Credit Application Form 2009-2026

What is the Credit Application Form

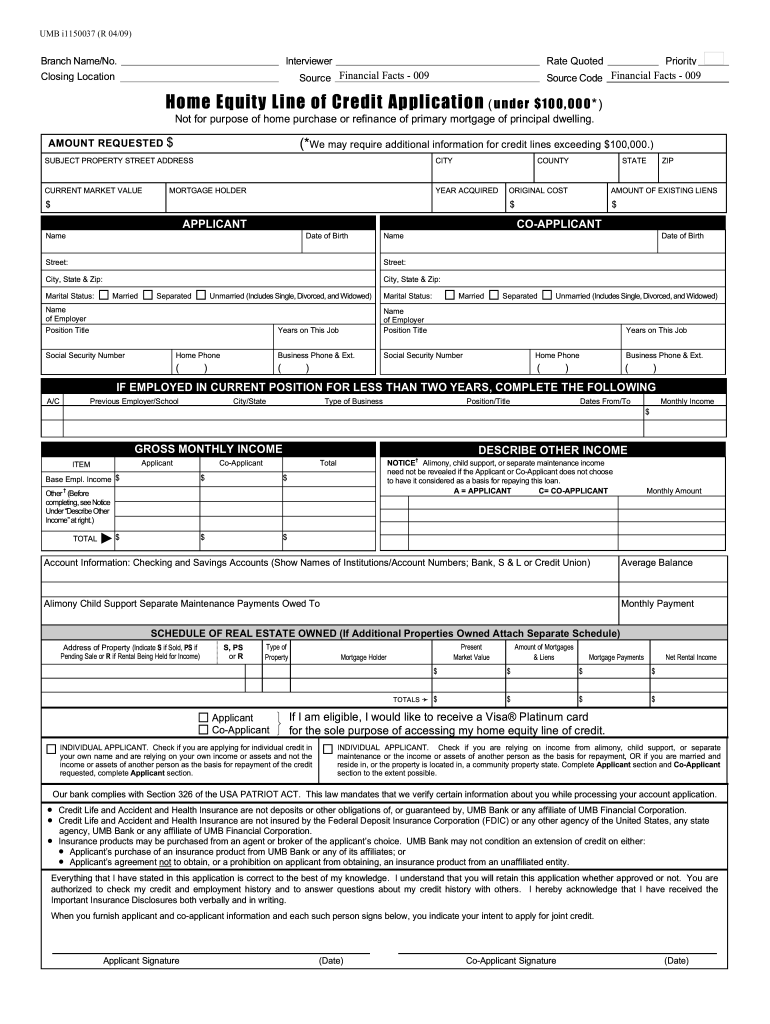

The credit application form is a crucial document used by lenders to assess an applicant's financial status and creditworthiness. This form collects essential information, such as personal details, employment history, income, and existing debts. By providing this information, applicants enable lenders to make informed decisions regarding loan approvals and terms. Understanding the purpose of this form is vital for anyone seeking home credit near them.

Steps to Complete the Credit Application Form

Completing the credit application form involves several straightforward steps:

- Gather necessary documents: Collect all required documentation, including identification, proof of income, and any existing loan information.

- Fill out personal information: Enter your name, address, Social Security number, and contact details accurately.

- Detail your employment history: Provide information about your current and previous employers, including job titles and duration of employment.

- Disclose financial information: Include your income, monthly expenses, and any outstanding debts to give a complete picture of your financial situation.

- Review and submit: Carefully check all entries for accuracy before submitting the form, either online or in person.

Legal Use of the Credit Application Form

The legal use of the credit application form is governed by regulations that protect both lenders and borrowers. In the United States, lenders must comply with the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA), ensuring that applicants are treated fairly and that their information is handled responsibly. By using a compliant platform for submitting this form, applicants can ensure their data is secure and that they are protected under these laws.

Required Documents

When applying for home credit, certain documents are typically required to support your application. These may include:

- Government-issued ID: A valid driver's license or passport to verify your identity.

- Proof of income: Recent pay stubs, tax returns, or bank statements to demonstrate your financial stability.

- Employment verification: A letter from your employer or recent employment contracts.

- Credit history: A report detailing your credit score and any existing debts.

Eligibility Criteria

Eligibility for home credit typically depends on several factors, including:

- Credit score: A minimum credit score is often required, with higher scores improving your chances of approval.

- Income level: Lenders assess your income to ensure you can afford the loan payments.

- Debt-to-income ratio: This ratio compares your monthly debt payments to your gross monthly income, helping lenders evaluate your financial health.

- Employment stability: A consistent employment history can enhance your application.

Application Process & Approval Time

The application process for home credit involves submitting the completed credit application form along with required documents. After submission, lenders typically review applications within a few days to a week. Approval time may vary based on the lender's policies and the complexity of your financial situation. Applicants can usually check their home credit loan status online, providing transparency throughout the process.

Quick guide on how to complete home credit application form

The simplest method to obtain and sign Credit Application Form

Across the breadth of a company, ineffective workflows related to document approvals can drain a substantial amount of work hours. Signing documents such as Credit Application Form is a routine aspect of operations in any organization, which is why the efficiency of each agreement's lifecycle signNowly impacts the overall effectiveness of the company. With airSlate SignNow, signing your Credit Application Form can be as straightforward and quick as possible. This platform provides you with the latest version of nearly any form. Even better, you can sign it immediately without needing to install external software on your computer or printing anything out as physical copies.

Steps to obtain and sign your Credit Application Form

- Explore our library by category or use the search function to locate the document you require.

- View the form preview by clicking on Learn more to confirm it is the correct one.

- Click Get form to begin editing right away.

- Fill out your form and include any essential details using the toolbar.

- Upon completion, click the Sign tool to sign your Credit Application Form.

- Select the signature method that is easiest for you: Draw, Create initials, or upload a photo of your written signature.

- Click Done to finish editing and proceed to document-sharing options as required.

With airSlate SignNow, you have everything necessary to manage your documents efficiently. You can discover, fill out, modify and even send your Credit Application Form in a single tab with ease. Enhance your workflows with a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I change a registered mobile number in HDFC bank?

You can change registered mobile number in HDFC Bank account online by following the steps given below:Step-1: Go to official website of HDFC BankStep-2: Login to HDFC Net Banking PageStep-3: Click on Update Email ID and Landline NumberStep-4: Edit the number you want to changeStep-4: Confirm the number by typing it once againAfter following the steps mentioned in above articles, you can change or update mobile nimber registered in your HDFC Bank Account Online without visiting the bank branch.Your New Mobile Number will be Updated within 24 Hours!!!Point to be NotedIt is true that you can change your mobile number in HDFC Bank Account online still I recommend you to get this done personally by visiting the bank branch. It will eliminate risk( although very rare) of hacking confidential information.Hope this works for you.

-

What are the best short stories that touch our heart?

The story of Aitzaz Hassan. A sixteen years old Pakistani boy who saved the lives of hundereds of school children in Pakistan. On the bright morning of January 6, 2014, Aitzaz along with two of his friends signNowed the gate of Government High School, Ibrahimzai in North West Pakistan (the school is attended by around 2,000 students). He was not allowed to enter the school on account of being a few minutes late. Right at this moment a man aged between 20-25 approached the school gate and told the guard that he wants to go inside to "take admission" to this school. At this point, Aitzaz and his friends spotted a detonating device protruding out of this man's jacket. Horrified, Aitzaz's friends ran inside the school to save their lives. Aitzaz on the other hand hustled to the bomber and confronted him while he was trying to force his way through the school gate. The bomber tried his best to run inside but could not escape Aitzaz's iron grip. Upon failure he detonated his suicide vest killing both Aitzaz and himself. No other school student was injured. Less than one year and 100 miles later, this happened:On this occasion, terrorists managed to enter another school building and killed around 140 school students. This time sadly, there was no Aitzaz around to stop them.For his bravery and courage, Aitzaz was declared Herald's Person of the Year for 2014 and his school was renamed Aitzaz Hasan Shaheed High School.

-

Can you tell me how to apply for a home loan in India?

Before you start the home loan process, determine your total eligibility, which will mainly depend on your repaying capacity. Your repayment capacity is based on your monthly disposable/surplus income, which, in turn, is based on factors such as total monthly income/surplus less monthly expenses, and other factors like spouse’s income, assets, liabilities, stability of income, etc.The bank has to make sure that you’re able to repay the loan on time. The higher the monthly disposable income, the higher will be the loan amount you will be eligible for. Typically, a bank assumes that about 50% of your monthly disposable/surplus income is available for repayment. The tenure and interest rate will also determine the loan amount. Further, the banks generally fix an upper age limit for home loan applicants, which could impact one’s eligibility.For Home Loans your CIBIL Score should be above 750 and also ensure the following documents are available for the process of your Home Loan application.List of papers/ documents applicable to all applicants:Loan Application: Completed loan application form duly filled in and affixed with 3 Passport size photographsProof of Identity (Any one): PAN/ Passport/ Driver’s License/ Voter ID cardProof of Residence/ Address (Any one): Recent copy of Telephone Bill/ Electricity Bill/Water Bill/ Piped Gas Bill or copy of Passport/ Driving License/ Aadhar CardProperty Papers:Permission for construction (where applicable)Registered Agreement for Sale (only for Maharashtra)/Allotment Letter/Stamped Agreement for SaleOccupancy Certificate (in case of ready to move property)Share Certificate (only for Maharashtra), Maintenance Bill, Electricity Bill, property tax receiptApproved Plan copy (Xerox Blueprint) & Registered Development agreement of the builder, Conveyance Deed (For New Property)Payment Receipts or bank A/C statement showing all the payments made to Builder/SellerAccount Statement:Bank A/c. Statement (Individual) for last six monthsIf any previous loan from other Banks/Lenders, then Loan A/C statement for last 1 yearIncome Proof for Salaried Applicant/ Co-applicant/ Guarantor:Last 3 months Salary Slip.Copy of Form 16 for last 2 years or copy of IT Returns for last 2 financial years, acknowledged by IT Dept.Income Proof for Non-Salaried Co-applicant/ Guarantor:Business Registration Proof.Balance Sheet & Profit & loss A/c for last 3 yearsBusiness License Details(or equivalent)TDS Certificate (Form 16A, if applicable)Certificate of qualification (for C.A./ Doctor and other professionals)IT returns for last 3 yearsYou can apply for an attractive offer with best possible Rate of Interest and Terms for Personal, Business and Home Loan.FundsTiger is an Online Lending Marketplace where you can avail fast and easy Home, Business and Personal Loans via 30+ Banks and NBFCs at best possible rates. We will also help you to improve your Credit Score. We have dedicated Relationship Managers who assist you at every step of the process. We can also help you in Balance Transfers that will help you reduce your Interest Outgo.

-

What is the home loan process in SBI?

The SBI is one of the major banks which provide the housing loan to customer in order to fulfil their dream of purchasing and living in their own house. The SBI bank has come up with variety of options to offer the home loans for different categories of the customers, and hence it is rightly said that it provides everything for everyone. The SBI has designed various schemes in such a manner that is beneficial for the all segments of the customers be it in interest rates term or repayment schedule terms. Also, the bank has started giving loan to employees or unemployed women at reasonable interest rates.Eligibility Criteria for Home LoanEmployment Stability: It’s a crucial aspect for home loan consideration. Unless the applicant is salaried and employed for at least 2 years in the current profession or if the applicant is self-employed with minimum 5 years of total earnings loan will not be processed.Age Criteria: The younger the applicant is there is more probability of getting loan. Most banks offer home loan for salaried employees only if they are between the age group of 20 to 60 years. However for self-employed this will change to 24 to 65 years.Credit Rating: Apart from the applicant’s company’s performance, individual credit rating has a lot of importance. Good credit rating will increases the chance of getting the loan with more flexibility on loan amount, EMI, tenure and interest rates. Default payment records, fraudulent tracks, and outstanding loan, will reflect negatively on the applicant, this could lead to bank’s cancelling the loan request or will charge high rate of interest.Employer: If the applicant is working with an employer who has high reputation and impressive turnover, the credibility of the applicant will respectively increase. Being a part of reputed and high turnover companies is an asset for the applicant especially when it comes to applying for home loan.Financial Situation: For this factor, not just present status is considered, the past records of financial stability holds lot of value in deciding the eligibility for home loan. It is a key to success in all fields if you have good financial records, this can decide the interest rate percentage, loan amount and tenure when applying for loan.Documents Required for home loanComplete Home Loan Application Form with one passport size photograph.Photo Identity Proof: Passport/ Driving License/ Voter ID/ PANResidence Address Proof: License/ Registered Rent Agreement/ Utility BillResidence Ownership Proof: Sale deed or rental agreementIncome Proof: salary slip, bank statement and Form 16Job Continuity Proof: Appointment letter at employment and validation letter from HRBank Statement: Past 6 months’ documentProperty Documents: Sale deed, Katha, transfer of ownershipAdvance Processing Cheque: A cancelled cheque for validation of bank accountInvestment Proof: LIC, mutual funds, property document etc.Financial Documents:a. For Salaried Individual: 3 month salary slip, Form 16 and bank statementb. For Self-Employed Individual: IT returns for last 2 years along with computation of income tax for past 2 years certified by a Chartered accountantc. For Self-Employed Non- Professionals: IT returns for last 3 years along with computation of income tax for past 2 years certified by a Chartered accountantNow just you need to apply loan from online and submit all required documents for home loan then bank people will consult you. If you are applying from lender after your online process they will contact you and proceed the loan.

-

What is it like to be a geek in a prison?

I'm a hacker who served 4.5 months of a 9 month sentence 5 years ago. I was in two jails in that time, spending the majority of the time in the second, lower security place. The experience totally changed me, but in a positive way.First of all, I actually had a lot of fun in jail. My education made certain aspects of the prison system very easy for me to navigate, such as legal documentation and debating with guards. My ability to mend broken electronics very quickly became known. These things made me feel very safe, since people were actively protecting me. It also made me feel quite important in the community.It started when someone came to me and asked what I knew about mending mobile phones. In UK jails, many people have mobiles, usually obtained by over-the-fence smuggling. Pay-as-you-go credit vouchers are a major form of currency. This guy was very important on the wing - he had a crew of other guys who walked around with him and people often came to pay him. I said I knew enough about phones, and what did he want? He explained that someone had owed him money but couldn't pay. He'd taken the guy's phone as payment, but the phone was pin-locked and he couldn't get in. The phone was an old Samsung, one which I knew (having previously owned one) didn't impose any limit on the number of pin attempts. So I told the guy: yeah, I know a few tricks. But I need to get my tools out so I'll do it overnight. (Note: I didn't have any tools). The guy left me with the phone overnight, and I sat up through the night to try all 10,000 possible 4-digit combinations. Thankfully, the correct code turned up in the mid 2000s. So the next day this guy turned up and was amazed that I had figured out the code. He went round telling everyone that I was some tech wizard and that people should always come to me with their problems. In return for the job he arranged for me to have a Playstation 2 in my cell for two weeks, and to get access to a phone whenever I wanted. For the rest of my time, people would bring me trivially broken electronics and I would retire for the evening to make it out like I was doing something difficult, then return the fixed item the next day. It massively increased my quality of life in there.Secondly, it opened my eyes to how people less fortunate than me live their lives, and how terrible the prison system is for most people. Many, many people in jail were severely mentally ill. There was no support for them. Some were killed in jail, either by inmates or staff, because they flipped out and people got scared. Another large group of people were hopelessly addicted to very harmful drugs. People who exploited this group were the most powerful - they would have drugs smuggled in, then build an army of addicts who would do their bidding to get the next fix. It was a really explosive situation. Almost every act of violence was drug debt related. Immigrants were completely screwed in jail, because there was no way for them to navigate the bureaucracy. I helped several people avoid deportation, including one cell-mate who had a hit contract out on him in Jamaica because he defended his business when yardies tried to extort him. He couldn't read or write, so he couldn't fill out the asylum application. His patois was so strong that his lawyer couldn't really understand what he said, and the border agency was going to send him back to Jamaica to be killed. I wrote letters to the border agency, the prison governor and the home secretary and he was granted asylum and an interpreter was arranged so that his legal visits would be more productive. Hundreds of others in similar situations go without that help every year.Thirdly, I saw some horrible things. For example: 'syruping' - when someone mixes sugar into a bucket of boiling water and dumps it on someone's face. The dissolved sugar makes the boiling water cling to the skin longer, and the skin peels off leaving the raw flesh exposed. I also saw someone held down by four guys, who performed anal surgery on him with a sharpened spoon to extract drugs he was hiding. He later maimed all four of his assailants, stabbing them in the neck with a pen (saw that too). Another was a guy who was clearly paranoid schizophrenic. His cell was opposite mine. He started screaming one night and barricaded himself in. He then stripped off and covered himself with baby oil, and started setting fire to his cell. The guards came in riot gear to tackle him, but he was so slippery it was like trying to catch an eel. He gave them the run around for quite a while before they eventually held him down and injected him* and he was carried away screaming. He died in hospital.Fourthly, I felt so ashamed of myself that I changed my life forever. I was a middle class white kid with a great education who got obsessed with hacking and document security as a teenager and went down for figuring out how to replicate the driving license, thus throwing away many of the advantages that luck, society and my parents had given me. Everyone else in there had no such advantages. Most of them were born to a life where poverty, drugs, violence and lack of education all being concentrated in their environment led to them being systematically channeled into prison. I was there essentially through misplaced intellectual curiosity, while others were there because their lives were so bad out of jail that crime was actually a rational survival choice. Society failed them, while it tried to hold me up with both hands. I was, and am, disgusted with myself. Upon leaving jail I learned programming, worked freelance to pay for my tuition while I got a degree, got a PhD position, and am now working towards spending my life using my skills as efficiently as I can to improve the lives of as many people as possible. If I ever have a lazy moment, I just have to cast my mind back to prison, and the disgust with myself rises up again, and I launch myself back into work with an energy I never knew I had before prison.Finally, I would say that my criminal record has not held me back. I no longer have to legally disclose it**, but when I did I always did so with a letter explaining some of the circumstances and how deeply it had affected my life. I had several positive comments about my disclosure, and I have never been turned down for a job I've applied for. It doesn't have to hold you back - your attitude has to convince a potential employer that your background makes you a great candidate, not a worse one.*This has been corrected: In my haste to write the post I previously wrote that a dart was used, when in fact it was a needle. Thanks to Marty Bee for pointing out that this was not likely.**For those who are curious, a conviction becomes 'spent' in the UK after a certain time. The times were recently reduced in a little publicised law (Legal Aid, Sentencing and Punishment of Offenders Act 2012), so my conviction was 'spent' after 48 months.

-

What was your experience being a bank teller?

What you experience as a teller seems to vary on not only the bank you work for, but the branch you work in. For instance, my experience as a teller is probably very different than those in a lot of other bank branches because I work at a branch that has a lot of higher end clientele. We do a lot more catering and hand-holding than other branches do, and sometimes have to bend the rules a little to get things done.My day starts with me putting up my stuff in a secure area in the break room. If I’m opening, I disarm the alarms and do the morning walk-through with another teller. Then we deal with all the daily duties like getting the work together from earlier that week to send to the main office, putting together the sell for the armored truck, or auditing one of the many machines or vaults we have.I get out my drawer, boot everything up, finish putting the Nightdrops in the system, and then I wait. The morning is usually slow, so we spend a lot of time talking and trying to entertain ourselves… or trying not to fall asleep. Businesses show up a little later in the morning usually or throughout the day. And from there its an array of change orders, trying to sort out the mass of bills and checks sometimes neatly put together and sometimes crammed in a bag with such little care that it could take you 5–10 mins just to sort into some sort of order. But you get through all that and then you wait some more… and you wait some more…. and you wait some more… Given, a lot of branches are actually busy, so there is very little waiting involved, and much more trying not to lose your mind. But this is my branch.There’s a lot of checks being cashed, checks and bills being deposited, and people asking what their balance is. You get the occasional person bringing in their change to cash out. Or you get to let someone into their safe deposit box. That’s all the easy part of being a teller.The hard part is the questions you have to answer and the regulations that you have to follow. Telling people “I’m sorry I can’t do that,” and then having to try and explain why, because they don’t understand. It’s a lot of filling out forms. If I had a dollar for every slip I’ve had to fill out for someone I would’ve nearly doubled my paycheck every month. All of that is monotonous, though. And it can drive you crazy after a while. But the part of my job I really enjoy are those rare instances when I feel like I can actually really help someone. To put in the extra mile and teach someone who’s concerned about counterfeit 20s in her yard sale how to tell the difference between what’s real and what’s fake. To teach someone who doesn’t know English very well how to write out English numbers on his checks so he can pay his employees. It’s painstakingly going through every transaction with someone on their banking statement and showing them the result until they’re satisfied. It’s teaching high school kids how to fill out their first bank deposit form. It’s letting someone know their driver’s license is about to expire. It’s always been the small things that really make the job worth doing to me.But in between all of that, there are the vast arrays of paperwork that have to be done every day. Phone calls for all the check, debit card, and foreign currency orders. Followed by writing out hold logs. Trying to fill private banking’s little tasks. Occasional product phone calls can be assigned, which can take anywhere from one minute to an hour and thirty depending on the number of calls and the type. There’s filling out the occasional credit card application for a customer or a direct deposit request form. Then there’s the federal reporting forms that have to be filled out occasionally depending on the circumstance. In our branch, we also get a large amount of loan work that gets sent our way, so that takes up some time as well—completing their transactions and being essentially front-line secretaries. There are of course sales goals to fill, but at least in my bank, my job doesn’t rely on me signNowing my goal.Even with all that seriousness, some of it can be very funny. Like the truck who ran over lane 4. Or the fact that our ATM is constantly on the fritz and has a taste for eating people’s checks. Or when we’ve accidentally sent two tubes to the same lane. Or that guy who came in wanting to withdrawal $2000 in 1s for a wedding… or someone who chose to deposit an entire tub full of coin. There are days when I go home wanting to scream, and then there are days when I smile from ear to ear, but in the end, I love my job. It may not be an end game for me, but I have very few complaints. I work for a good company, and for now, that’s good enough for me.As for advice… the only thing I can tell you is… try to find joy in the small things. Be kind and people will often be kind to you.

-

How did bank managers and staff in India treat you whenever you approach them for some loans?

When I was making plans to go to the USA to attend graduate school, my father and I went to different banks asking for education loan.At that time, my father made just enough to support our family and all he has is a small house. No Savings or any other property.The home value is more than the loan amount we requested for. Most of the banks turned us down and I almost gave up on my dream to go to Grad school.I went to Andhra bank near my area. This was a new branch and I just went to try my luck. The bank manager is a soft-spoken person. He asked me for my details and other stuff. He told me that he can’t guarantee a loan until the appraisal is done.Two days later, he called me telling that the appraiser is in town and they want to see my home to estimate it’s value. I called my dad and they got the appraisal done. The manager looked into my study certificates and told me that he will do his best to get the loan approved.He went above and beyond his duty and got the loan approved. I got my loan papers and the next day, he got transferred to a different branch.I finished my Master’s degree and now, I am having a good job. I called the manager to convey my thanks for his help. He told me that he is really happy for me and that I was the first one who got an education loan from the new branch.Thank you, Sir!!!!

Create this form in 5 minutes!

How to create an eSignature for the home credit application form

How to generate an eSignature for the Home Credit Application Form in the online mode

How to make an electronic signature for your Home Credit Application Form in Google Chrome

How to create an electronic signature for signing the Home Credit Application Form in Gmail

How to make an electronic signature for the Home Credit Application Form right from your smart phone

How to generate an eSignature for the Home Credit Application Form on iOS

How to make an eSignature for the Home Credit Application Form on Android devices

People also ask

-

What is a Credit Application Form and why is it important?

A Credit Application Form is a document used by businesses to collect essential information from clients seeking credit. This form is crucial as it helps assess the creditworthiness of applicants, ensuring that businesses make informed lending decisions. Using an efficient Credit Application Form can streamline the approval process and enhance financial management.

-

How can airSlate SignNow simplify the Credit Application Form process?

airSlate SignNow offers a user-friendly platform that allows businesses to create, send, and eSign Credit Application Forms effortlessly. With customizable templates, you can tailor your forms to meet specific needs, reducing time spent on paperwork. This efficiency not only speeds up the application process but also enhances the overall customer experience.

-

What features does airSlate SignNow offer for managing Credit Application Forms?

airSlate SignNow includes features such as document templates, automated workflows, and secure eSignature capabilities that are perfect for managing Credit Application Forms. These features ensure that your forms are easy to fill out, sign, and process, while also maintaining compliance with legal standards. Additionally, you can track the status of your applications in real-time, ensuring a smooth workflow.

-

Is airSlate SignNow affordable for small businesses needing a Credit Application Form?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses that need a Credit Application Form. Our pricing plans are flexible and cater to various budgets, allowing you to choose the best option for your needs. With airSlate SignNow, you can leverage advanced features without breaking the bank.

-

Can I customize my Credit Application Form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your Credit Application Form to align with your brand and specific requirements. You can add your logo, change colors, and rearrange fields to ensure that the form meets your business needs. This level of customization enhances the professionalism of your documents.

-

What integration options does airSlate SignNow provide for Credit Application Forms?

airSlate SignNow seamlessly integrates with various business tools and software, making it easy to manage your Credit Application Forms. Whether you're using CRM systems, accounting software, or other applications, our platform can connect with them to streamline your processes. This integration helps in automatically populating data and maintaining consistency across your business operations.

-

How secure is the information collected in a Credit Application Form through airSlate SignNow?

Security is a top priority for airSlate SignNow. When you use our platform for your Credit Application Form, all data is encrypted and stored securely to protect sensitive information. We comply with industry standards and regulations, ensuring that your applicants' information is safe from unauthorized access.

Get more for Credit Application Form

Find out other Credit Application Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document