R43 Form 2019

What is the R43 Form

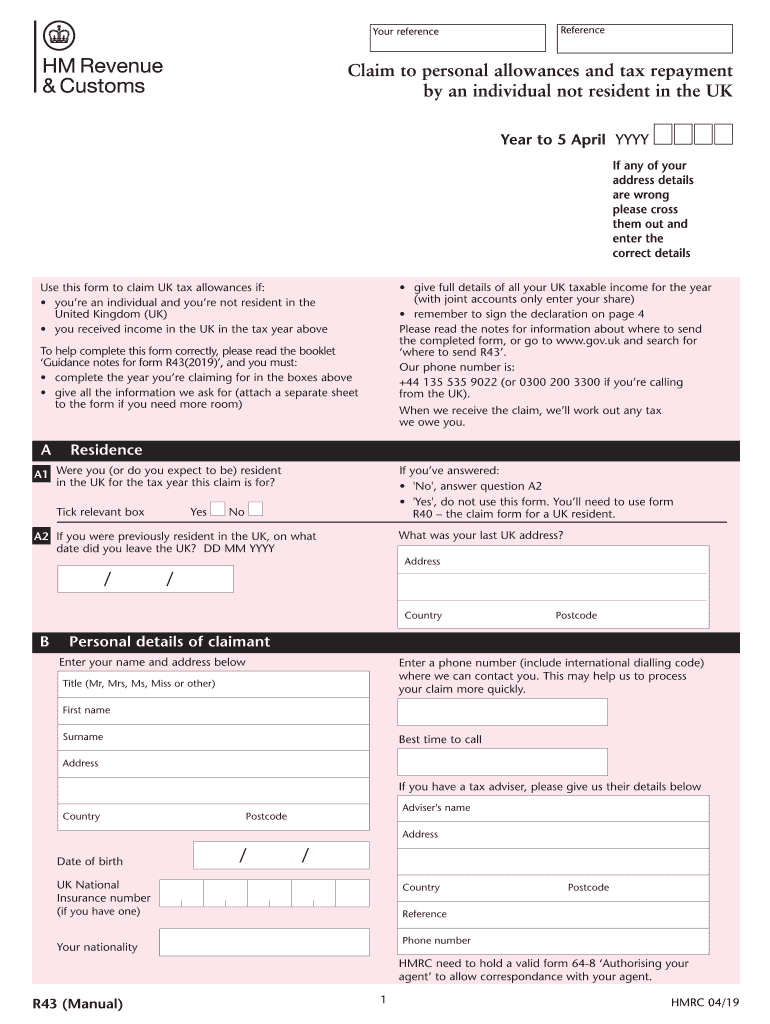

The R43 form, also known as the HMRC form R43 2018, is a tax document used in the United Kingdom for individuals who have received income from abroad and need to report it for tax purposes. This form is particularly relevant for those who are not residents of the UK but have UK income that may be subject to taxation. The R43 form helps taxpayers claim relief from UK tax on foreign income, ensuring compliance with tax regulations.

How to use the R43 Form

Using the R43 form involves several steps to ensure accurate reporting of foreign income. First, gather all necessary documentation regarding your income from abroad. Next, fill out the form by providing details such as your personal information, the nature of the income, and any tax relief you are claiming. After completing the form, review it for accuracy and submit it to HMRC as instructed. It is essential to keep a copy of the submitted form for your records.

Steps to complete the R43 Form

Completing the R43 form requires attention to detail. Follow these steps:

- Gather all relevant income documents, including payslips and tax statements from foreign sources.

- Provide personal details, including your name, address, and National Insurance number.

- Detail the foreign income you received, specifying the amounts and the currency.

- Indicate any tax relief you are claiming, ensuring you meet the eligibility criteria.

- Review the form for accuracy before submission.

Legal use of the R43 Form

The R43 form must be used in accordance with UK tax laws. It is legally binding when completed accurately and submitted on time. To ensure compliance, taxpayers should familiarize themselves with HMRC regulations regarding foreign income and tax relief. Using the form correctly can help avoid penalties and ensure that taxpayers do not pay more tax than necessary on their foreign earnings.

