Loanliner Forms

What is the Loanliner Forms

The Loanliner forms are essential documents used in the loan application process, specifically designed to streamline the borrowing experience. These forms capture critical information about the borrower, the loan amount, and the terms of the loan. They are primarily utilized by financial institutions to assess the eligibility of applicants and to ensure compliance with lending regulations. Understanding the Loanliner forms is crucial for anyone looking to secure a loan, as they set the foundation for the borrowing agreement.

How to use the Loanliner Forms

Using the Loanliner forms involves several straightforward steps. First, gather all necessary personal and financial information, including income details, employment history, and any existing debts. Next, access the Loanliner forms through a reliable platform, ensuring that you are using the most current version. Fill out the forms accurately, providing all required information. Once completed, review the forms for any errors or omissions before submitting them to the lending institution. This careful approach helps facilitate a smooth loan application process.

Steps to complete the Loanliner Forms

Completing the Loanliner forms requires attention to detail. Follow these steps for effective completion:

- Gather necessary documents, such as proof of income, tax returns, and identification.

- Access the Loanliner forms through a secure online platform.

- Fill in personal information, including name, address, and Social Security number.

- Provide financial details, including income sources and monthly expenses.

- Review the completed forms for accuracy, ensuring all sections are filled out.

- Submit the forms electronically or as instructed by the lender.

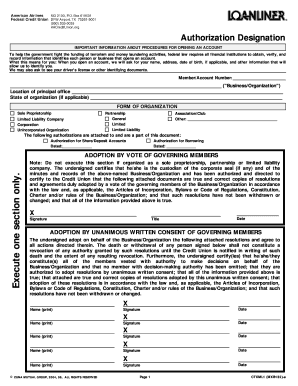

Legal use of the Loanliner Forms

The legal use of Loanliner forms is governed by various regulations that ensure their validity. These forms must comply with federal and state laws regarding lending practices. When completed and signed, they serve as a binding agreement between the borrower and the lender. It's essential to understand that electronic signatures on these forms are legally recognized, provided they meet the requirements set forth by the ESIGN Act and UETA. This legal framework ensures that the Loanliner forms hold up in court if disputes arise.

Key elements of the Loanliner Forms

Key elements of the Loanliner forms include essential details that facilitate the loan process. These elements typically encompass:

- Borrower information: Name, address, and contact details.

- Loan specifics: Amount requested, purpose of the loan, and repayment terms.

- Financial disclosures: Income, assets, and liabilities.

- Signature section: Where the borrower acknowledges the terms and conditions.

Each of these components plays a vital role in determining the borrower's eligibility and the lender's decision-making process.

Form Submission Methods (Online / Mail / In-Person)

Submitting Loanliner forms can be done through various methods, accommodating the preferences of borrowers. The primary submission methods include:

- Online submission: Many lenders allow borrowers to submit completed forms electronically through secure portals.

- Mail: Borrowers can print the forms and send them via postal service, ensuring they are sent to the correct address.

- In-person submission: Some borrowers may prefer to deliver their forms directly to a lender's office, allowing for immediate confirmation of receipt.

Choosing the right submission method can enhance the efficiency of the loan application process.

Quick guide on how to complete loanliner forms 177910

Accomplish Loanliner Forms effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without any holdups. Handle Loanliner Forms on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign Loanliner Forms with ease

- Find Loanliner Forms and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive data using tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your edits.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and electronically sign Loanliner Forms and guarantee outstanding communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loanliner forms 177910

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is loanliner and how can it benefit my business?

Loanliner is a comprehensive solution for managing loan documents efficiently. It enables businesses to streamline their loan processing, reducing paperwork and the time spent on approvals. By utilizing loanliner, you can enhance your operational efficiency and improve customer satisfaction.

-

How much does loanliner cost?

The pricing for loanliner is designed to be cost-effective, catering to businesses of all sizes. We offer various plans based on your needs, ensuring that you only pay for the features that matter most to you. For specific pricing details, please visit our website or contact our sales team.

-

What features does loanliner offer?

Loanliner comes with an array of features, including document eSigning, template creation, and automated workflows. These features allow you to manage the entire loan lifecycle seamlessly. With loanliner, you can also customize your documents easily to meet specific requirements.

-

Is loanliner easy to integrate with other software?

Yes, loanliner is designed for easy integration with various software applications commonly used in the financial sector. Whether you are using CRM systems, accounting software, or other tools, loanliner can be seamlessly incorporated into your existing workflows. This enhances overall efficiency and ensures a smooth transition.

-

Can loanliner help reduce loan processing time?

Absolutely! Loanliner signNowly reduces loan processing time by automating many of the manual tasks involved. With quick eSigning and streamlined document management, you can shorten the approval cycle and focus more on your core business activities. This leads to faster service delivery to your customers.

-

What industries can benefit from using loanliner?

Loanliner is versatile and can benefit various industries, including banking, real estate, and lending businesses. Any organization that requires efficient management of loan documentation can leverage loanliner to simplify their processes. The adaptability of loanliner makes it suitable for a broad range of professionals.

-

Is there customer support available for loanliner users?

Yes, we offer comprehensive customer support for all loanliner users. Our support team is dedicated to helping you navigate the platform and resolve any issues that may arise. Whether you need technical assistance or guidance on features, our experts are here to assist you.

Get more for Loanliner Forms

- Award acknowledgment grant of authority and authorization form

- Employee tuition reimbursement university of rochester rochester form

- Cuny heo evaluation form

- Instrumental and terminal values worksheet form

- The care for oregon sm nursing loan program form

- Mspn proposal usf system university of south florida form

- Request for incident records form

- Contact us sf state graduate programs san francisco state form

Find out other Loanliner Forms

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe