Crs 1 Form

What is the CRS 1 Form?

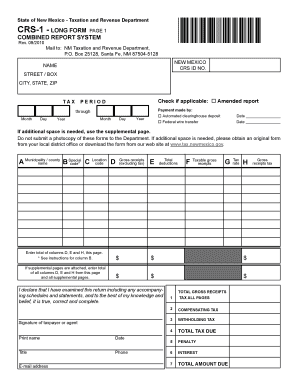

The CRS 1 form is a document used primarily in New Mexico for reporting and remitting gross receipts tax. This form is essential for businesses operating within the state, as it provides a means to report their sales and calculate the appropriate tax owed to the state government. The CRS 1 form is typically required for various business entities, including sole proprietorships, partnerships, and corporations, ensuring compliance with state tax regulations.

How to Use the CRS 1 Form

Utilizing the CRS 1 form involves several key steps to ensure accurate reporting. First, businesses must gather all relevant sales data for the reporting period. This includes total sales, exempt sales, and any deductions applicable. Once the data is compiled, it can be entered into the form, which includes sections for reporting gross receipts, calculating tax due, and providing business information. After completing the form, it must be submitted to the New Mexico Taxation and Revenue Department by the specified deadline.

Steps to Complete the CRS 1 Form

Completing the CRS 1 form requires careful attention to detail. Follow these steps:

- Gather all sales records for the reporting period, including receipts and invoices.

- Determine the total gross receipts from all sales made.

- Identify any exempt sales and deductions that apply to your business.

- Fill out the form by entering your total gross receipts, exemptions, and deductions in the appropriate sections.

- Calculate the total tax owed based on the gross receipts reported.

- Review the completed form for accuracy before submission.

Legal Use of the CRS 1 Form

The CRS 1 form holds legal significance as it is the official document for reporting gross receipts tax in New Mexico. Properly completing and submitting this form is crucial for compliance with state tax laws. Failure to file the CRS 1 form or inaccuracies in reporting can lead to penalties, interest, and potential legal issues. It is important for businesses to understand their obligations and ensure timely and accurate submissions to maintain good standing with state authorities.

Filing Deadlines / Important Dates

Filing deadlines for the CRS 1 form vary based on the reporting frequency assigned to the business, which can be monthly, quarterly, or annually. Businesses should be aware of their specific deadlines to avoid late filing penalties. Generally, the CRS 1 form is due on the 25th day of the month following the reporting period. For example, if reporting for the month of January, the form must be submitted by February 25. Keeping a calendar of these important dates can help ensure compliance.

Who Issues the Form

The CRS 1 form is issued by the New Mexico Taxation and Revenue Department. This department is responsible for the administration of tax laws in the state, including the collection of gross receipts tax. Businesses can obtain the form directly from the department's website or through their local tax offices. It is important for businesses to use the most current version of the form to ensure compliance with any recent changes in tax regulations.

Quick guide on how to complete crs 1 form 42116490

Prepare Crs 1 Form effortlessly on any gadget

Web-based document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the suitable form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents promptly without delays. Manage Crs 1 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to edit and electronically sign Crs 1 Form with minimal effort

- Obtain Crs 1 Form and click Get Form to begin.

- Leverage the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Crs 1 Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crs 1 form 42116490

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CRS 1 form and why is it important?

The CRS 1 form is a critical document used for tax purposes, providing detailed information about your business’s financial activities. Accurately completing the CRS 1 form can help ensure compliance with local regulations and avoid penalties. Using airSlate SignNow, you can easily fill, sign, and send your CRS 1 form securely.

-

How can airSlate SignNow help with filling out the CRS 1 form?

airSlate SignNow simplifies the process of completing the CRS 1 form through its user-friendly interface. You can easily input data, access templates, and make edits, ensuring that all required information is accurately captured. With airSlate SignNow, the process is efficient and reduces the chance of errors.

-

Are there any costs associated with obtaining the CRS 1 form through airSlate SignNow?

Using airSlate SignNow to manage your CRS 1 form comes with a flexible pricing structure tailored to meet different business needs. You can choose from various plans based on how frequently you need to send and eSign documents. This makes airSlate SignNow a cost-effective solution for managing the CRS 1 form and other documentation.

-

What features does airSlate SignNow offer for handling tax forms like the CRS 1 form?

airSlate SignNow offers a variety of features designed to streamline the management of tax forms, including the CRS 1 form. Key features include document templates, real-time collaboration, secure eSigning, and tracking capabilities. These tools ensure efficient handling and compliance when dealing with important documents.

-

Can I integrate airSlate SignNow with other tools when working on the CRS 1 form?

Yes, airSlate SignNow integrates seamlessly with numerous applications, enhancing your workflow when dealing with the CRS 1 form. Whether you use CRM systems, cloud storage, or productivity tools, these integrations streamline document management and ensure accessibility. This makes it convenient to manage your CRS 1 form with existing software.

-

Is it safe to use airSlate SignNow for the CRS 1 form?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documents, including the CRS 1 form, are protected with advanced encryption. Trusted by millions, airSlate SignNow complies with international security standards to keep your sensitive information safe. You can sign and send tax forms with confidence.

-

How can I ensure that my CRS 1 form is filed correctly using airSlate SignNow?

To ensure your CRS 1 form is filed correctly, utilize airSlate SignNow's guided templates and editing tools, which help prevent common errors. Additionally, the platform allows for collaborative reviews, so multiple stakeholders can verify the information before submission. This ensures that your CRS 1 form is accurate and compliant.

Get more for Crs 1 Form

Find out other Crs 1 Form

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service