Form 3582 Payment Voucher for Individual E Filed Returns Ftb Ca

What is the California Form 3582 Payment Voucher for Individual E-filed Returns?

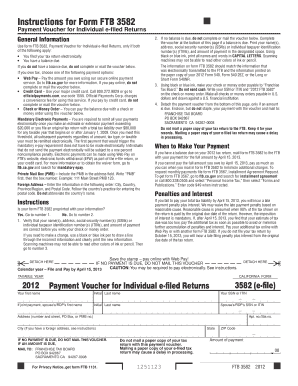

The California Form 3582 is a payment voucher specifically designed for individuals who are filing their tax returns electronically. This form serves as a means for taxpayers to submit their payment for any taxes owed to the California Franchise Tax Board (FTB) when they choose to e-file their returns. The Form 3582 is essential for ensuring that payments are accurately processed and credited to the taxpayer's account.

Using this form helps streamline the payment process, particularly for those who prefer the convenience of electronic filing while still needing to submit a payment. It is important for taxpayers to understand the purpose and requirements of the Form 3582 to ensure compliance with California tax regulations.

Steps to Complete the California Form 3582 Payment Voucher

Completing the California Form 3582 involves several key steps to ensure accurate submission. First, gather all necessary information, including your personal details, tax identification number, and the amount due. Next, accurately fill out the form, ensuring that all fields are completed correctly. Pay particular attention to the payment amount and any applicable penalties or interest.

Once the form is filled out, review it for accuracy. After confirming that all information is correct, you can submit the form along with your payment. This can be done electronically if you are using an online payment method or by mailing the form to the appropriate address provided by the FTB.

Legal Use of the California Form 3582 Payment Voucher

The California Form 3582 is legally recognized as a valid payment method for taxes owed by individuals who file their returns electronically. To ensure that the form is considered legally binding, it must be completed accurately and submitted in accordance with California tax laws. Compliance with the requirements set forth by the FTB is essential for the form to be accepted.

Additionally, using a trusted digital platform for completing and submitting the form can enhance its legal standing. Digital signatures and secure submission methods help protect the integrity of the document and ensure that it meets all legal requirements.

How to Obtain the California Form 3582 Payment Voucher

Taxpayers can easily obtain the California Form 3582 through the California Franchise Tax Board's official website. The form is typically available for download in PDF format, allowing users to print it out for completion. Additionally, many tax preparation software programs include the Form 3582 as part of their offerings, making it accessible for those who prefer to file electronically.

It is advisable to ensure that you are using the most current version of the form, as updates may occur annually or as tax laws change. Always check for the latest version before completing the form to avoid any issues with your submission.

Key Elements of the California Form 3582 Payment Voucher

The California Form 3582 includes several key elements that are crucial for accurate completion. These elements typically include the taxpayer's name, address, Social Security number or Individual Taxpayer Identification Number, and the amount of tax due. Additionally, the form may require information regarding the tax year for which the payment is being made.

It is important to ensure that all information is entered correctly, as errors can lead to processing delays or complications with your tax account. Understanding these key elements helps taxpayers navigate the form more effectively and ensures a smoother filing experience.

Filing Deadlines for the California Form 3582 Payment Voucher

Filing deadlines for the California Form 3582 are aligned with the state tax return deadlines. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential for taxpayers to be aware of these deadlines to avoid penalties and interest on late payments.

Additionally, if you are filing for an extension, you must still submit your payment by the original due date to avoid additional charges. Keeping track of these important dates ensures compliance with California tax regulations and helps maintain good standing with the FTB.

Quick guide on how to complete form 3582 payment voucher for individual e filed returns ftb ca

Effortlessly Prepare Form 3582 Payment Voucher For Individual E filed Returns Ftb Ca on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any delays. Handle Form 3582 Payment Voucher For Individual E filed Returns Ftb Ca on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Modify and Electronically Sign Form 3582 Payment Voucher For Individual E filed Returns Ftb Ca with Ease

- Obtain Form 3582 Payment Voucher For Individual E filed Returns Ftb Ca and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to apply your changes.

- Choose your preferred method to submit your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign Form 3582 Payment Voucher For Individual E filed Returns Ftb Ca and ensure excellent communication at any phase of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3582 payment voucher for individual e filed returns ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Form 3582?

The California Form 3582 is a document used for specific state reporting requirements. It is commonly needed for businesses operating in California to ensure compliance with state regulations. Properly completing the California Form 3582 can help avoid penalties and make the filing process smoother.

-

How can airSlate SignNow help with the California Form 3582?

airSlate SignNow provides an easy-to-use platform for eSigning and sending the California Form 3582. Our solution simplifies the process, ensuring that all your documents are securely signed and stored. This makes managing your compliance paperwork more efficient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for the California Form 3582?

Yes, airSlate SignNow offers affordable pricing plans that cater to different business needs. You can choose a subscription plan that includes access to features for managing and eSigning documents like the California Form 3582. Reviewing our pricing page will help you find the best option for your budget.

-

What features does airSlate SignNow offer for completing the California Form 3582?

airSlate SignNow includes features like templates, in-app signing, and document tracking specifically for the California Form 3582. Our user-friendly interface allows for quick completion, ensuring that users can efficiently manage and sign their documents. Additionally, you can easily store and retrieve your forms at any time.

-

Can I integrate airSlate SignNow with other tools for California Form 3582 management?

Absolutely! airSlate SignNow supports integrations with various business applications to enhance your workflow for the California Form 3582. Whether you use CRM systems or other document management tools, our platform can streamline your processes by connecting seamlessly with your existing software.

-

What are the benefits of using airSlate SignNow for the California Form 3582?

Using airSlate SignNow for the California Form 3582 offers numerous benefits such as improved efficiency, reduced paperwork, and enhanced compliance tracking. Our solution allows you to manage all your necessary documents digitally while ensuring their security. Furthermore, eSigning the form can save you valuable time and resources.

-

How do I get started with airSlate SignNow for the California Form 3582?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, and choose the plan that fits your needs. Once registered, you can upload the California Form 3582, set it up for eSigning, and begin managing your documents with ease.

Get more for Form 3582 Payment Voucher For Individual E filed Returns Ftb Ca

- Pdf paycheck deduction form

- Donation value guide 2017 spreadsheet form

- L 1 tax 2012 form

- What is affidavit of domicile form

- Internship manual pdf college of education florida international form

- Matka patti calculation form

- Child care program evaluation template form

- Rgwlawenfscholarship the ronnie williams foundation criminal justice scholarship application thergwfoundation form

Find out other Form 3582 Payment Voucher For Individual E filed Returns Ftb Ca

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will