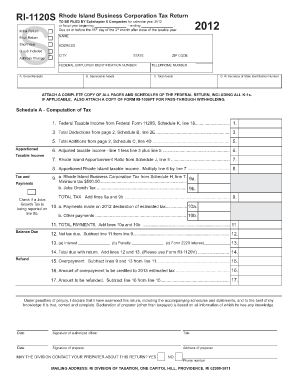

Ri 1120s Form

What is the Ri 1120s Form

The Ri 1120s Form is a tax document used by S corporations in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is specifically designed for S corporations, which are a type of business entity that passes corporate income, losses, and deductions directly to shareholders for federal tax purposes. By using the Ri 1120s Form, S corporations can ensure compliance with federal tax regulations while providing necessary information to shareholders regarding their individual tax obligations.

How to use the Ri 1120s Form

To effectively use the Ri 1120s Form, businesses must first gather all relevant financial information, including income, expenses, and deductions. The form requires detailed reporting of various financial aspects, such as gross receipts, cost of goods sold, and other income. Once all information is compiled, the form should be completed accurately, ensuring that all calculations are correct. After filling out the form, it must be submitted to the IRS by the designated deadline, typically on or before March 15 of each year for calendar year filers.

Steps to complete the Ri 1120s Form

Completing the Ri 1120s Form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the basic information section, including the corporation's name, address, and employer identification number (EIN).

- Report income by detailing gross receipts and any other income sources.

- List allowable deductions, such as salaries, rent, and utilities, to arrive at the taxable income.

- Complete the shareholder information section, detailing each shareholder's share of income, deductions, and credits.

- Review the form for accuracy and completeness before submitting it to the IRS.

Legal use of the Ri 1120s Form

The legal use of the Ri 1120s Form is governed by IRS regulations that dictate how S corporations must report their income and expenses. To ensure the form is legally valid, it must be completed accurately and filed on time. Additionally, the form must be signed by an authorized officer of the corporation, confirming that the information provided is true and correct. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Ri 1120s Form are critical for compliance. Generally, the form must be filed by March 15 of each year for S corporations operating on a calendar year basis. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is essential for businesses to mark these dates on their calendars to avoid late filing penalties and ensure timely reporting of their financial activities.

Required Documents

To complete the Ri 1120s Form, several documents are typically required, including:

- Income statements detailing gross receipts and other income.

- Expense reports outlining all deductible business expenses.

- Shareholder information, including their ownership percentages and contributions.

- Prior year tax returns, if applicable, for reference and consistency.

Penalties for Non-Compliance

Non-compliance with the filing requirements associated with the Ri 1120s Form can lead to significant penalties. These may include monetary fines for late submissions, as well as interest on any unpaid taxes. Additionally, failure to provide accurate information can result in audits and further scrutiny from the IRS. It is crucial for S corporations to adhere to all regulations to avoid these potential repercussions.

Quick guide on how to complete ri 1120s form

Effortlessly Prepare Ri 1120s Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents swiftly and without complications. Manage Ri 1120s Form on any device with airSlate SignNow's Android or iOS applications, streamlining any document-related process today.

The Simplest Method to Edit and eSign Ri 1120s Form with Ease

- Obtain Ri 1120s Form and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with specific tools provided by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and press the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Eliminate the woes of lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Edit and eSign Ri 1120s Form while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 1120s form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ri 1120s Form?

The Ri 1120s Form is a tax document used by S corporations in Rhode Island to report their income and calculate their tax liability. This form is essential for businesses to ensure compliance with state tax regulations and avoid penalties. Understanding how to accurately complete the Ri 1120s Form can save time and reduce stress during tax season.

-

How can airSlate SignNow help with the Ri 1120s Form?

airSlate SignNow streamlines the process of signing and sending the Ri 1120s Form. With our intuitive platform, users can easily upload the form, send it for eSignature, and keep track of the completion status. This simplifies the necessary paperwork and ensures that your documents are securely signed and stored.

-

Is there a cost associated with using airSlate SignNow for the Ri 1120s Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to essential features for managing documents such as the Ri 1120s Form. You can choose a plan based on your volume of usage and required features to best suit your budget.

-

Does airSlate SignNow offer integrations for accounting software when working with the Ri 1120s Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software that may help in preparing the Ri 1120s Form. This compatibility allows users to import data directly, reducing the chances of manual errors and enhancing overall efficiency in document submission.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management brings multiple benefits, including enhanced security, faster processing times, and easy access from any device. When preparing documents like the Ri 1120s Form, you can ensure compliance and improve collaboration within your team. Our platform also reduces paper usage and streamlines workflows.

-

How can I ensure my Ri 1120s Form is secure with airSlate SignNow?

airSlate SignNow prioritizes security by employing strong encryption methods and secure cloud storage for documents, including the Ri 1120s Form. Additionally, you can set access controls and track document activity to monitor who views or edits your files. This ensures that sensitive information remains protected throughout the signing process.

-

Can I access previous Ri 1120s Forms using airSlate SignNow?

Yes, airSlate SignNow allows you to easily access and track all your signed documents, including previous Ri 1120s Forms. Our cloud-based platform keeps a comprehensive history of your document activities, enabling you to retrieve older forms when needed for record-keeping or compliance purposes.

Get more for Ri 1120s Form

- Apply prc online form

- Student reference form grades k 8 acs international schools

- Dental shadowing form

- Warren amp velda wilson foundation scholarship providing form

- Teacher recommendation form forcheerleading tryouts

- Standard operating practice ecu student financial services form

- Documentation of a psychological psychiatric disabilitydoc form

- Sants college form

Find out other Ri 1120s Form

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast