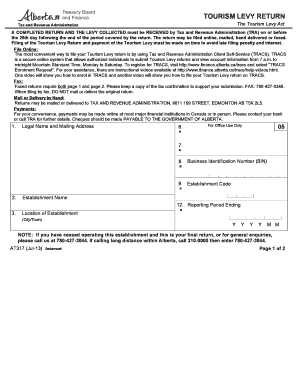

TOURISM LEVY RETURN Form

What is the tourism levy return?

The tourism levy return is a document that businesses in the tourism sector must file to report and remit the tourism levy collected from guests. This levy is typically imposed by local or state governments to fund tourism-related initiatives and infrastructure. The return provides a detailed account of the amount collected over a specific period, ensuring compliance with local regulations. Understanding the requirements and implications of this return is crucial for businesses to operate legally and contribute to community development.

Steps to complete the tourism levy return

Completing the tourism levy return involves several important steps to ensure accuracy and compliance. Here are the key steps:

- Gather necessary information: Collect data on the total amount of tourism levy collected during the reporting period.

- Fill out the form: Accurately complete the tourism levy return form, providing all required details, including business information and the total levy amount.

- Review for accuracy: Double-check all entries for correctness to avoid errors that could lead to penalties.

- Submit the form: File the completed return through the designated submission method, whether online, by mail, or in person.

How to obtain the tourism levy return

Obtaining the tourism levy return form is straightforward. Businesses can typically access the form through their local or state government website, where it is often available for download. Additionally, some jurisdictions may provide the form at their offices or through designated tourism boards. It is essential to ensure that the correct version of the form is used, as requirements may vary by location.

Legal use of the tourism levy return

The tourism levy return must be completed and submitted in accordance with local laws and regulations to be considered legally binding. Compliance with the relevant legal frameworks is essential for the return to be accepted by authorities. This includes ensuring that the form is filled out accurately and submitted by the specified deadlines. Failure to comply with these regulations can result in penalties or legal repercussions for the business.

Filing deadlines / important dates

Filing deadlines for the tourism levy return vary by jurisdiction, making it crucial for businesses to be aware of their specific deadlines. Generally, returns may be due monthly, quarterly, or annually, depending on the amount of levy collected. Businesses should keep track of these important dates to avoid late submissions and potential fines. It is advisable to consult local regulations or government websites for the most accurate and up-to-date information regarding filing deadlines.

Penalties for non-compliance

Non-compliance with tourism levy return requirements can lead to significant penalties for businesses. These penalties may include fines, interest on unpaid levies, and potential legal action. The severity of the penalties often depends on the duration of the non-compliance and the amount of levy owed. To avoid these consequences, businesses should prioritize timely and accurate filing of their tourism levy returns.

Quick guide on how to complete tourism levy return

Effortlessly Prepare TOURISM LEVY RETURN on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle TOURISM LEVY RETURN on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

Steps to Modify and eSign TOURISM LEVY RETURN with Ease

- Locate TOURISM LEVY RETURN and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or disorganized files, boring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you select. Modify and eSign TOURISM LEVY RETURN while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tourism levy return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tourism levy return?

A tourism levy return is a document that businesses in the tourism sector must file to report and pay their tourism levy obligations. It ensures compliance with local regulations governing tourism activities and helps businesses manage their financial responsibilities effectively.

-

How can airSlate SignNow help with my tourism levy return?

airSlate SignNow simplifies the process of preparing and submitting your tourism levy return by providing an easy-to-use platform for electronic signatures and document management. This allows you to complete and send your documents quickly, ensuring timely compliance with applicable regulations.

-

What features does airSlate SignNow offer for tourism levy return submissions?

Key features of airSlate SignNow for tourism levy return submissions include secure electronic signatures, customizable document templates, and integration with popular accounting software. These features streamline your return preparation process, reducing errors and saving time.

-

Is there a cost associated with using airSlate SignNow for tourism levy returns?

Yes, airSlate SignNow offers various subscription plans that cater to different business needs. The pricing is competitive and designed to provide a cost-effective solution for managing your tourism levy return and other document signing requirements.

-

Can I integrate airSlate SignNow with other software to manage my tourism levy returns?

Absolutely! airSlate SignNow can be easily integrated with various accounting and financial management software, allowing you to sync your tourism levy return data seamlessly. This integration helps streamline your workflow and enhance accuracy.

-

How secure is my data when using airSlate SignNow for tourism levy returns?

airSlate SignNow ensures your data is secure with industry-standard encryption, secure cloud storage, and compliance with data protection regulations. Your tourism levy return documents are protected from unauthorized access, giving you peace of mind.

-

What are the benefits of using airSlate SignNow for my tourism levy return process?

Using airSlate SignNow for your tourism levy return process offers numerous benefits, including increased efficiency, reduced turnaround times, and improved compliance. The platform's user-friendly interface makes it easy for businesses to manage their return submissions with confidence.

Get more for TOURISM LEVY RETURN

- Above this line for official use only 481367666 form

- California real estate transfer disclosure statement nolo form

- Free prenuptial agreement create download and print form

- Direct deposit form automatic debit and credit agreement

- The quick home inspection checklist what to look for when form

- Code of laws title 63 chapter 15 child custody and form

- Legal considerations for fire and emergency services 3rd edition form

- Mcas grade 6 mathematics reference sheet form

Find out other TOURISM LEVY RETURN

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later