CT600 Company Tax Return CT600 Company Tax Return 2018

What is the CT600 Company Tax Return?

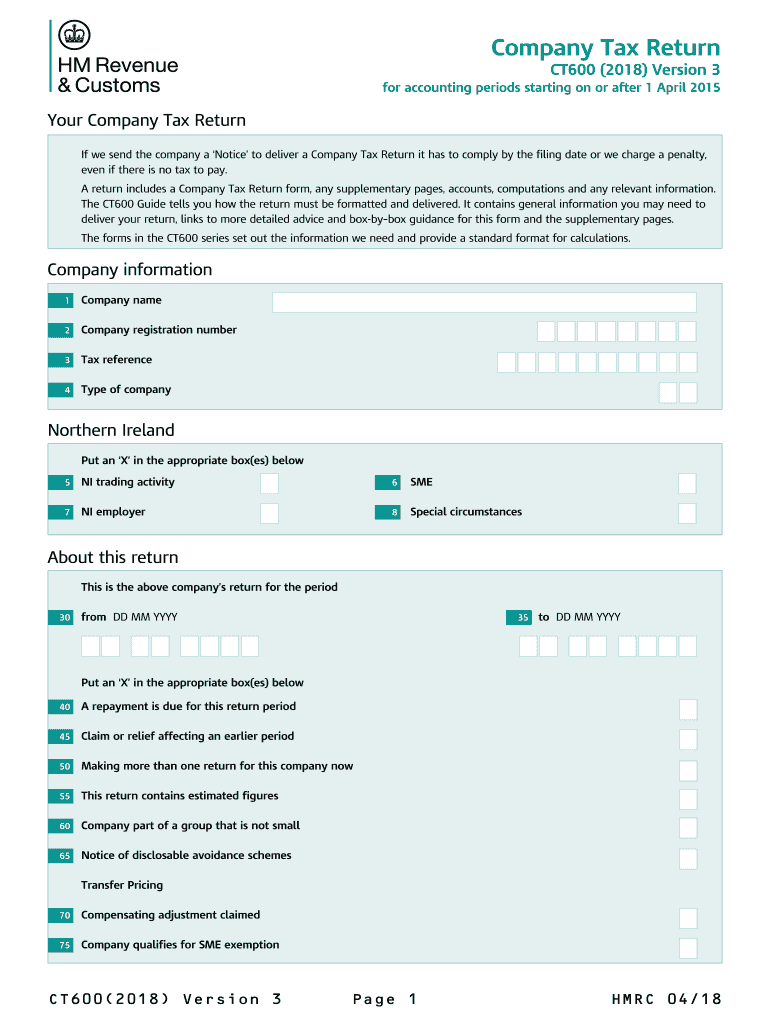

The CT600 Company Tax Return is a crucial document that UK companies must submit to HM Revenue and Customs (HMRC) to report their profits and calculate the corporation tax owed. This form is essential for ensuring compliance with tax regulations and provides a comprehensive overview of a company's financial performance over a specific accounting period. The form requires detailed information, including income, expenses, and any applicable tax reliefs or allowances. Understanding the structure and requirements of the CT600 is vital for accurate and timely submission.

Steps to Complete the CT600 Company Tax Return

Completing the CT600 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including profit and loss statements, balance sheets, and any relevant tax documentation. Next, fill out the form by entering the required information in the designated sections, such as income, expenses, and tax calculations. It is essential to double-check all entries for accuracy before submission. Once completed, the form can be submitted online or via mail, depending on your preference. Keeping a copy for your records is also recommended.

Legal Use of the CT600 Company Tax Return

The CT600 is legally binding and must be completed in accordance with UK tax laws. Failure to submit the form accurately can lead to penalties and interest charges. It is important to ensure that all information provided is truthful and complete, as HMRC may conduct audits or reviews. Utilizing reliable electronic tools for submission can enhance the legal standing of the document and provide an audit trail that verifies compliance with eSignature laws.

Required Documents for the CT600 Company Tax Return

To complete the CT600, several documents are necessary to provide a clear financial picture. These include:

- Profit and loss statements

- Balance sheets

- Tax relief claims and supporting documentation

- Details of any capital gains or losses

- Information on any group relief claims if applicable

Having these documents ready will streamline the completion process and ensure that all required information is included in the form.

Filing Deadlines / Important Dates

Timely submission of the CT600 is critical to avoid penalties. The filing deadline for the CT600 is typically twelve months after the end of the accounting period. Companies must ensure they are aware of their specific deadlines to maintain compliance with HMRC regulations. Late submissions may incur fines and interest on any unpaid tax, making it essential to plan ahead and file on time.

Form Submission Methods

The CT600 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via HMRC's online services, which is the preferred method for many businesses

- Paper submission by mailing a completed form to HMRC, though this may take longer to process

- In-person submission at designated HMRC offices, if applicable

Choosing the right submission method can impact processing times and the overall efficiency of your tax return filing.

Quick guide on how to complete ct600 2018 company tax return ct600 2018 company tax return

Prepare CT600 Company Tax Return CT600 Company Tax Return effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage CT600 Company Tax Return CT600 Company Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to edit and eSign CT600 Company Tax Return CT600 Company Tax Return with ease

- Locate CT600 Company Tax Return CT600 Company Tax Return and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign CT600 Company Tax Return CT600 Company Tax Return and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct600 2018 company tax return ct600 2018 company tax return

Create this form in 5 minutes!

How to create an eSignature for the ct600 2018 company tax return ct600 2018 company tax return

How to generate an eSignature for the Ct600 2018 Company Tax Return Ct600 2018 Company Tax Return in the online mode

How to generate an electronic signature for the Ct600 2018 Company Tax Return Ct600 2018 Company Tax Return in Google Chrome

How to make an electronic signature for putting it on the Ct600 2018 Company Tax Return Ct600 2018 Company Tax Return in Gmail

How to make an electronic signature for the Ct600 2018 Company Tax Return Ct600 2018 Company Tax Return straight from your smart phone

How to generate an electronic signature for the Ct600 2018 Company Tax Return Ct600 2018 Company Tax Return on iOS devices

How to generate an electronic signature for the Ct600 2018 Company Tax Return Ct600 2018 Company Tax Return on Android devices

People also ask

-

What is the form CT600 and why do I need it?

The form CT600 is a corporation tax return that companies in the UK must file with HMRC. It is essential for reporting profits and determining the corporation tax liability. By using airSlate SignNow, you can easily eSign and send your completed form CT600, ensuring compliance and a streamlined filing process.

-

How does airSlate SignNow simplify the process of completing form CT600?

airSlate SignNow provides an intuitive platform that allows you to fill out and eSign your form CT600 easily. The solution simplifies document management by enabling collaborative editing and real-time updates. This ensures you have the most up-to-date information on your form CT600 at all times.

-

What are the pricing options for using airSlate SignNow for form CT600?

airSlate SignNow offers several pricing plans to accommodate various business needs, starting with a free trial. Each plan includes access to features that facilitate the eSigning of documents, including form CT600. Check our pricing page for detailed options and choose the one that fits your requirements.

-

Can I integrate airSlate SignNow with other tools to manage form CT600?

Yes, airSlate SignNow seamlessly integrates with a variety of popular applications such as Google Drive, Dropbox, and Salesforce, allowing for efficient management of your form CT600. These integrations help streamline your workflow, ensuring that all necessary documents are readily accessible and easily eSigned.

-

What security measures does airSlate SignNow have for documents like form CT600?

At airSlate SignNow, your data security is our priority. We implement advanced encryption protocols to protect your documents, including form CT600, during transmission and storage. Our platform also complies with industry standards for data protection, ensuring peace of mind as you manage important tax documents.

-

How can I track the status of my form CT600 after sending it with airSlate SignNow?

Once you send your form CT600 through airSlate SignNow, you can easily track its status in real time. The platform provides notifications when the document is viewed, signed, and completed. This tracking feature helps you stay informed and ensures the timely filing of your corporation tax return.

-

Is airSlate SignNow suitable for small businesses needing to file form CT600?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses that need to file form CT600. Our user-friendly interface and cost-effective solution make it an ideal choice for small businesses looking to streamline their document management and eSigning processes.

Get more for CT600 Company Tax Return CT600 Company Tax Return

Find out other CT600 Company Tax Return CT600 Company Tax Return

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself