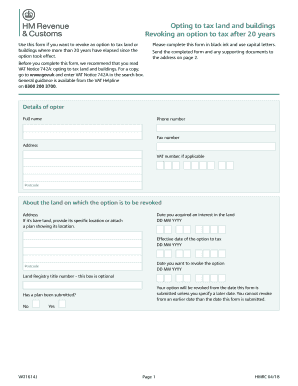

Vat1614a 2018

What is the VAT 5L?

The VAT 5L form is a specific document used in the United Kingdom for businesses to apply for a refund of VAT (Value Added Tax) that they have paid on goods and services. This form is particularly relevant for businesses that have opted to tax certain properties and need to reclaim VAT on related expenses. Understanding the purpose and requirements of the VAT 5L is essential for businesses looking to manage their VAT obligations effectively.

How to Use the VAT 5L

Using the VAT 5L form involves several key steps to ensure that the application for VAT refund is completed accurately. First, gather all necessary documentation, including invoices and receipts that demonstrate the VAT paid. Next, fill out the VAT 5L form with the required information, ensuring that all details are correct and complete. Finally, submit the form to HMRC, either online or via mail, depending on your preference and the specific guidelines provided by HMRC.

Steps to Complete the VAT 5L

Completing the VAT 5L form requires careful attention to detail. Follow these steps:

- Collect all relevant invoices that show the VAT you have paid.

- Fill out the form with your business details, including your VAT registration number.

- Clearly specify the amounts of VAT you are claiming back.

- Review the form for accuracy to avoid delays in processing.

- Submit the completed form to HMRC through the preferred method.

Legal Use of the VAT 5L

The legal use of the VAT 5L form is governed by specific regulations set by HMRC. To ensure compliance, businesses must only submit claims for VAT that they are entitled to reclaim. This means that the VAT must have been incurred on goods and services that are used for taxable business activities. Failure to comply with these regulations can result in penalties or rejection of the claim.

Key Elements of the VAT 5L

Several key elements must be included in the VAT 5L form for it to be valid. These include:

- Your business name and address.

- Your VAT registration number.

- A detailed breakdown of the VAT amounts being claimed.

- Supporting documents that validate your claim.

Form Submission Methods

The VAT 5L form can be submitted to HMRC through various methods. Businesses can choose to submit the form online through the HMRC portal or send a paper version via mail. Each method has its own processing times, so it is advisable to consider which option best fits your business needs.

Quick guide on how to complete vat1614j opting to tax land and buildings vat1614j opting to tax land and buildings

Complete Vat1614a seamlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct template and safely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without any hold-ups. Manage Vat1614a on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to alter and eSign Vat1614a effortlessly

- Locate Vat1614a and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Alter and eSign Vat1614a and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat1614j opting to tax land and buildings vat1614j opting to tax land and buildings

Create this form in 5 minutes!

How to create an eSignature for the vat1614j opting to tax land and buildings vat1614j opting to tax land and buildings

How to create an electronic signature for the Vat1614j Opting To Tax Land And Buildings Vat1614j Opting To Tax Land And Buildings online

How to make an electronic signature for your Vat1614j Opting To Tax Land And Buildings Vat1614j Opting To Tax Land And Buildings in Chrome

How to create an electronic signature for putting it on the Vat1614j Opting To Tax Land And Buildings Vat1614j Opting To Tax Land And Buildings in Gmail

How to make an electronic signature for the Vat1614j Opting To Tax Land And Buildings Vat1614j Opting To Tax Land And Buildings from your smart phone

How to make an eSignature for the Vat1614j Opting To Tax Land And Buildings Vat1614j Opting To Tax Land And Buildings on iOS

How to create an electronic signature for the Vat1614j Opting To Tax Land And Buildings Vat1614j Opting To Tax Land And Buildings on Android

People also ask

-

What is the VAT 5L printable version?

The VAT 5L printable version is a specific form designed for businesses to report their Value Added Tax. It's essential for compliance with VAT regulations and easy handling of VAT submissions. airSlate SignNow offers a streamlined way to access and eSign this document.

-

How can I access the VAT 5L printable version using airSlate SignNow?

You can easily access the VAT 5L printable version through the airSlate SignNow platform. Simply log in, navigate to the document templates section, and choose the relevant VAT form. This allows you to fill out and eSign the form efficiently.

-

Is there a cost associated with the VAT 5L printable version on airSlate SignNow?

The VAT 5L printable version is included in airSlate SignNow's subscription plans. While there may be costs associated with using the platform, the seamless integration and document handling usually outweigh the expenses. Check our pricing page for detailed information.

-

What features does the airSlate SignNow platform offer for working with the VAT 5L printable version?

airSlate SignNow offers robust features for managing the VAT 5L printable version, including secure eSigning and document storage. You can also collaborate in real-time with your team, add comments, and track the status of the document. Our user-friendly interface ensures that you can complete all tasks easily.

-

Can I integrate airSlate SignNow with other software to streamline VAT reporting?

Yes, airSlate SignNow allows for integrations with various accounting and productivity tools. This means you can connect the VAT 5L printable version with your existing systems to enhance your workflow and ensure accurate VAT reporting. Check our list of integrations for more details.

-

What benefits does using airSlate SignNow for the VAT 5L printable version provide?

Using airSlate SignNow for the VAT 5L printable version allows for faster processing, improved accuracy, and enhanced compliance with VAT regulations. Additionally, the platform's ease of use can save your business time and reduce the likelihood of errors. Your documents are stored securely and accessible anytime.

-

Can I customize the VAT 5L printable version in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the VAT 5L printable version to fit your specific business needs. You can add your company's branding, adjust the layout, or include any necessary fields that might be relevant to your VAT submissions.

Get more for Vat1614a

- Tss application form

- Continued claim form edd

- Northern tool credit application form

- Wells fargo fha pre foreclosure sale addendum pfsa wells fargo fha pre foreclosure sale addendum pfsa form

- Ncuc form ce 1 revised april 2013 before the north

- Taste test form

- Form tf0001

- Usda form rd 1942 52 rev 9 96 cash flow projection forms sc egov usda

Find out other Vat1614a

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors