Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon Form

What is the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon

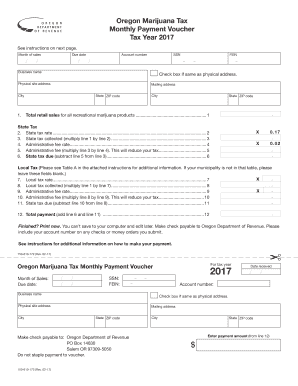

The Oregon Marijuana Tax Monthly Payment Voucher, identified as form 150 610 172, is a document used by businesses involved in the marijuana industry to report and remit state taxes. This form is specifically designed for entities that are required to pay taxes on marijuana sales in Oregon. It outlines the necessary information regarding the amount owed, the period for which the payment is made, and any relevant details about the business. Understanding this form is crucial for compliance with state tax regulations.

How to use the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon

Using the Oregon Marijuana Tax Monthly Payment Voucher involves several steps to ensure accurate reporting and timely payment. First, businesses must complete the form by providing all required information, including the total tax due for the reporting period. Once the form is filled out, it can be submitted either electronically or via mail, depending on the preferred submission method. It is important to keep a copy of the completed voucher for record-keeping and future reference.

Steps to complete the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon

Completing the Oregon Marijuana Tax Monthly Payment Voucher requires careful attention to detail. Follow these steps:

- Gather all necessary financial records related to marijuana sales for the reporting period.

- Fill out the form with accurate figures, including total sales and tax calculated.

- Review the completed form for any errors or omissions.

- Submit the form electronically through the designated state portal or mail it to the appropriate address.

Legal use of the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon

The Oregon Marijuana Tax Monthly Payment Voucher is legally binding when completed and submitted according to state regulations. To ensure its legal standing, businesses must comply with the requirements set forth by the Oregon Department of Revenue. This includes accurate reporting of sales and timely payment of taxes. Failure to adhere to these regulations may result in penalties or legal repercussions.

State-specific rules for the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon

Oregon has specific rules governing the use of the Marijuana Tax Monthly Payment Voucher. Businesses must be aware of the tax rates applicable to marijuana sales, which can vary based on the type of product sold. Additionally, there are deadlines for submitting the voucher and remitting payment, which are crucial to avoid late fees. Understanding these state-specific regulations is essential for compliance and successful business operations in the marijuana industry.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Marijuana Tax Monthly Payment Voucher are typically set on a monthly basis. Businesses are required to submit their voucher and payment by the last day of the month following the reporting period. For example, taxes for sales made in January must be reported and paid by the end of February. Keeping track of these important dates is vital to maintain compliance and avoid penalties.

Quick guide on how to complete oregon marijuana tax monthly payment voucher 150 610 172 oregon

Complete Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon with ease

- Find Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon marijuana tax monthly payment voucher 150 610 172 oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon?

The Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon, is a specific document required for cannabis businesses in Oregon to report and remit their monthly tax obligations. This voucher ensures compliance with state regulations while simplifying the payment process for marijuana retailers.

-

How can I obtain the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon?

You can obtain the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon, directly from the Oregon Department of Revenue's website or through our platform, airSlate SignNow. We provide templates and electronic signatures to streamline the filing process for cannabis businesses.

-

What are the features of using airSlate SignNow for the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon?

airSlate SignNow offers features like easy document sharing, secure electronic signatures, and automated reminders for filing deadlines for the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon. Our platform enhances efficiency and helps ensure that all tax submissions are completed accurately and on time.

-

Are there any costs associated with using airSlate SignNow for the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon?

Yes, there is a pricing structure for using airSlate SignNow, but our solution is designed to be cost-effective, especially for businesses managing the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon. Subscription plans are available based on your business needs, making it accessible for various budgets.

-

What benefits does airSlate SignNow provide for cannabis businesses dealing with the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon?

Using airSlate SignNow enhances compliance, speeds up the submission process, and reduces the risk of errors when filing the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon. Our platform allows businesses to focus more on growth while we handle the complexities of document management.

-

Is airSlate SignNow compliant with Oregon state regulations for the Marijuana Tax Monthly Payment Voucher?

Yes, airSlate SignNow is fully compliant with Oregon state regulations for the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon. We ensure that all forms are up-to-date and reflect the latest legislative requirements to help businesses remain compliant.

-

Can I integrate airSlate SignNow with other accounting software for the Oregon Marijuana Tax Monthly Payment Voucher?

Absolutely! airSlate SignNow can easily integrate with various accounting software and systems to streamline the filing and payment process for the Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon. This integration helps businesses manage their finances more effectively.

Get more for Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon

- Into by and between form

- S 60325 claims or actions for personal injuries property damage form

- 1 borrowers promise to pay in return for a loan that i have form

- Operating agreement xyz llc regular an indiana limited form

- Krs chapter 202a hospitalization of the mentally ill form

- La 00llc 1 form

- How to form an llc in massachusettsnolo

- How to form an llc in marylandnolo

Find out other Oregon Marijuana Tax Monthly Payment Voucher, 150 610 172 Oregon

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free