K 53 Kansas Department of Revenue Form

What is the K-53 Kansas Department of Revenue?

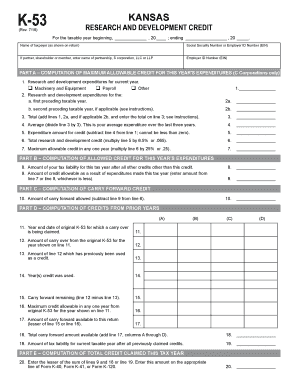

The K-53 form is a document issued by the Kansas Department of Revenue, primarily used for tax-related purposes. This form is essential for individuals and businesses in Kansas who need to report specific financial information to the state. It serves as a means for the department to collect necessary data for tax assessment and compliance. Understanding the K-53 form is crucial for ensuring accurate reporting and adherence to state tax regulations.

How to use the K-53 Kansas Department of Revenue

Using the K-53 form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents that pertain to your tax situation. This may include income statements, expense records, and any relevant tax credits or deductions. Next, accurately fill out the form, ensuring that all information is complete and correct. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the specific instructions provided by the Kansas Department of Revenue.

Steps to complete the K-53 Kansas Department of Revenue

Completing the K-53 form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including income and expense records.

- Access the K-53 form through the Kansas Department of Revenue website or obtain a physical copy.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail, following the submission guidelines provided.

Legal use of the K-53 Kansas Department of Revenue

The K-53 form must be used in accordance with Kansas state tax laws. It is legally binding once completed and submitted correctly. To ensure its validity, all information provided must be truthful and accurate. Misrepresentation or errors can lead to penalties or legal repercussions. Therefore, understanding the legal implications of the K-53 form is essential for compliance with state regulations.

Key elements of the K-53 Kansas Department of Revenue

The K-53 form includes several key elements that are vital for proper completion:

- Personal Information: This section requires the taxpayer's name, address, and identification number.

- Income Details: Report all sources of income, including wages, dividends, and business earnings.

- Expense Reporting: Document any allowable deductions or expenses that may reduce taxable income.

- Signature: The form must be signed to certify that the information provided is accurate and complete.

Form Submission Methods (Online / Mail / In-Person)

The K-53 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to submit the K-53 electronically through the Kansas Department of Revenue’s online portal, which may offer faster processing times.

- Mail Submission: For those who prefer traditional methods, the form can be printed and mailed to the appropriate address provided by the department.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at designated Kansas Department of Revenue offices.

Quick guide on how to complete k 53 kansas department of revenue

Prepare K 53 Kansas Department Of Revenue seamlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It serves as a perfect eco-conscious substitute to traditional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents promptly without any hold-ups. Manage K 53 Kansas Department Of Revenue on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign K 53 Kansas Department Of Revenue effortlessly

- Find K 53 Kansas Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with specialized tools that airSlate SignNow provides for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign K 53 Kansas Department Of Revenue and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 53 kansas department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the K 53 Kansas Department Of Revenue form used for?

The K 53 Kansas Department Of Revenue form is designed for individuals and businesses to report and manage their tax liabilities in Kansas. It simplifies the process of submitting financial information and ensures compliance with state regulations. Utilizing airSlate SignNow can streamline the eSigning process for this essential document.

-

How can airSlate SignNow help with the K 53 Kansas Department Of Revenue form?

airSlate SignNow provides an efficient way to electronically sign and send the K 53 Kansas Department Of Revenue form. With its user-friendly interface, users can complete necessary fields and send documents securely without the hassle of physical signatures. This not only saves time but also enhances document security.

-

Is there a cost associated with using airSlate SignNow for the K 53 Kansas Department Of Revenue?

Yes, while airSlate SignNow offers various pricing plans to accommodate different business needs, it is considered a cost-effective solution for managing documents like the K 53 Kansas Department Of Revenue. The subscription plans include options for businesses of all sizes, ensuring you only pay for what you use.

-

What features does airSlate SignNow offer for managing the K 53 Kansas Department Of Revenue form?

airSlate SignNow boasts features such as document templates, customizable workflows, and an intuitive eSigning experience, which are invaluable for handling the K 53 Kansas Department Of Revenue. Additionally, it provides real-time tracking and notification features to keep you informed throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for the K 53 Kansas Department Of Revenue?

Absolutely! airSlate SignNow supports numerous integrations with popular platforms, making it easy to manage the K 53 Kansas Department Of Revenue form within your existing workflow. This compatibility allows for seamless data transfer between systems, reducing duplication and errors.

-

What are the benefits of using airSlate SignNow for the K 53 Kansas Department Of Revenue?

Using airSlate SignNow for the K 53 Kansas Department Of Revenue offers numerous benefits, including increased efficiency, enhanced security, and reduced processing time. Its eSigning capabilities mean you can finalize documents remotely, which is especially beneficial for businesses without a central office location.

-

Is it easy to set up airSlate SignNow for the K 53 Kansas Department Of Revenue?

Yes, airSlate SignNow is designed with user-friendliness in mind, making setup for the K 53 Kansas Department Of Revenue straightforward. The onboarding process is quick, with plenty of resources and support available to ensure that all users can easily navigate and utilize the platform effectively.

Get more for K 53 Kansas Department Of Revenue

- Bachelor of science in chemical engineering cme form

- Completed hra and physicianamp39s certification of routine physical form

- Find the lowest car insurance quotes here online european form

- Participant record request university of south florida form

- Norwalk community college transcript request form

- Norwalk community college transcript form

- Independent verification worksheet navarro college form

- Nutrition initial assessment intake form student

Find out other K 53 Kansas Department Of Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors