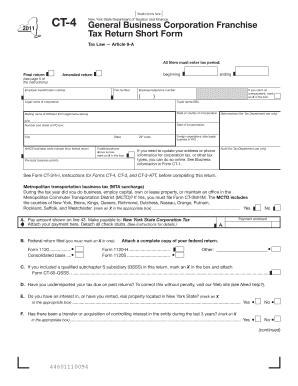

Ct 4 ; General Business Corporation Franchise Tax Return Short Form

What is the Ct 4 ; General Business Corporation Franchise Tax Return Short Form

The Ct 4 ; General Business Corporation Franchise Tax Return Short Form is a tax form used by corporations in the United States to report their franchise tax obligations. This form is specifically designed for general business corporations that meet certain criteria, allowing them to file a simplified version of the standard franchise tax return. The form captures essential financial information, ensuring compliance with state tax regulations while streamlining the filing process for eligible corporations.

How to use the Ct 4 ; General Business Corporation Franchise Tax Return Short Form

Using the Ct 4 form involves several key steps. First, ensure that your corporation qualifies to use the short form based on its revenue and business activities. Next, gather all necessary financial documents, including income statements and balance sheets. You will need to accurately fill out the form with your corporation's financial data, including gross receipts and deductions. Once completed, the form can be submitted electronically or via mail, depending on your preference and state regulations.

Steps to complete the Ct 4 ; General Business Corporation Franchise Tax Return Short Form

Completing the Ct 4 form requires careful attention to detail. Begin by entering your corporation's basic information, such as the name, address, and federal employer identification number (EIN). Next, report your total gross receipts for the tax year, followed by any allowable deductions. Ensure that all calculations are accurate, as errors can lead to delays or penalties. After reviewing the form for completeness, sign and date it before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Ct 4 form. Typically, the form must be filed annually, with specific due dates that may vary by state. Corporations should mark their calendars for these important dates to avoid late fees or penalties. Additionally, extensions may be available, but they often require a separate request to be filed before the original deadline.

Required Documents

To successfully complete the Ct 4 form, several documents are necessary. These include financial statements such as income statements and balance sheets, previous tax returns, and any supporting documentation for deductions claimed. Having these documents readily available will facilitate a smoother filing process and help ensure accuracy in reporting.

Penalties for Non-Compliance

Failure to file the Ct 4 form on time or inaccuracies in the submitted information can result in penalties. Common consequences include monetary fines and interest on unpaid taxes. In severe cases, non-compliance may lead to legal action or the suspension of business operations. It is essential for corporations to understand these risks and prioritize timely and accurate filing.

Quick guide on how to complete ct 4 general business corporation franchise tax return short form

Effortlessly Prepare Ct 4 ; General Business Corporation Franchise Tax Return Short Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Ct 4 ; General Business Corporation Franchise Tax Return Short Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign Ct 4 ; General Business Corporation Franchise Tax Return Short Form with Ease

- Obtain Ct 4 ; General Business Corporation Franchise Tax Return Short Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically designed for this task.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to submit your form, whether via email, SMS, an invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ct 4 ; General Business Corporation Franchise Tax Return Short Form and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 4 general business corporation franchise tax return short form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ct 4 ; General Business Corporation Franchise Tax Return Short Form?

The Ct 4 ; General Business Corporation Franchise Tax Return Short Form is a simplified tax form used by corporations in Connecticut to report their income and calculate their franchise tax. This form allows businesses to file efficiently, ensuring compliance with state tax regulations while minimizing complexity.

-

Who needs to file the Ct 4 ; General Business Corporation Franchise Tax Return Short Form?

Any business operating as a corporation in Connecticut must file the Ct 4 ; General Business Corporation Franchise Tax Return Short Form if it meets the state's tax thresholds. It is essential to ensure proper filing to avoid penalties and maintain good standing with state authorities.

-

How can airSlate SignNow help with filing the Ct 4 ; General Business Corporation Franchise Tax Return Short Form?

airSlate SignNow streamlines the document signing process, making it easy to send and eSign your Ct 4 ; General Business Corporation Franchise Tax Return Short Form electronically. This not only saves time but also enhances organization and ensures your forms are securely stored and easily accessible.

-

Are there any costs associated with using airSlate SignNow for the Ct 4 ; General Business Corporation Franchise Tax Return Short Form?

While airSlate SignNow offers a range of pricing plans, the cost-effective solution ensures that you can choose a plan that fits your business needs. The pricing typically includes access to features that streamline the signing and submission process for forms like the Ct 4 ; General Business Corporation Franchise Tax Return Short Form.

-

What features of airSlate SignNow are beneficial for filing the Ct 4 ; General Business Corporation Franchise Tax Return Short Form?

airSlate SignNow provides useful features such as customizable templates, real-time status tracking, and secure document storage. These features simplify the process of preparing and filing your Ct 4 ; General Business Corporation Franchise Tax Return Short Form, making compliance easier.

-

Can airSlate SignNow integrate with other accounting software for the Ct 4 ; General Business Corporation Franchise Tax Return Short Form?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, enhancing your filing process for the Ct 4 ; General Business Corporation Franchise Tax Return Short Form. This allows for better workflow management and ensures that all necessary documentation is easily accessible.

-

What are the benefits of using airSlate SignNow for the Ct 4 ; General Business Corporation Franchise Tax Return Short Form?

Using airSlate SignNow for the Ct 4 ; General Business Corporation Franchise Tax Return Short Form offers advantages such as expedited filing times, enhanced security, and reduced reliance on traditional paper methods. This digital approach can lead to greater efficiency in managing your business's tax obligations.

Get more for Ct 4 ; General Business Corporation Franchise Tax Return Short Form

- What is an indemnity agreement with examples form

- Free delaware small estate affidavit form pdfwordeforms

- Agreement for sale of business by sole proprietorship with seller to form

- Townstate form

- Utopia the creation of a nation help docs documentation lemon form

- Article 68 dissolution and disposition of corporate form

- State of kansas hereinafter referred to as the trustor whether one or more and form

- Kentucky llc formslimited liability company formsus legal

Find out other Ct 4 ; General Business Corporation Franchise Tax Return Short Form

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT