Media Services New York State Wage Theft Prevention Act Form 2012-2026

What is the New York Wage Theft Prevention Act Form?

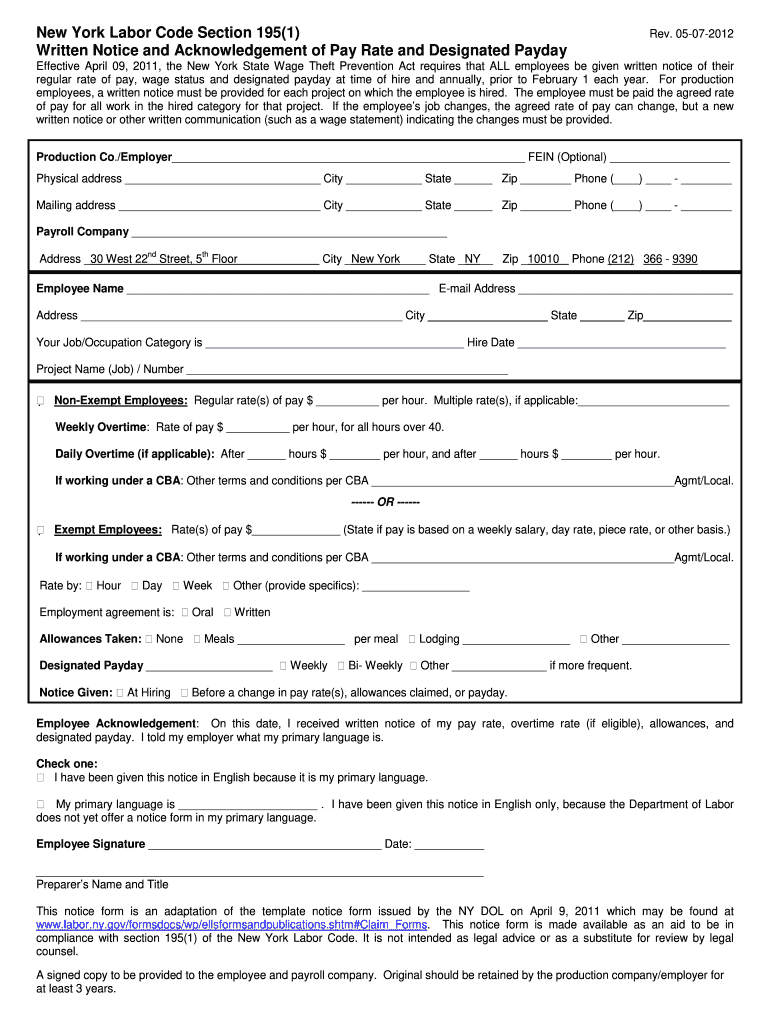

The New York Wage Theft Prevention Act Form is a legal document designed to ensure that employees are informed about their rights regarding wages and pay practices. This form is a critical component of the Wage Theft Prevention Act (WTPA), which aims to protect workers from wage theft by requiring employers to provide clear and comprehensive wage notices. The form typically includes details such as the employee's rate of pay, overtime policies, and the employer's contact information. By using this form, employers fulfill their obligation to inform employees about their compensation, thereby promoting transparency and compliance with state labor laws.

Key Elements of the New York Wage Theft Prevention Act Form

Several key elements must be included in the New York Wage Theft Prevention Act Form to ensure its validity and compliance with state regulations. These elements include:

- Employee Information: Name, address, and contact details of the employee.

- Employer Information: Name, address, and contact details of the employer.

- Rate of Pay: The employee's hourly rate or salary, including any overtime rates.

- Pay Frequency: How often the employee will be paid (weekly, bi-weekly, etc.).

- Overtime Policy: Explanation of how overtime is calculated and paid.

- Other Benefits: Information about any additional benefits or bonuses.

Including these elements ensures that the form meets legal requirements and provides necessary information to employees.

Steps to Complete the New York Wage Theft Prevention Act Form

Completing the New York Wage Theft Prevention Act Form involves several straightforward steps. Follow these guidelines to ensure accuracy and compliance:

- Gather Information: Collect all necessary employee and employer information, including contact details and pay rates.

- Fill Out the Form: Carefully input the gathered information into the form, ensuring all fields are completed accurately.

- Review for Accuracy: Double-check the information for any errors or omissions to avoid potential disputes.

- Obtain Signatures: Both the employer and employee should sign the form to acknowledge receipt and understanding of the wage information.

- Distribute Copies: Provide a copy of the completed form to the employee and retain a copy for the employer's records.

Following these steps will help ensure that the form is completed correctly and serves its intended purpose.

Legal Use of the New York Wage Theft Prevention Act Form

The legal use of the New York Wage Theft Prevention Act Form is essential for both employers and employees. For employers, providing this form is a legal requirement under the WTPA, and failure to do so may result in penalties or claims of wage theft. For employees, receiving this form is a way to understand their rights and entitlements regarding wages. It serves as a legal record that can be referenced in case of disputes over pay or working conditions. Ensuring that the form is completed accurately and retained by both parties is crucial for legal protection.

How to Obtain the New York Wage Theft Prevention Act Form

Obtaining the New York Wage Theft Prevention Act Form is a straightforward process. Employers can access the form through the New York State Department of Labor's website or other official state resources. Additionally, many payroll software solutions provide templates for this form, making it easier for employers to comply with the law. It is important to ensure that the most recent version of the form is used to meet current legal requirements. Employers should also consider consulting legal counsel if they have questions about the form or its implications.

Penalties for Non-Compliance

Failure to comply with the requirements of the New York Wage Theft Prevention Act can result in significant penalties for employers. These penalties may include:

- Monetary Fines: Employers may face fines for not providing the required wage theft prevention notice.

- Back Wages: Employers may be liable for back wages owed to employees if wage theft is proven.

- Legal Action: Employees may file lawsuits against employers for violations, leading to potential legal costs and damages.

Understanding these penalties emphasizes the importance of using the New York Wage Theft Prevention Act Form correctly and ensuring compliance with all relevant labor laws.

Quick guide on how to complete media services new york state wage theft prevention act form

Simplify Your HR Processes with Media Services New York State Wage Theft Prevention Act Form Template

Every HR professional recognizes the importance of keeping employee information neat and organized. With airSlate SignNow, you gain access to an extensive collection of state-specific labor documents that greatly enhance the locating, managing, and storing of all work-related files in one location. airSlate SignNow enables you to oversee Media Services New York State Wage Theft Prevention Act Form management from start to finish, with all-inclusive editing and eSignature tools always at your disposal. Improve your precision, document security, and reduce minor manual mistakes with just a few clicks.

The optimal method to edit and eSign Media Services New York State Wage Theft Prevention Act Form:

- Choose the relevant state and search for the form you require.

- Access the form page and click Get Form to start working on it.

- Allow Media Services New York State Wage Theft Prevention Act Form to load in the editor and follow the prompts that highlight mandatory fields.

- Input your information or incorporate additional fillable fields into the document.

- Utilize our tools and features to adjust your form as needed: annotate, redact sensitive details, and create an eSignature.

- Review your document for mistakes before submitting it.

- Click Done to save changes and download your form.

- Alternatively, send your document directly to recipients and gather signatures and information.

- Securely store completed documents in your airSlate SignNow account and access them whenever needed.

Employing a versatile eSignature solution is crucial when handling Media Services New York State Wage Theft Prevention Act Form. Make even the most intricate workflow as straightforward as possible with airSlate SignNow. Initiate your free trial today to discover what you can achieve with your department.

Create this form in 5 minutes or less

FAQs

-

If you were president, which promises would you make?

If you were president, which promises would you make?Female PresidentsGet humans out of government by replacing them with Blockchain, Artifical Intelligence, Big Data and 5G broadband. A more transparent government based on fairness and logic. (Two things people aren’t known for in politics. )(What Could Blockchain Do for Politics? – Welcome to Blockchain – Medium) / (Motivating the Greatest Geniuses in AI to Change the World Instead of Destroy It)Ideas:1. Universal Healthcare. An expansion of Medicaid would be the easiest thing since our taxes already pay for it. The money for Medicaid and Medicare can be combined.2. 35–70% tax on small business, corporations, and citizens with income that exceeds $5 million annual domestically or abroad. (Corporations are people. So what if people were corporations?)Companies like Amazon use water, create waste, dump pollution, contribute to homelessness, gentrify neighborhoods and take up space on par with a city or large town. Why aren’t they charged for their carbon footprint?A progressive tax takes a larger percentage of income from high-income groups than from low-income groups and is based on the concept of ability to pay. A progressive tax system might, for example,tax low-income taxpayers at 10 percent, middle-income taxpayers at 15 percent and high-income taxpayers at 30 percent.How much revenue Companies make by state. Click to enlarge.3. Equal rights for all and equal pay no matter the occupation. Whatever is the highest salary/hourly pay for a specific sector will be the set pay rate for that occupation/field.The goal is for industry/business/institutions to reassess how much they pay individuals and restructure wages/salaries accordingly. The race pay gap and gender pay gap are real and detrimental to society. A District manager shouldn’t make more than a public school teacher when only one of them has full benefits. Most cases the teacher doesn’t have full benefits. ( Starbucks announces 100 percent gender, racial pay equity )No Golden Parachutes for indivduals associated with crimes, embezzlement, mismanagement. Golden Parachute riders will be redistributed to customers and down-sized employees in such cases.Worker’s rights will be protected. 40 hour work week in every industry. No more ‘open availability’ or ‘Right to Work’ States. Companies should learn to schedule people. Workers are assets not slaves. People can be scheduled for less hours but not for more than 40 hours they end up working for less pay. The cost of living includes health, transporation, and childcare which should be taken into account by employers. Many people are not properly compensated for overtime. The language for overtime has become subjective in most industries. Thus leading to wage theft. ( It Is Expensive to Be Poor)5 to 42-week paid maternity leave for fathers and mothers. (Depends on doctors recommendation)National childcare centers and 12-hour child care centers for 0–14 years old open Mon.-Sun. and during school closures. Sliding pay scale. Subsidized by federal government and/or corporations.All businesses will respect national holidays. Paid sick leave, paid holidays, retirement planning, life insurance for all workers.Contract workers and part-time workers should have workers rights which should include healthcare/ dental care/ eye care/ mental health/ sick leave/ maternity 5-42 weeks for both sexes (Gig Economy Renews Debate Over Whether Contractors Are Really Employees)Companies that do mass firing/layoffs of over 50 people must provide severance pay (dependent of duration employment and experience of worker) and work transition such as certificate classes/ pay for professional licenses/ new job placement.Prisoner’s working for third party company and/or via subsidary or for the state in dangerous occupations such as firemen will have minimum wage and worker’s rights as well. Their life insurance policy will be remitted to their immediate family tax-free upon their death if they die in the line of duty. Their work experience should guarantee them a position in said career regardless of past criminal activity.4. Min. wage is $15.00/hr.Wage theft will lead to business closure and revoking of business licenses/LLC for 10 years or temporary seizure of business by workers who will run it.Wages will increase by 1.50 ¢ every 5 years depending on the economy and cost of living.Workers will be given a stake in their employment either through stocks or ownership (2–10%).5. The popular vote is the only vote. (Majority rules literally.) Same day voting and registration. Voting available on weekends and evenings.6. Free transportation to voting booth for the elderly and disabled. Voting booths will be in public buildings.7. Voting can be done on registered personal phones or from a secure phone network that has gov’t oversight and encryption. (Done in partnership with phone carriers.)8. Sexual orientation/intercourse, birth control, marriage, illegal drugs, guns will not be regulated by states or the federal government because they are too costly to prosecute/appeal/repeal and lead to too much incarceration/disenfranchisement.Guns will no longer be a right but a privilege for those who are licensed, trained, and agree to bi-annual home/mental health checks. Training for guns will be every 2–4 years as well as renewing licenses. No more consealed weapons or open carry. Guns are for hunting, gun range, and protecting the home from intruders. (Gun Control - ProCon.org )9. Prison/jail will be for reform and a pathway to reintegrating former prisoners to society. Punishment and lack of a social safety net create repeat offenders.No more lifetime sentences unless it is for heinous crimes of rape and murder.Private prison must provide programs that lead to degree-seeking and job placement.No prison/jail time for nonviolent crime that doesn’t lead to property damage over $10,000.Community service and fines (sliding scale dependent on income) will be compulsory for all nonviolent crimes. Nonviolent crimes will not be internet accessible/public after 4 years of good behavior or for any underage offenders. Records are sealed automatically after all requirements are met. (ReducingRecidivism_StatesDeliverResults.pdf)A study published in 2011 found the ankle monitoring system reduced the recidivism rate by up to half compared to traditional incarceration. Instead of wasting away in a jail cell, eating up federal dollars, convicted criminals are given the opportunity to contribute to society. (Measuring Recidivism)No bail for nonviolent crimes. You are given a fine and court date. Go home. Go to work. Don’t miss your court.If you miss your court date you get more fines that are garnished from your wages.If you are unemployed you are doing supervised community service like trash pickup on highway/public parks, building homes for the homeless, janitorial work for nonprofits and public buildings until you pay your fines with community service hours.If you unemployed and unable to do physical work you will be required to report to a clinical social worker who will plan out alternative charitable works for you to do.Option to have court hearings via video conferencing for single parents, disabled, elderly and terminally ill.Violent crime must entail at least two of the following: death, bodily harm, use of a deadly weapon to terrorize or intimidate, mental harm, and/or property damage over $5000.No lifetime imprisonment for underage offenders for any crime. Schooling program and psychiatric detention for youthful offenders who kill/murder/rape. Monitoring of all violent felons by city/state allowed for up to 10 years+ depending on crime. They get the right to be 'forgotten' .Reinstatement or issue of license, board certification will be by a case by case basis.No former prisoner will be denied the right to social welfare benefits, housing, employment, have a career, license, qualification, certification, start or maintain a legal business.Especially if they do not have a criminal record/history of using said business/industry for money laundering or other illegalities that cheat the government of taxes/unfairly exploit/bring harm to the community and/or employees.Electronic ankle monitoring system/mini drone surveilance that allows people to re-enter the workforce10. Amendments to protect social services/benefits that aid in keeping crime down. All vulnerable Americans will have a safety net and not be penalized for being poor, elderly, having a pre-existing condition, in ill health, disabled, or homeless.11. Amendments to protect civil rights of the disabled, LBGTQ+, and noncitizens who work as migrant workers.Migrant workers will have mental health counseling, legal recourse, and compensation for wage theft, rape, and assault.12. An Outside elected oversight committee of experts to check the check and balances of government and audit the branches ethically and monetarily every year.They will also audit the pentagon and military braches as well.(Exclusive: Massive Pentagon agency lost track of hundreds of millions of dollars )('I said no 20 times', military rape victims speak out)(Military sex assault reports jump 10% )13. No more borders. People only stay because they can’t go back home. (The answer to border security is technology, not wall )An “open” border secured with ID implants and tech to recognize criminals. International laws to detain and transport them to their home of origin quickly and efficiently. (The Surprisingly Compelling Argument for Open Borders)There will be customs officials and The Transportation Security Administration that will keep track of movement. (Facial Recognition In China Is Big Business As Local Governments Boost Surveillance )Border town housing, daily passes, weekly passes, and monthly passes for migrant workers/temporary work Visa holders.14. Invest in infrastructure.automated transportation: planes, trains, and automobilesheating and cooling of brick and mortar/online K-12 schools for Inclement weather, (Why Can't Public Schools Keep the Heat On?)Replace pipes for water and sanitation.hydraulic turbines: converts the energy of flowing water into mechanical energy.Supersonic inter-state rail, inter-city rail, and national underground Boring travel. (ASCE's 2017 Infrastructure Report Card | GPA: D+)15. Amendments to protect the investment in tech. to improve quality of life, the environment, desalination of water, national parks and public lands indefinitely.We are not preparing our country to compete in the new energy economy of the future and create millions of new jobs, we lag behind most of our competitors in the rest of the world in a four key ways.We have no national energy portfolio standard that encourages clean, renewable power and shifts away from dirty and dangerous energy.We have an outdated electrical grid (Keeping the Lights On: The Clean Power Plan and the Real Threat to Grid Reliability - Center for American Progress ) unsuited for the task of carrying energy from regions rich in wind, solar, and geothermal potential to the people who need the energy.We don’t make dirty energy companies pay for the pollution they pump into the air; in fact, we give them billions every year in tax breaks. (It Is Time to Phase Out 9 Unnecessary Oil and Gas Tax Breaks - Center for American Progress)And we don’t invest enough in research, development, and deployment to inspire our entrepreneurs and leverage their discoveries by helping bring their bold new technologies to market. (Invest in America’s Clean Energy Future - Center for American Progress) /(The Missing Ingredient in Our Recovery - Center for American Progress)/(We Must Help Universities Invest in Good Technology - Center for American Progress )16. Rape, sexual assault, child molestation will be considered violent crimes. Often they aren’t treated as such or punished with the same severity.17. Civil Rights for children.Voting age is lowered to 16 years old. (the nation - lower the voting age to 16 )Same legal rights as adults e.g Right to a lawyer, fair trial, and speedy process.Right to reasonable care.Right to their body. No forced circumcision for ceremonial purposes. No cruel unusual punishment or corporal punishment.Even though the government will not regulate marriage there will be an amendment that establishes no one can consent to any contract, including one for marriage, until they are 18 years old. No one under the age of 18 can legally consent to sex and marriage with an adult ever. No more child marriage because it infringes on the civil rights of the child. (The Loopholes That Allow Child Marriage In The U.S. )18. Elderly villages for those who want to live as independently as they can. A company trust and social workers will aid in maintaining these satellite locations.Land trusts to prevent gentrification will be created by the federal government but managed by the community.Rent/tax/mortgage caps for the homes of the elderly, wartime veterans, and disabled.19, Basic income for the elderly, disabled, all veterans of wartime, and single parents not receiving child support (until the child is 18).20. Sex work and drugs that were once illegal will be services to be sold under legal business entities. Staff will have a 2-10% stake in business. Businesses must be formed legally, be transparent with their practices, provide worker’s rights/protections under the law, and pay tax.21. Nationalized K-12 education that teachescomprehensive sex hygiene/health, consent, sexual intercourse, sex positivity, menstruation, proper safer sex practices, pregnancyAll explanation about sex will be age appropriate and be taught K-12. (The case for starting sex education in kindergarten)History, a second language (K-12), critical thinking, emotional intelligence, math, sciences, art/film, music, robotics, civics, political science/journalism, coding, small business implementation, finance/investing and tech.History will be taught truthfully and include the history of Native American, indigenous peoples, African Americans, slavery, and that of the commonwealths, and occupation of former U.S. colonial possessions of America. No more lies. (More Than A Month: For My 4th Grade Teacher, Mrs. James | PBS Education)Teachers/instructors in will be experts and professionally active in their field.Students will shadow industry professionals to introduce them to possible careers and have paid internships from age 14 to 19 every summer.Students upon graduation will have an active investment profolio and sponsor/mentor/ angel investor.22. Free college and free vocational school. No age limits for career/job training, vocational schools, or apprenticeships.23. No taxes/price hikes/price inequality based on sex/gender -specific adult hygiene products such as tampons/pads/ adult diapers/razors, etc. (OP-ED: The Tax on Feminine Hygiene Products is Sexist, Period )Cost of such items will be absorbed by employers, healthcare system, and provided by/accessible through WIC/SNAP. ('Pink Tax' forces women to pay more than men )24. Every state must designate five areas (2 - 4 acres) for rent-capped affordable housing.3D-Printed Home Can Be Constructed For Under $4,000A reasonable area that 20% of its homeless or below poverty level population can occupy. The housing must be Green, energy efficient, and sustainable.It must have amenities for internet access, tv/cable, landline, heating, cooling, cooking, bathing, and washing clothes.Large corporations only receive tax credits if they help create, sponsor, and support such communities.25. Corporations are no longer people. (When Did Companies Become People? Excavating The Legal Evolution)“Corporate welfare” is dependent on how much aid it has given local and domestic communities.Aid will be defined as creating/ financially supporting childcare centers/programs, 3 hot meals daily for low income children, libraries with internet/broadband, K-12 schools, work training programs that create self-sufficiency/scholarships/certifications/licenses/college credit and affordable housing for low-income families and/or working poor adults. (If Corporations Are People, They Should Act Like It)26. National reparations for slavery, those put in debtor’s prison (Ending Modern-Day Debtors' Prisons), sterilization due to state eugenics programs (Unwanted Sterilization and Eugenics Programs in the United States), those falsely imprisoned/put to death for a crime they did not commit and the descendants of those who suffered peonage.27. Transfer all lands trusts to Native American tribes. (Native American Trust Lands Explained | 1st Tribal Lending Blog) Return tribal lands and burial grounds to Native Americans. Honor original treaties with Native Americans that benefited their tribes. Give back tribes their indigenous designations so they may be recognized by the government. (List of unrecognized tribes in the United States - Wikipedia)Pay tribes for use of land to create affordable 3D printed housing, colleges and public schools.Pay tribes for use of land to run high speed sky rails and underground Boring for traffic.28. Companies must pay the public royalties for use of their data especially if they sell it or make a profit using it. If they are dead any next of kin and direct descendant will continue to receive payment.29. A percentage of taxes and crowdfunding will create a hedge fund/ trust that will be used to pay down civilian credit card debt/medical debt for the poor/elderly.30. No one will be denied employment for the nonviolent criminal record, traffic citations, poor credit or debt if they are transparent.* Companies must record all employment interviews to be reviewed by the EEOC* Companies will receive the tax credit for hiring directly from prison reform programs.* Companies will provide personal finance classes and help with matching employee retirement funds.Employees with over 10 years of service in a past or present industries fired or forced to resign due to age descrimination or pregnancy will receive retroactive pensions. (IBM is facing allegations of rampant age discrimination) /(Fired for being pregnant )31. Ten-year cap on credit interest.* Debt forgiveness/ consolidation for low income families/students.32. Emergency services /911 on will be uniform and nationalized.* Modern capabilities to receive emergency texts, use satellite GPS to find locations (HBO's John Oliver Reveals Stunning Tech Failures with 911 Emergency Calls)* FEMA will be in partnership with 91133. Nationalized Police procedure and training for self-defense, hand-to-hand combat, de-escalation, fitness tests, psychological appraisals and marksmanship exams. (American policing is broken. Here’s how to fix it.)* Endless drilling on even the most routine scenarios.Shooting at moving vehicles, with people brandishing knives and at suspects fleeing a scene are all strictly forbidden except under extreme circumstances.* Weekly drills challenging them to find creative ways out of confrontations and spent long nights at the shooting range to upgrade their marksmanship.* Police involved in the planting of evidence, rape/sodomy/sexual assault of apprehended, theft, torture, shooting of unarmed citizens, the permanent bodily harm of those being apprehended, use of excessive force for nonviolent crime and shooting of unarmed citizens not in the mist of a crime in the back leads to firing and loss of retirement and pay. No suspension and 5- 15+ years in prison automatically. They cannot work in law enforcement ever again. (Secret NYPD Files: Officers Can Lie To Juries Or Brutally Beat Civilians And Still Keep Their Jobs)* Mandatory body cams that can only be shut off by the local FBI and State Attorney General.* All body cam and drone footage are public domain if crime unbecoming of a police officer such as the death in custody, rape, sexual assault, wrongful arrest, permanent bodily harm occurs during an arrest. Must be released online/to the media immediately. Of course care will be taken to shield the victim from exposure or identification. Victim/victim’s family will have final say on media release.* Mandatory micro drones record and follow police everywhere while on duty or carrying service firearm.34. No more bipartisan/party government.Congress/Senate/Federal agencies positions/offices will be filled by lottery. Majority votes will pick candidates who have the qualifications to add their names to each state lottery.No cronyism/nepotism. No adult children, relatives or “friends” can work along side you in any capacity, represent your office, or stand in for you in any circumstance.Mental health assesment, IQ test with a strong focus on critical thinking and logic, General Knowledge and Education test, Civics test, ethics test with essays and yearly vetting.Lottery candidates will run against other lottery candidates for offices, positions, or seats.Campaigns will be funded by public donations from citizen tax payers, crowdfunding and grassroot efforts only.No money from foreign powers or Super Pacs.Only radio ads, newspaper ads, billboards, and limited television ad campaigns will be allowed. No oversaturation of media allowed.To join government one must have Masters or Doctorate degrees in at least two of the following fields: Science, economics, public health, mathematics, Business Law, Constitutional Law, EducationTo join the Federal government/hold higher public office/lead an agency one must have interned in each branch of government, serve as mayor of a township/city, governor of a state, and held a seat in Congress/Senate to eventually be President or part of the President’s cabinet.No lifetime positions in any branch or agency of government. You may run for up to two five-year terms if chosen by lottery and relected.Automatic retirement at age 55.Every seat position is elected by the people.35. No more death penalty. It’s too expensive and takes too long. (Costs of the Death Penalty)36. Federal funding of states will be dependent on the followingTransparency with state and local taxes.Must provide breakdown of how taxes are used every fiscal year to the populace and fed. gov’t.Adhering to federal law and civil rights of citizens.Providing a safety net and affordable housing for the most vulnerable like the elderly, working poor, homeless, and disabled.Efforts to clean environmental pollution and improve infrastructure in a sustainable way.37. All foreign powers/individuals/companies can no longer own property in the USA. All properties that were purchased or rented and remain empty for more than a month will be used for citzen housing. Persons will be reimbursed a set amount determined by the original cost of the property when first erected. for property if they cannot find a citizen buyer and year long occupants.38. Additional Bills of Rights for all women, LGBTQ, and Children to protect their employment, autonomy, access to social services/benefits, right to vote, legal rights/protection and safety under the law.39. An amendment to protect and improve social safety nets.Social safety nets will never be defunded for wars or other political agendas.Social safety net funds collected via taxes will no longer be diverted elsewhere.People are working more for less in the US and it is peonage. People fall into debt paying for things that should be basic rights: Shelter, food, clothing, internet, lights/heating/cooling, water, transportation, and healthcare. All of which should be guaranteed rights.Our taxes should go to maintaining and implementing that every citizen has said rights. Taxes should also fund programs that are beneficial to the environment and to all. (The Fire Sale of America’s Oceans - Center for American Progress) Right now taxes are funding expensive trips/golfing/doors/diningroom sets/hiding rooms/parades for those in government as they get rich off of insider trading and promoting extremist/corporate/foreign interests. (Trump's Cabinet Scandals: Is Abuse Of Office Contagious? )People forget we all become vulnerable as we age. There is no guarantee that you will have care if you are unable to work or care for yourself. Our society needs to be fair and better. It doesn’t have to be utopia but we should all have a chance to live and strive. (Getting old in America) ( America will soon be overrun by senior citizens. Yes, that includes you )….SourcesNo Wonder Teachers Are Saying Enough Is EnoughZinke's Cynical Plan to Make America's National Parks Dependent on Mining and Drilling - Center for American ProgressOpinion: Repeal the Second Amendment – The New York Times – MediumTop 5 Recidivism Reducing Programs | EfficientGovWhat can US cops learn from gunless British police?An 18-Year-Old Said She Was Raped While In Police Custody. The Officers Say She Consented.We Need to Start Telling the Truth About White Supremacy in Our Schoolshttps://www.ted.com/topics/raceGetting Your Period Is Still Oppressive in the United StatesNew National Report Shows Rise of Debtors’ Prison for Kids, With Implications for Racial Disparities in Juvenile CourtsDutch prisons are closing because the country is so safeSome “Unrecognized” Tribes Still Waiting After 130 YearsKentucky Bill To Outlaw Child Marriage Stalled Amid Conservative ConcernsThe Incarcerated Women Who Fight California’s WildfiresFor $1 an hour, inmates fight California fires. 'Slave labor' or self-improvement?Enforcing minimum wage is harder than you thinkTeaching Native American History in a Polarized AgeTeaching the Truth About America’s History: Only the Truth Can Make Us FreeSometimes It Takes A 'Village' To Help Seniors Stay In Their HomesThe Dutch Village Where Everyone Has DementiaWhy other countries kick our butt on clean energy: A primerERA: In the StatesEconomist Makes Case For Open Borders PolicyEpisode 436: If Economists Controlled The BordersWhy Can't the United States Build a High-Speed Rail System?Developments And Adoption Of Blockchain In The U.S. Federal GovernmentBlockchain for Government: IBM Blockchain BlogUsing blockchain to improve data management in the public sectorChinese police don high-tech glasses to nab suspects | The Japan TimesWhy Social Work is so ImportantWhy Our World Needs Social WorkPrison abolition movement - WikipediaU.S. Customs and Border Protection

Create this form in 5 minutes!

How to create an eSignature for the media services new york state wage theft prevention act form

How to generate an eSignature for the Media Services New York State Wage Theft Prevention Act Form in the online mode

How to generate an eSignature for your Media Services New York State Wage Theft Prevention Act Form in Google Chrome

How to create an eSignature for signing the Media Services New York State Wage Theft Prevention Act Form in Gmail

How to make an electronic signature for the Media Services New York State Wage Theft Prevention Act Form from your smart phone

How to make an eSignature for the Media Services New York State Wage Theft Prevention Act Form on iOS devices

How to make an electronic signature for the Media Services New York State Wage Theft Prevention Act Form on Android devices

People also ask

-

What is a wage theft prevention notice?

A wage theft prevention notice is a document that employers provide to employees, detailing their rights regarding wages and any deductions. This notice is essential for protecting employee rights and ensuring compliance with labor laws. airSlate SignNow allows businesses to efficiently create and send these notices digitally.

-

How does airSlate SignNow help with wage theft prevention notices?

airSlate SignNow simplifies the process of creating, sending, and signing wage theft prevention notices. With a user-friendly interface, businesses can ensure their employees receive the necessary information regarding their wage rights. This not only helps in compliance but also builds trust and transparency with employees.

-

What are the benefits of using airSlate SignNow for wage theft prevention notices?

Using airSlate SignNow for wage theft prevention notices offers numerous benefits, including ease of use, automation of document workflows, and enhanced tracking of signatures. This cloud-based solution enables businesses to stay compliant, reduce paperwork, and ensure that their employees are informed about their rights effectively.

-

Are there any integrations available with airSlate SignNow for wage theft prevention notices?

Yes, airSlate SignNow offers seamless integrations with various HR and payroll systems to help manage wage theft prevention notices more efficiently. These integrations streamline workflows, allowing for automatic updates and communications. This ensures that employees receive their notices promptly without any manual effort.

-

What pricing plans does airSlate SignNow offer for users managing wage theft prevention notices?

airSlate SignNow provides flexible pricing plans that cater to different business sizes and needs, particularly those managing wage theft prevention notices. Plans are designed to be cost-effective, ensuring businesses can stay compliant without breaking the bank. There’s also a free trial available to explore features.

-

Can I customize wage theft prevention notices using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize wage theft prevention notices to fit their specific business requirements. You can add logos, adjust text, and include specific details relevant to your employees. This customization ensures that your notices are not only compliant but also personalized.

-

Is airSlate SignNow secure for sending wage theft prevention notices?

Yes, airSlate SignNow prioritizes security and compliance with industry standards for document handling, including wage theft prevention notices. All documents are encrypted and stored securely, ensuring that sensitive information is protected. This gives businesses peace of mind while managing their documentation.

Get more for Media Services New York State Wage Theft Prevention Act Form

- Mailing address symetra life insurance company group form

- Pdf gynecology questionnaire magnolia obgyn form

- 17 most important questions to ask about health and safety form

- Are you planning to enroll in your employers health insurance plan form

- Facilityagency change form

- Anthem treatment autism form

- Diversity grantsamerican academy of otolaryngology head form

- Bapplicationb for patient assistance needymeds form

Find out other Media Services New York State Wage Theft Prevention Act Form

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple