PA Schedule M Reconciliation of Federal Taxable Income Form

What is the PA Schedule M Reconciliation Of Federal Taxable Income

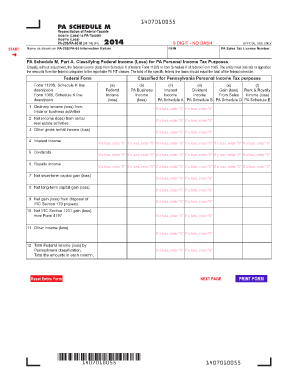

The PA Schedule M Reconciliation Of Federal Taxable Income is a tax form used by Pennsylvania residents to reconcile their federal taxable income with their state taxable income. This form is essential for ensuring that taxpayers accurately report their income and comply with state tax regulations. It allows individuals and businesses to adjust their federal income to reflect state-specific tax rules, ensuring that all taxable income is correctly accounted for in Pennsylvania.

Steps to complete the PA Schedule M Reconciliation Of Federal Taxable Income

Completing the PA Schedule M involves several key steps:

- Gather necessary financial documents, including your federal tax return and any supporting schedules.

- Identify any differences between your federal and Pennsylvania taxable income. Common adjustments may include state-specific deductions or credits.

- Fill out the form by entering your federal taxable income and making the necessary adjustments to arrive at your Pennsylvania taxable income.

- Review the completed form for accuracy, ensuring all calculations are correct and all necessary information is included.

- Submit the form along with your Pennsylvania tax return by the designated filing deadline.

Legal use of the PA Schedule M Reconciliation Of Federal Taxable Income

The PA Schedule M is legally recognized as part of the Pennsylvania tax filing process. It must be completed accurately and submitted in accordance with state regulations. Failure to comply with the legal requirements associated with this form can result in penalties, fines, or additional tax liabilities. Therefore, it is crucial to understand the legal implications of the information reported on this form.

Key elements of the PA Schedule M Reconciliation Of Federal Taxable Income

Several key elements are essential when completing the PA Schedule M:

- Federal Taxable Income: The starting point for the reconciliation process.

- Adjustments: Specific additions or subtractions that reflect Pennsylvania tax law.

- Final Pennsylvania Taxable Income: The result after all adjustments have been made, which will be reported on your state tax return.

- Signature: The form must be signed to certify that the information provided is accurate and complete.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the PA Schedule M. Typically, the form must be submitted by the same deadline as your Pennsylvania state tax return. For most taxpayers, this is April 15th. However, extensions may be available, and it is advisable to check the Pennsylvania Department of Revenue's website for any updates or changes to deadlines.

Form Submission Methods (Online / Mail / In-Person)

The PA Schedule M can be submitted in various ways, depending on your preference and circumstances:

- Online: Many taxpayers choose to file electronically through approved tax software that supports Pennsylvania forms.

- Mail: You can print the completed form and send it to the appropriate Pennsylvania Department of Revenue address.

- In-Person: Some individuals may opt to deliver their forms directly to local tax offices, although this method is less common.

Quick guide on how to complete pa schedule m reconciliation of federal taxable income

Complete PA Schedule M Reconciliation Of Federal Taxable Income effortlessly on any gadget

Digital document administration has gained traction among organizations and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, adjust, and eSign your documents quickly without interruptions. Handle PA Schedule M Reconciliation Of Federal Taxable Income on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign PA Schedule M Reconciliation Of Federal Taxable Income effortlessly

- Obtain PA Schedule M Reconciliation Of Federal Taxable Income and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your choice. Alter and eSign PA Schedule M Reconciliation Of Federal Taxable Income to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa schedule m reconciliation of federal taxable income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PA Schedule M Reconciliation Of Federal Taxable Income?

PA Schedule M Reconciliation Of Federal Taxable Income is a form used by Pennsylvania businesses to reconcile their federal taxable income with the state’s requirements. This process helps ensure accurate state tax reporting and compliance. Understanding this form is crucial for businesses looking to avoid penalties and ensure proper tax liabilities.

-

How can airSlate SignNow help with PA Schedule M Reconciliation Of Federal Taxable Income?

airSlate SignNow simplifies the process of preparing and submitting PA Schedule M Reconciliation Of Federal Taxable Income by providing easy-to-use electronic signature capabilities. You can securely send, eSign, and manage documents related to tax reconciliation from any device. This not only saves time but also enhances compliance and accuracy in your submissions.

-

Is airSlate SignNow cost-effective for handling tax documents like PA Schedule M?

Yes, airSlate SignNow offers a cost-effective solution for managing tax documents, including PA Schedule M Reconciliation Of Federal Taxable Income. Our pricing plans cater to various business needs, ensuring that you receive excellent value while streamlining your document workflow. By reducing manual processes, you can potentially save on operational costs.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as template creation, document routing, status tracking, and secure eSigning specifically designed for tax documents like PA Schedule M Reconciliation Of Federal Taxable Income. These features facilitate a seamless experience from document preparation to submission, ensuring that you meet all compliance requirements efficiently.

-

Can I integrate airSlate SignNow with accounting software for handling PA Schedule M?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, allowing you to manage your PA Schedule M Reconciliation Of Federal Taxable Income directly within your existing workflow. This integration streamlines the data transfer process and enhances collaboration between the teams responsible for tax reporting.

-

What are the benefits of using airSlate SignNow for tax reconciliation?

Using airSlate SignNow for tax reconciliation, including PA Schedule M Reconciliation Of Federal Taxable Income, offers numerous benefits such as increased efficiency, reduced errors, and shorter turnaround times. The platform’s user-friendly interface speeds up the document management process and allows for real-time updates and notifications, ensuring everyone stays informed.

-

How secure is airSlate SignNow when dealing with sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information concerning PA Schedule M Reconciliation Of Federal Taxable Income. We ensure that all data is securely stored and transmitted, providing peace of mind when handling confidential tax documents.

Get more for PA Schedule M Reconciliation Of Federal Taxable Income

Find out other PA Schedule M Reconciliation Of Federal Taxable Income

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors