Form 8880

What is the Form 8880

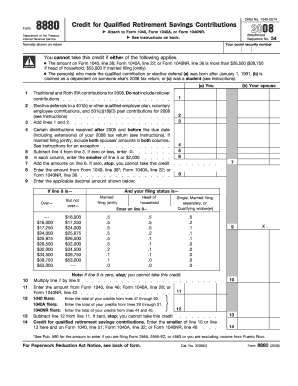

The Form 8880, officially known as the Credit for Qualified Retirement Savings Contributions, is a tax form used by eligible taxpayers in the United States to claim a credit for contributions made to retirement savings accounts. This form is particularly beneficial for individuals who are saving for retirement and meet specific income thresholds. The credit can reduce the amount of tax owed, making it an important tool for encouraging retirement savings among lower and middle-income earners.

How to use the Form 8880

To use the Form 8880 effectively, taxpayers must first determine their eligibility based on income and filing status. The form requires information about contributions made to qualified retirement accounts, such as IRAs or 401(k)s. Once the necessary information is gathered, taxpayers can fill out the form, calculate the credit, and include it with their tax return. It is essential to ensure that all details are accurate to avoid delays in processing or potential audits.

Steps to complete the Form 8880

Completing the Form 8880 involves several key steps:

- Gather necessary documents, including income statements and records of retirement contributions.

- Determine eligibility based on the IRS guidelines for income limits and filing status.

- Fill out the form, ensuring all required fields are completed accurately.

- Calculate the credit amount based on the contributions and applicable rates.

- Attach the completed Form 8880 to your tax return before submission.

Legal use of the Form 8880

The legal use of Form 8880 is governed by IRS regulations. Taxpayers must adhere to the guidelines outlined by the IRS to ensure that their claims for the retirement savings contributions credit are valid. This includes providing accurate information regarding income and contributions, as well as understanding the implications of any errors or omissions. Proper legal use ensures compliance and maximizes the benefits of the credit.

Eligibility Criteria

Eligibility for the Form 8880 is primarily determined by income and filing status. Taxpayers must meet specific adjusted gross income (AGI) limits, which can vary based on whether they are single, married filing jointly, or head of household. Additionally, the contributions must be made to a qualified retirement plan, and taxpayers cannot be claimed as a dependent on someone else's tax return. Understanding these criteria is crucial for successfully claiming the credit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8880 align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If additional time is needed, taxpayers can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these important dates is essential for ensuring timely submissions and avoiding issues with the IRS.

Quick guide on how to complete form 8880 1654434

Effortlessly Prepare Form 8880 on Any Device

The management of online documents has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right format and securely save it online. airSlate SignNow provides all the features necessary to create, edit, and electronically sign your documents quickly without any delays. Manage Form 8880 on any device using the airSlate SignNow apps for Android or iOS and simplify any document-based task today.

How to Modify and Electronically Sign Form 8880 with Ease

- Locate Form 8880 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors requiring new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Form 8880, ensuring smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8880 1654434

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8880 and why do I need it?

Form 8880 is a tax form used to claim the Retirement Savings Contributions Credit, which is available to eligible taxpayers who contribute to retirement accounts. Utilizing Form 8880 can help you maximize your tax benefits and encourage savings for retirement.

-

How can airSlate SignNow help me with Form 8880?

airSlate SignNow provides an efficient platform for sending and eSigning Form 8880 documents securely and easily. You can create, share, and manage your Form 8880 submissions straightforwardly, streamlining your process and saving valuable time.

-

What features does airSlate SignNow offer for managing Form 8880?

With airSlate SignNow, you get features like customizable templates, secure cloud storage, and electronic signature capabilities ideal for Form 8880. These features ensure that your documents are both professionally prepared and legally binding, simplifying compliance.

-

Is there a cost associated with using airSlate SignNow for Form 8880?

Yes, airSlate SignNow offers a range of pricing plans to suit different needs, starting from a free trial to more comprehensive options for businesses. Choosing the right plan can help you efficiently manage your Form 8880 workflows without straining your budget.

-

How does airSlate SignNow ensure the security of my Form 8880 documents?

airSlate SignNow prioritizes security with features such as bank-level encryption and secure cloud storage, protecting your Form 8880 documents throughout the signing process. You can confidently share sensitive information, knowing that your data is safe.

-

Can I integrate airSlate SignNow with other tools for processing Form 8880?

Yes, airSlate SignNow integrates seamlessly with various applications including Google Drive, Dropbox, and CRM systems, making it easy to handle Form 8880 within your existing workflow. This integration maximizes efficiency and minimizes data duplication.

-

What benefits can I expect from using airSlate SignNow for Form 8880?

By using airSlate SignNow for your Form 8880 processes, you can expect improved speed, lower costs, and enhanced compliance. The solution simplifies document management, allowing you and your team to focus on what really matters—your retirement savings.

Get more for Form 8880

- San gabriel valley council eagle resume form

- Registration form alarm

- Pleading paper law library of fresno county ca fresnolawlibrary form

- Dj contract pdf form

- Maryland joint marital property statement how titled form

- Unified pre hearing form

- Dodea form 2942

- Garland amateur radio emergency service form

Find out other Form 8880

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo