Ct 200 V Form

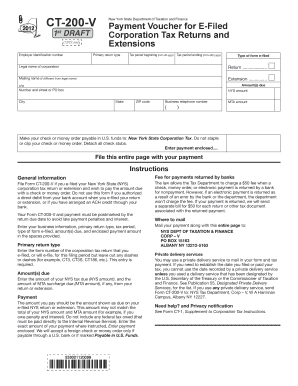

What is the Ct 200 V?

The Ct 200 V is a tax form used in New York for reporting certain tax information related to business entities. This form is specifically designed for corporations and partnerships to disclose their income, deductions, and tax credits. It plays a crucial role in ensuring compliance with state tax regulations and helps the New York State Department of Taxation and Finance assess the tax liabilities of these entities.

How to use the Ct 200 V

Using the Ct 200 V involves several steps, including gathering necessary financial information and completing the form accurately. Taxpayers must ensure they have all relevant documents, such as income statements and expense records, before starting. The form should be filled out with precise details regarding income, deductions, and any applicable credits. Once completed, it can be submitted electronically or via mail, depending on the preference of the taxpayer and the requirements of the state.

Steps to complete the Ct 200 V

Completing the Ct 200 V requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the form with accurate information regarding your business’s income and deductions.

- Review the form for any errors or omissions to ensure accuracy.

- Submit the completed form either online through a secure portal or by mailing it to the appropriate tax office.

Legal use of the Ct 200 V

The Ct 200 V is legally binding when completed and submitted according to New York tax laws. It is essential for businesses to understand the legal implications of the information provided on the form. Accurate reporting is critical, as discrepancies can lead to audits or penalties. Compliance with the relevant tax regulations ensures that businesses maintain their good standing with the state.

Filing Deadlines / Important Dates

Timely filing of the Ct 200 V is crucial to avoid penalties. Generally, the form must be submitted by the due date for the business’s tax return. Important deadlines may vary based on the type of business entity and fiscal year-end. It is advisable to check the New York State Department of Taxation and Finance website for the most current filing dates and any extensions that may apply.

Required Documents

When completing the Ct 200 V, various documents are necessary to support the information reported. These may include:

- Income statements detailing revenue generated by the business.

- Expense reports outlining all deductible costs incurred during the tax period.

- Previous tax returns for reference and consistency.

- Any relevant documentation for tax credits claimed.

Form Submission Methods (Online / Mail / In-Person)

The Ct 200 V can be submitted through multiple methods, providing flexibility for taxpayers. Options include:

- Online submission via the New York State Department of Taxation and Finance secure portal.

- Mailing the completed form to the designated tax office address.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete ct 200 v 210625331

Complete Ct 200 V effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Ct 200 V on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Ct 200 V with ease

- Obtain Ct 200 V and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of submitting your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Ct 200 V and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 200 v 210625331

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct 200 v and how can it benefit my business?

The ct 200 v is a powerful electronic signature solution offered by airSlate SignNow that enables businesses to streamline their document signing process. By using the ct 200 v, organizations can reduce turnaround times and improve workflow efficiency, ensuring that critical documents are signed promptly.

-

How much does the ct 200 v cost?

The ct 200 v is offered at competitive pricing to ensure that businesses of all sizes can access our eSignature solutions. For detailed pricing information, it’s best to visit our website or contact our sales team to find a plan that fits your needs and budget.

-

Are there any specific features of the ct 200 v that stand out?

Yes, the ct 200 v includes features such as customizable templates, in-person signing, and integration capabilities with popular applications. These features make it easy for businesses to manage document workflows and enhance productivity.

-

Can the ct 200 v integrate with other software tools?

Definitely! The ct 200 v integrates seamlessly with various popular software tools such as CRM systems and cloud storage services. This allows businesses to work within their existing ecosystems while leveraging the advanced capabilities of airSlate SignNow.

-

Is the ct 200 v secure for handling sensitive documents?

Absolutely. The ct 200 v prioritizes security and complies with industry standards, ensuring that your documents are encrypted and securely stored. This makes it an ideal choice for businesses that handle sensitive information.

-

How easy is it to set up and use the ct 200 v?

The ct 200 v is designed with user-friendliness in mind, making the setup process quick and straightforward. Users can easily navigate the platform, allowing your team to start sending and signing documents without a steep learning curve.

-

What support options are available for ct 200 v users?

airSlate SignNow offers a variety of support options for ct 200 v users, including detailed documentation, live chat, and email support. Our dedicated team is here to assist you with any questions or issues you may encounter.

Get more for Ct 200 V

- 405 974 2390 fax 405974 3842 form

- Directed to their counselor form

- Hanger plate carrier with bearing plate and form

- Provider information change form tmhpcom

- Email artisanaromaticsgmail form

- Eden press form

- Arizona aloha festival primary forum to carry out this form

- I affirm and attest under penalty of perjury that i form

Find out other Ct 200 V

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation