89 225 Request for Waiver of Penalty for Failure to File Andor Pay Electronically 89 225 Request for Waiver of Penalty for Failu Form

What is the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically

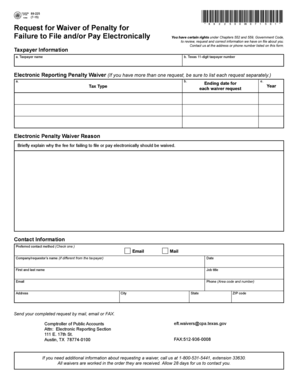

The 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically is a formal document used by taxpayers in Texas to request a waiver of penalties associated with the failure to file or pay taxes electronically. This form is particularly relevant for individuals and businesses that may have encountered challenges in meeting electronic filing requirements. By submitting this request, taxpayers can seek relief from penalties that may have accrued due to non-compliance with electronic filing mandates.

Steps to Complete the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically

Completing the 89 225 Request For Waiver involves several key steps to ensure that the form is filled out accurately. First, gather all necessary information, including your tax identification number, details of the penalties incurred, and any supporting documentation that explains the circumstances of your failure to file or pay electronically. Next, fill out the form carefully, ensuring that all sections are completed. Finally, review your submission for accuracy before sending it to the appropriate tax authority.

Key Elements of the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically

This form includes several critical elements that must be addressed for it to be considered valid. Key components include your personal or business information, a detailed explanation of the reasons for the waiver request, and any supporting documentation that substantiates your claims. Additionally, it is essential to include your signature and date to affirm the authenticity of the request.

Legal Use of the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically

The legal use of the 89 225 Request For Waiver is governed by tax regulations in Texas. It is important to understand that while submitting this form does not guarantee the waiver of penalties, it provides a formal avenue for taxpayers to present their case. Compliance with all relevant tax laws and regulations is necessary to enhance the likelihood of a favorable outcome.

State-Specific Rules for the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically

In Texas, specific rules apply to the submission of the 89 225 Request. These rules may include deadlines for submission, required documentation, and the process for appealing a denial of the waiver request. Familiarizing yourself with these state-specific guidelines is crucial to ensure compliance and to maximize your chances of a successful waiver.

Filing Deadlines / Important Dates

Timeliness is essential when submitting the 89 225 Request. Taxpayers should be aware of any deadlines associated with filing this request, as late submissions may result in the denial of the waiver. It is advisable to check the Texas Comptroller's website or consult with a tax professional for the most current filing deadlines and important dates related to this form.

Quick guide on how to complete 89 225 request for waiver of penalty for failure to file andor pay electronically 89 225 request for waiver of penalty for

Effortlessly prepare 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically 89 225 Request For Waiver Of Penalty For Failu on any device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically 89 225 Request For Waiver Of Penalty For Failu on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically 89 225 Request For Waiver Of Penalty For Failu with ease

- Obtain 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically 89 225 Request For Waiver Of Penalty For Failu and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and electronically sign 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically 89 225 Request For Waiver Of Penalty For Failu and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 89 225 request for waiver of penalty for failure to file andor pay electronically 89 225 request for waiver of penalty for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically?

The 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically is a form that businesses in Window, Texas can use to request a waiver for penalties incurred due to the late filing or payment of taxes electronically. This form can help mitigate financial penalties when extenuating circumstances exist.

-

Who is eligible to submit the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically?

Eligibility for the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically typically includes businesses and individuals who have experienced legitimate issues that prevented timely filing or payment. It's essential to provide evidence supporting your situation to increase the likelihood of approval.

-

How can airSlate SignNow assist with the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically?

AirSlate SignNow simplifies the process of submitting the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically by allowing users to electronically sign, send, and manage documents efficiently. This saves time and ensures that submissions are completed accurately and securely.

-

What features does airSlate SignNow offer for users filing the 89 225 Request For Waiver Of Penalty?

AirSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are beneficial when completing the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically. These tools help streamline the workflow and enhance compliance with filing requirements.

-

Is there any cost associated with using airSlate SignNow for the 89 225 form?

Yes, airSlate SignNow operates on a subscription model, with pricing tiers designed to fit various business needs. The efficiency and time-saving features offered make the cost of using airSlate SignNow worthwhile, especially when handling forms like the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically.

-

Can I integrate airSlate SignNow with other software for filing the 89 225 Request?

Absolutely! AirSlate SignNow offers various integrations with commonly used business software, which can streamline the process of preparing and submitting the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically. This integration helps maintain consistency across your business operations.

-

What are the benefits of using airSlate SignNow for the 89 225 Request?

By using airSlate SignNow for the 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically, users benefit from enhanced document security, real-time updates, and a signNow reduction in processing time. These advantages contribute to a smoother experience when dealing with tax-related filings.

Get more for 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically 89 225 Request For Waiver Of Penalty For Failu

- Form 433 d installment agreement pdf irs

- Form 8809 rev august 2020 application for extension of time to file information returns

- Form 14039 b business identity theft affidavit

- Publication 1179 rev july 2020 general rules and specifications for substitute forms 1096 1098 1099 5498 and certain other

- Irs 1586 form

- Irs 14039 b form

- Ulam in vivo animal core necropsy histology ampamp pathology request form

- Sample drop off locations form

Find out other 89 225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically 89 225 Request For Waiver Of Penalty For Failu

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast