Ftb Ca Form

What is the Ftb Ca

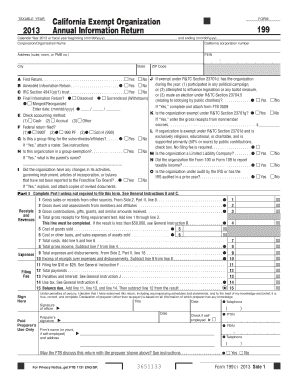

The Ftb Ca form is a crucial document used by California taxpayers for various tax-related purposes. It is primarily associated with the California Franchise Tax Board (FTB), which oversees state income tax collection. This form is essential for reporting income, claiming deductions, and ensuring compliance with state tax laws. Understanding its purpose is vital for individuals and businesses alike, as it helps facilitate accurate tax reporting and payment.

How to use the Ftb Ca

Using the Ftb Ca form involves several straightforward steps. First, gather all necessary financial documents, such as W-2s, 1099s, and other income statements. Next, carefully fill out the form, ensuring that all information is accurate and complete. Pay attention to any specific instructions provided by the California Franchise Tax Board, as these can vary depending on your tax situation. Once completed, you can submit the form online, by mail, or in person, depending on your preference.

Steps to complete the Ftb Ca

Completing the Ftb Ca form requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all relevant financial documents, including income statements and prior tax returns.

- Review the instructions for the Ftb Ca to understand the requirements specific to your tax situation.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check your entries for any errors or omissions.

- Submit the form through your chosen method: online, by mail, or in person.

Legal use of the Ftb Ca

The Ftb Ca form is legally binding when filled out correctly and submitted in accordance with California tax laws. To ensure its legal validity, taxpayers must provide accurate information and comply with all relevant regulations. This includes adhering to deadlines and maintaining proper documentation to support any claims made on the form. Failure to comply with these legal requirements can result in penalties or audits from the California Franchise Tax Board.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for avoiding penalties associated with the Ftb Ca form. Typically, the deadline for filing individual income tax returns in California is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be mindful of any specific deadlines related to extensions or estimated tax payments, as these can vary based on individual circumstances.

Required Documents

When preparing to complete the Ftb Ca form, certain documents are essential. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year’s tax return for reference

Having these documents ready will streamline the process and help ensure accurate reporting.

Quick guide on how to complete ftb ca

Complete Ftb Ca effortlessly on any device

Digital document management has become well-liked among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, alter, and eSign your documents swiftly without delays. Manage Ftb Ca on any platform with airSlate SignNow Android or iOS applications and simplify any document-centered task today.

How to edit and eSign Ftb Ca seamlessly

- Locate Ftb Ca and then click Get Form to begin.

- Use the tools we provide to finalize your document.

- Highlight key sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Ftb Ca and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Ftb Ca?

airSlate SignNow is an innovative platform that enables businesses to easily send and eSign documents online. With its user-friendly interface and features tailored for Ftb Ca, it streamlines your document signing process, enhancing efficiency and productivity.

-

What pricing plans does airSlate SignNow offer for Ftb Ca users?

airSlate SignNow offers various pricing plans to suit different needs, including a plan designed specifically for Ftb Ca users. These plans are cost-effective, providing excellent value while delivering powerful features essential for document management and eSignature needs.

-

What features does airSlate SignNow provide for Ftb Ca?

airSlate SignNow includes a wide range of features for Ftb Ca, such as customizable templates, automated workflows, and real-time tracking of document status. These features are designed to simplify the signing process and ensure compliance with industry standards.

-

How can airSlate SignNow benefit users in Ftb Ca?

For users in Ftb Ca, airSlate SignNow offers benefits like enhanced security, increased productivity, and reduced turnaround times. By leveraging its capabilities, businesses can improve their document workflow and focus on core activities.

-

Does airSlate SignNow integrate with other tools for Ftb Ca?

Yes, airSlate SignNow seamlessly integrates with various tools and applications commonly used by Ftb Ca users. This ensures that you can easily incorporate the eSigning solution into your existing workflows, enhancing overall efficiency.

-

Is it easy to use airSlate SignNow for Ftb Ca customers?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for Ftb Ca customers to navigate the platform. With its intuitive interface, even those with minimal technical expertise can quickly start sending and signing documents effortlessly.

-

What documents can be signed using airSlate SignNow for Ftb Ca?

airSlate SignNow allows Ftb Ca users to sign a variety of documents, including contracts, agreements, and forms. This versatility makes it a perfect choice for businesses across different industries that need to streamline their document processes.

Get more for Ftb Ca

- Form 392

- For sale by owner california disclosure forms 100408774

- Real estate office policy manual template 100073588 form

- Clickit realty reviews 48848923 form

- Ct600 2018 company tax return ct600 2018 company tax return form

- Title 24 california energy code compliance at each construction form

- Under federal fmla employees are entitled to take ctgov form

- New voter form

Find out other Ftb Ca

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation