Fillabkle Form 8854

What is the Fillabkle Form 8854

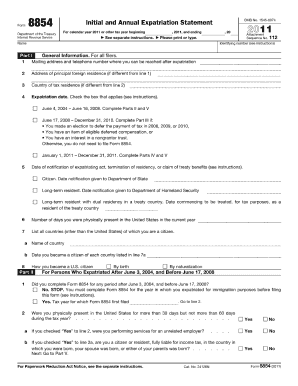

The Fillabkle Form 8854, also known as the Initial and Annual Expatriation Statement, is a crucial document for U.S. citizens and long-term residents who are expatriating. This form is used to report information regarding the expatriate’s tax obligations and to ensure compliance with U.S. tax laws. The form must be filed with the Internal Revenue Service (IRS) to avoid penalties and to confirm that the individual has met all tax liabilities prior to expatriation.

How to use the Fillabkle Form 8854

Using the Fillabkle Form 8854 involves several steps to ensure proper completion. First, gather all necessary financial documents, including tax returns for the past five years. Next, fill out the form accurately, providing details about your income, assets, and liabilities. It is essential to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail to the IRS, depending on the preferred method of filing.

Steps to complete the Fillabkle Form 8854

Completing the Fillabkle Form 8854 requires careful attention to detail. Follow these steps:

- Gather all relevant financial information, including your tax returns.

- Download the Fillabkle Form 8854 from the IRS website.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for completeness and accuracy.

- Submit the form electronically or by mail to the IRS.

Legal use of the Fillabkle Form 8854

The legal use of the Fillabkle Form 8854 is essential for individuals who are expatriating. Filing this form is a requirement under U.S. law to report expatriation and to ensure that all tax obligations are met. Failure to file the form can result in significant penalties, including the loss of tax benefits and potential legal repercussions. It is important to understand the legal implications of not filing this form correctly.

Filing Deadlines / Important Dates

When dealing with the Fillabkle Form 8854, it is crucial to be aware of filing deadlines. Generally, the form must be submitted by the due date of your tax return for the year of expatriation. If you are filing for the first time as an expatriate, ensure that you stay updated on any changes to deadlines that the IRS may announce, as these can vary based on specific circumstances.

Required Documents

To complete the Fillabkle Form 8854, several documents are necessary. These typically include:

- Tax returns for the previous five years.

- Financial statements detailing your assets and liabilities.

- Any additional documentation that supports your expatriation status.

Having these documents ready will facilitate a smoother filing process.

Quick guide on how to complete fillabkle form 8854

Manage Fillabkle Form 8854 effortlessly on any device

Web-based document handling has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Handle Fillabkle Form 8854 on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign Fillabkle Form 8854 with ease

- Find Fillabkle Form 8854 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and hit the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign Fillabkle Form 8854 and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillabkle form 8854

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fillable Form 8854?

The Fillable Form 8854 is a tax declaration form used by U.S. citizens who are expatriating to report their assets and income. This form is crucial for ensuring compliance with U.S. tax laws upon leaving the country. Utilizing airSlate SignNow allows you to easily fill and electronically sign your Form 8854.

-

How does airSlate SignNow simplify the process of completing Fillable Form 8854?

airSlate SignNow streamlines the process by providing an intuitive interface that allows users to easily fill out the Fillable Form 8854. The platform offers features like templates and guided steps, which ensure that you don’t miss any required information. Our solution is designed to make document completion quick and efficient.

-

Are there any costs associated with using airSlate SignNow for Fillable Form 8854?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers based on user needs. Depending on the features you require for filling out the Fillable Form 8854, our plans are cost-effective and tailored for both individuals and businesses. You can choose a plan that best suits your requirements and budget.

-

Can I store my completed Fillable Form 8854 securely in airSlate SignNow?

Absolutely! airSlate SignNow provides robust security measures to ensure your completed Fillable Form 8854 is safely stored. With encrypted cloud storage and secure access controls, you can manage your documents confidently knowing that your sensitive information is protected.

-

Does airSlate SignNow offer any integrations for other applications while working with Fillable Form 8854?

Yes, airSlate SignNow seamlessly integrates with a variety of applications to enhance your workflow while working on your Fillable Form 8854. You can connect with popular tools like Google Drive, Dropbox, and more, allowing you to import and export documents effortlessly. This integration capability makes it easier to manage your paperwork.

-

Is airSlate SignNow user-friendly for completing Fillable Form 8854?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for everyone to complete the Fillable Form 8854. Even if you're not tech-savvy, our intuitive interface guides you through the process step-by-step, ensuring you can confidently fill and sign your documents.

-

What are the benefits of using airSlate SignNow for my Fillable Form 8854?

Using airSlate SignNow for your Fillable Form 8854 provides numerous benefits, including efficiency, cost savings, and ease of use. You can quickly complete and eSign documents without having to print anything, reducing both time and costs. Additionally, our platform ensures compliance with legal requirements, giving you peace of mind.

Get more for Fillabkle Form 8854

Find out other Fillabkle Form 8854

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed