purpose and requirements of the Form 949 is crucial for ensuring compliance and avoiding potential penalties.

How to use the Form 949

Using the Form 949 involves several key steps to ensure that it is filled out correctly and submitted properly. First, identify the specific requirements associated with the form, as these can vary depending on the context in which it is used. Next, gather all necessary information and documentation that may be required to complete the form accurately. Once the form is filled out, review it for any errors or omissions before submitting it to the appropriate agency or organization.

Steps to complete the Form 949

Completing the Form 949 requires careful attention to detail. Here are the steps to follow:

- Read the instructions thoroughly to understand what information is needed.

- Collect all relevant documents and data, such as identification numbers and financial information.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Double-check for any mistakes or missing information.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Form 949

The legal use of the Form 949 is governed by specific regulations that dictate how it must be completed and submitted. To ensure that the form is legally binding, it is essential to comply with all relevant laws, including those related to electronic signatures if applicable. Using a reliable platform for eSigning can enhance the legal validity of the form by providing necessary documentation and compliance with eSignature laws.

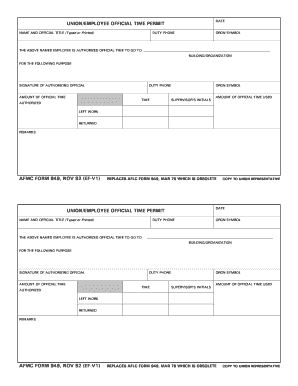

Key elements of the Form 949

Several key elements must be included when filling out the Form 949 to ensure its validity. These elements typically include:

- Personal or business identification information.

- Details regarding the purpose of the form.

- Any required signatures or authorizations.

- Supporting documentation, if necessary.

Form Submission Methods

The Form 949 can be submitted through various methods, depending on the requirements set by the issuing agency. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate address.

- Delivering the form in person to the relevant office.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Form 949 can lead to various penalties. These may include fines, legal repercussions, or delays in processing related applications. It is important to understand the implications of non-compliance and to ensure that the form is completed and submitted correctly to avoid any potential issues.

Quick guide on how to complete form 949

Prepare Form 949 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed materials, as you can access the correct format and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Form 949 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form 949 with ease

- Find Form 949 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form 949 and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 949

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 949 and how can airSlate SignNow help with it?

Form 949 is a specialized form used in various business processes. With airSlate SignNow, you can easily create, send, and eSign form 949, streamlining your document management. Our platform ensures that your form remains secure and accessible.

-

Is there a cost associated with using airSlate SignNow for form 949?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes access to essential features for managing and eSigning documents like form 949. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing form 949?

airSlate SignNow offers features such as customizable templates, real-time tracking, and team collaboration tools specifically for managing form 949. These features ensure that your workflow is efficient and your documents are handled seamlessly.

-

Can I integrate airSlate SignNow with other software while working with form 949?

Absolutely! airSlate SignNow supports multiple integrations with popular applications, allowing you to incorporate form 949 into your existing workflows. This enhances efficiency and ensures all your tools work together smoothly.

-

Is it easy to use airSlate SignNow for eSigning form 949?

Yes, airSlate SignNow is designed with user-friendliness in mind. You can eSign form 949 in just a few clicks, making the entire signing process quick and straightforward, even for those who are not tech-savvy.

-

What are the benefits of using airSlate SignNow for form 949 eSigning?

Using airSlate SignNow for eSigning form 949 offers numerous benefits, including enhanced security, reduced turnaround time, and improved document management. You can also save costs on printing and mailing, making it an environmentally friendly choice.

-

How does airSlate SignNow ensure the security of my form 949?

airSlate SignNow employs industry-standard encryption and other robust security measures to protect your form 949 and other documents. You can trust that your sensitive information remains confidential and secure.

Get more for Form 949

- Cardholder request form_111519

- Form 11 revenue commissioners

- Vat1614j opting to tax land and buildings vat1614j opting to tax land and buildings form

- What does a joint petition divorce meanlegalzoom legal info form

- Claim to personal allowances and tax repayment by an individual not resident in the uk claim to personal allowances and tax form

- Jv 457 twenty four month permanency attachment judicial council forms

- Parte sin abogado o abogado form

- Fl 530 california courts cagov form

Find out other Form 949

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now