Filing Deadlines / Important Dates

Timely submission of the R43 form is crucial to avoid penalties. Generally, the deadline for filing the form aligns with the end of the tax year in the UK, which is April fifth. Taxpayers should be aware of any specific deadlines set by HMRC for submitting the R43 form, especially if they are claiming tax relief. Keeping track of these dates helps ensure compliance and avoids unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

The R43 form can be submitted through various methods. Taxpayers may choose to file the form online via the HMRC website, which is often the most efficient option. Alternatively, the form can be printed and mailed to HMRC. In some cases, individuals may also submit the form in person at designated HMRC offices. Each submission method has its own processing times, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete claim to personal allowances and tax repayment by an individual not resident in the uk claim to personal allowances and tax

Complete R43 Form effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without any holdups. Handle R43 Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign R43 Form with ease

- Locate R43 Form and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign R43 Form and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim to personal allowances and tax repayment by an individual not resident in the uk claim to personal allowances and tax

Create this form in 5 minutes!

How to create an eSignature for the claim to personal allowances and tax repayment by an individual not resident in the uk claim to personal allowances and tax

How to create an electronic signature for the Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The Uk Claim To Personal Allowances And Tax online

How to generate an eSignature for your Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The Uk Claim To Personal Allowances And Tax in Chrome

How to make an eSignature for putting it on the Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The Uk Claim To Personal Allowances And Tax in Gmail

How to create an eSignature for the Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The Uk Claim To Personal Allowances And Tax straight from your smart phone

How to generate an eSignature for the Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The Uk Claim To Personal Allowances And Tax on iOS

How to create an eSignature for the Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The Uk Claim To Personal Allowances And Tax on Android devices

People also ask

-

What is the r43 2018 form and how can airSlate SignNow help?

The r43 2018 form is a specific document that requires accurate completion and timely submission. airSlate SignNow provides a seamless eSigning solution that simplifies the entire process, allowing you to fill out, sign, and send the r43 2018 form efficiently.

-

Is there a cost to use airSlate SignNow for the r43 2018 form?

Yes, there are various pricing plans available for airSlate SignNow, catering to different business needs. Each plan includes features that enhance your ability to manage documents like the r43 2018 form while ensuring a cost-effective solution for your business.

-

What features does airSlate SignNow offer for the r43 2018 form?

AirSlate SignNow offers a range of features for handling the r43 2018 form, including customizable templates, automated workflows, and secure cloud storage. These features streamline document management, making it easier to adapt and use the form in your operations.

-

Can I integrate airSlate SignNow with other software when working with the r43 2018 form?

Absolutely! AirSlate SignNow provides integrations with a variety of popular applications, making it easy to incorporate the r43 2018 form into your existing workflows. This capability ensures that you can efficiently manage and send documents without switching between different platforms.

-

How secure is airSlate SignNow when handling the r43 2018 form?

AirSlate SignNow prioritizes security with advanced encryption measures and compliance with data protection regulations. When you use our platform for the r43 2018 form, you can rest assured that your documents are stored and transmitted securely.

-

Can I track the status of my r43 2018 form using airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your r43 2018 form in real-time. You can see when it is sent, viewed, signed, and completed, which helps you stay updated and manage your documentation effectively.

-

Is it easy to manage multiple r43 2018 forms with airSlate SignNow?

Certainly! AirSlate SignNow is designed for efficiency, allowing you to manage multiple r43 2018 forms easily. Whether you're sending, signing, or storing, our user-friendly interface makes handling multiple documents hassle-free.

Get more for R43 Form

- Checkers job application form online

- Affidavit of ownership form

- 2009 residential energy conservation form city of houston

- App 103 appellants notice designating record on appeal judicial council forms courtinfo ca

- Ej 100 acknowledgment of satisfaction of judgment judicial council forms courtinfo ca

- Application form cdn usa 1 for oas and cpp benefits

- Ej 125 form 42131624

- Form isp3040pdffillercom

Find out other R43 Form

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free