Student Non Tax Filer Statement 2020-2026

What is the Student Non Tax Filer Statement

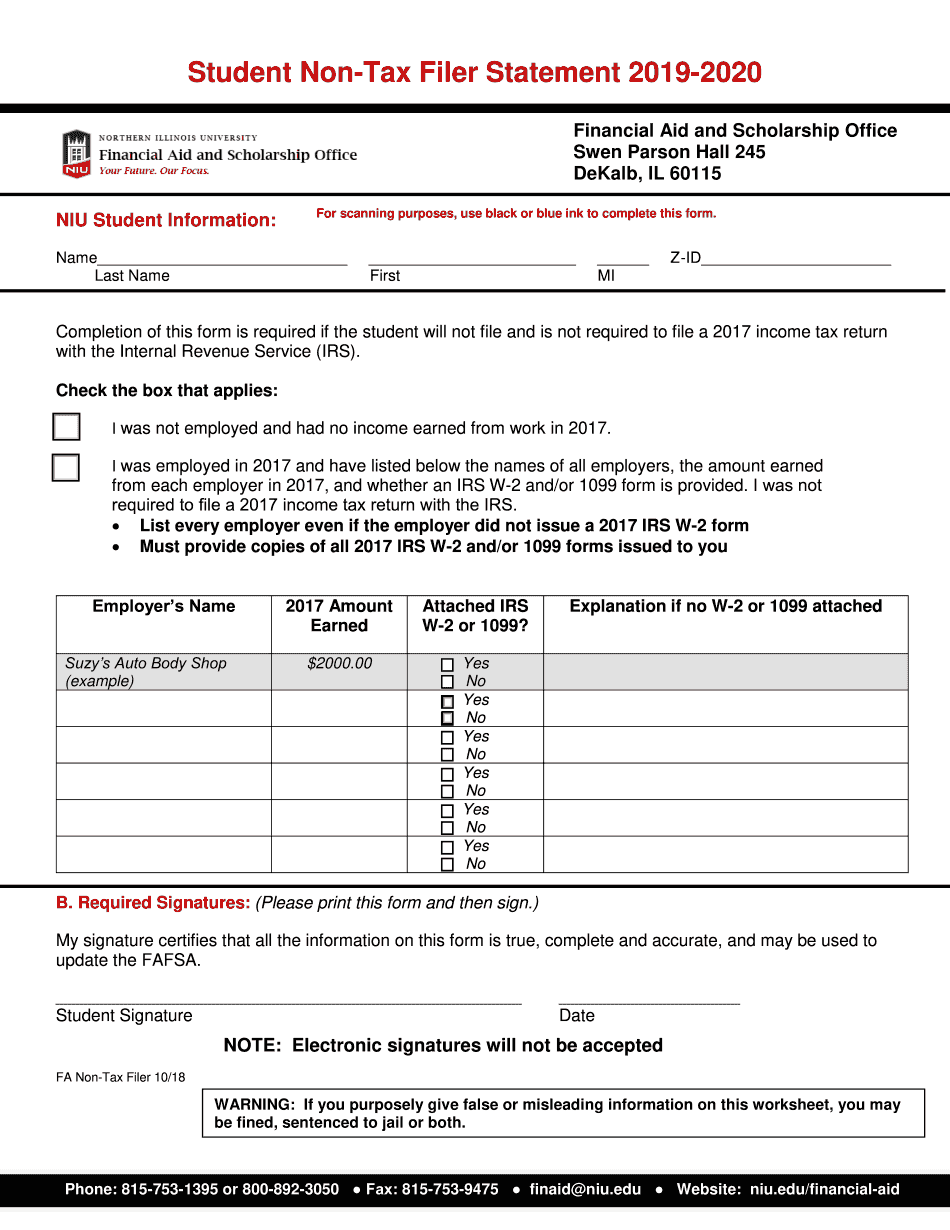

The Student Non Tax Filer Statement is a document used by students who are not required to file a federal tax return. This form serves as a declaration of income status, particularly for financial aid applications. It is essential for students seeking federal student aid, as it verifies that they did not earn enough income to necessitate filing taxes. The statement typically includes personal information, such as the student's name, Social Security number, and a declaration of no income during the specified tax year.

How to use the Student Non Tax Filer Statement

This statement is primarily used in the context of financial aid applications, such as the Free Application for Federal Student Aid (FAFSA). Students must complete the form accurately and submit it alongside their FAFSA to demonstrate their financial situation. By providing this statement, students can ensure that their financial aid eligibility is assessed correctly, allowing them access to necessary funding for their education.

Steps to complete the Student Non Tax Filer Statement

Completing the Student Non Tax Filer Statement involves a few straightforward steps:

- Gather necessary personal information, including your name, Social Security number, and the tax year in question.

- Clearly indicate that you did not earn any income during the specified year.

- Sign and date the statement to confirm its accuracy.

- Submit the completed statement as part of your FAFSA or to your educational institution as required.

Legal use of the Student Non Tax Filer Statement

The Student Non Tax Filer Statement is legally recognized as a valid form of documentation for students who do not meet the income threshold for tax filing. It must be completed truthfully, as providing false information can lead to penalties, including loss of financial aid or legal repercussions. Institutions may require this statement to comply with federal regulations regarding financial aid eligibility.

Key elements of the Student Non Tax Filer Statement

When completing the Student Non Tax Filer Statement, certain key elements must be included to ensure its validity:

- Personal Information: Full name, Social Security number, and contact information.

- Income Declaration: A clear statement indicating that no income was earned during the specified year.

- Signature: The student’s signature, confirming the accuracy of the information provided.

- Date: The date on which the statement is completed and signed.

Examples of using the Student Non Tax Filer Statement

Students may need to utilize the Student Non Tax Filer Statement in various scenarios, such as:

- Applying for federal student aid through FAFSA when they have no income to report.

- Providing documentation to their college or university for financial aid verification purposes.

- Demonstrating eligibility for scholarships that require proof of non-filing status.

Quick guide on how to complete student non tax filer statement 2019 2020

Set Up Student Non Tax Filer Statement Effortlessly on Any Gadget

Web-based document organization has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow furnishes you with all the necessary tools to generate, modify, and electronically sign your documents swiftly and without holdups. Manage Student Non Tax Filer Statement on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Modify and Electronically Sign Student Non Tax Filer Statement with Ease

- Obtain Student Non Tax Filer Statement and click on Get Form to initiate the process.

- Utilize the features we offer to complete your form.

- Emphasize important portions of your documents or mask sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Student Non Tax Filer Statement while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct student non tax filer statement 2019 2020

Create this form in 5 minutes!

How to create an eSignature for the student non tax filer statement 2019 2020

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is a non tax filer statement idoc?

A non tax filer statement idoc is a document used to confirm that an individual has not filed tax returns for a specific year. It is often required for various financial applications and is vital for showing proof of non-filing status. airSlate SignNow makes it easy to create and send this document securely.

-

How can airSlate SignNow assist me with a non tax filer statement idoc?

With airSlate SignNow, you can quickly generate and eSign a non tax filer statement idoc using our user-friendly platform. The service allows for seamless document collaboration and ensures that your documents are legally compliant and secure. Enjoy the efficiency of digital signatures to expedite the process.

-

What are the pricing options for airSlate SignNow when creating a non tax filer statement idoc?

airSlate SignNow offers flexible pricing plans suitable for various user needs. Whether you need a basic plan for occasional use or a more comprehensive solution for high-volume transactions, there is a suitable option for you. All plans provide access to features that enhance the creation of a non tax filer statement idoc.

-

Can I integrate airSlate SignNow with other applications for managing a non tax filer statement idoc?

Yes, airSlate SignNow integrates seamlessly with numerous applications, allowing for efficient management of a non tax filer statement idoc. You can connect with tools such as Google Drive, Dropbox, and CRM systems to streamline your workflow and document management processes. This integration enhances the overall usability of your document handling.

-

Is the non tax filer statement idoc legally binding when signed through airSlate SignNow?

Absolutely! A non tax filer statement idoc signed through airSlate SignNow is legally binding and complies with eSignature laws, such as the ESIGN Act and UETA. This ensures that your signed documents hold up in legal settings, providing peace of mind for all parties involved.

-

What features does airSlate SignNow offer for creating a non tax filer statement idoc?

airSlate SignNow includes a variety of features to enhance the creation of a non tax filer statement idoc, including customizable templates, drag-and-drop fields, and bulk send options. Additionally, users benefit from real-time tracking, notifications, and advanced security features to safeguard your documents. These tools streamline your signing process efficiently.

-

How long does it take to create a non tax filer statement idoc using airSlate SignNow?

Creating a non tax filer statement idoc with airSlate SignNow is quick and straightforward. Most users can generate and send their documents within minutes using our intuitive interface and pre-built templates. This efficiency helps expedite your document workflows considerably.

Get more for Student Non Tax Filer Statement

- 2015 instructions for form 8853 internal revenue service

- Form 13844 application for reduced user fee for installment

- Inst 1040 schedule a form

- 2019 schedule k form 990 internal revenue service

- 1041 t allocation of estimated tax payments to beneficiaries form

- 2019 instructions for form 944 internal revenue service

- 2019 form 1041 qft us income tax return for qualified funeral trusts

- Instructions for form 706 rev august 2019 instructions for form 706 united states estate and generation skipping transfer tax

Find out other Student Non Tax Filer Statement

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors