PDF Frozen Bank Account Letter Form

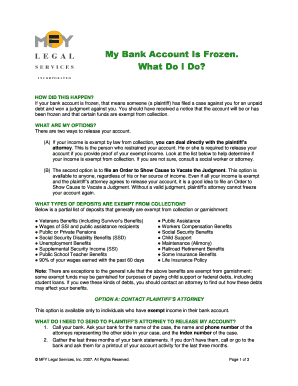

What is the Pdf Frozen Bank Account Letter

The pdf frozen bank account letter is a formal document used to communicate with a financial institution regarding the status of a frozen bank account. This letter typically outlines the reasons for the account freeze, requests information about the account, or seeks resolution regarding the funds. It is essential for individuals or businesses facing restrictions on their accounts, as it serves as a means to clarify the situation with the bank and initiate the process of unfreezing the account.

How to use the Pdf Frozen Bank Account Letter

To effectively use the pdf frozen bank account letter, individuals should first ensure that they have all relevant account information at hand, including account numbers and any correspondence from the bank. The letter should be addressed to the appropriate department within the bank, clearly stating the purpose of the communication. It is advisable to include any supporting documents that may assist in resolving the issue, such as identification or previous account statements. Once completed, the letter can be sent via email or traditional mail, depending on the bank's preferred method of communication.

Steps to complete the Pdf Frozen Bank Account Letter

Completing the pdf frozen bank account letter involves several key steps:

- Gather necessary information, including account details and any prior communication with the bank.

- Clearly state the purpose of the letter and the specific action you are requesting.

- Include your contact information for follow-up.

- Attach any relevant documents that support your request.

- Review the letter for clarity and completeness before sending.

Key elements of the Pdf Frozen Bank Account Letter

When drafting a pdf frozen bank account letter, it is crucial to include several key elements to ensure clarity and effectiveness:

- Sender's Information: Include your full name, address, and contact details.

- Bank's Information: Address the letter to the appropriate bank department, including their address.

- Subject Line: Clearly state that the letter pertains to a frozen bank account.

- Body of the Letter: Explain the situation, including account details and the reason for the freeze.

- Request for Action: Specify what you would like the bank to do, such as unfreezing the account or providing more information.

- Closing: Thank the bank for their attention and include your signature.

Legal use of the Pdf Frozen Bank Account Letter

The legal use of the pdf frozen bank account letter is significant in ensuring that the rights of the account holder are protected. This letter serves as a formal request for information and action from the bank, which can be crucial in legal disputes or financial matters. It is important to keep a copy of the letter and any responses received, as these documents may be needed for future reference or legal proceedings. Adhering to proper legal protocols in the letter can also enhance its effectiveness in resolving the issue.

Examples of using the Pdf Frozen Bank Account Letter

Examples of using the pdf frozen bank account letter include various scenarios, such as:

- A business owner whose account has been frozen due to suspected fraudulent activity, seeking clarification and resolution.

- An individual requesting the release of funds from a frozen account due to a legal dispute.

- A customer inquiring about the reasons for an account freeze after receiving no prior notification from the bank.

Quick guide on how to complete pdf frozen bank account letter

Effortlessly Prepare Pdf Frozen Bank Account Letter on Any Device

Managing documents online has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to access the correct form and securely keep it digital. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle Pdf Frozen Bank Account Letter on any device using the airSlate SignNow Android or iOS applications and simplify your document-centric processes today.

How to Edit and Electronically Sign Pdf Frozen Bank Account Letter with Ease

- Find Pdf Frozen Bank Account Letter and click on Get Form to initiate the process.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools offered by airSlate SignNow designed for that purpose.

- Create your electronic signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require fresh copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign Pdf Frozen Bank Account Letter to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf frozen bank account letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank statement letter?

A bank statement letter is a document that summarizes your banking activity over a specific period. This letter can be used to verify income, support loan applications, or validate financial status. Using airSlate SignNow, you can easily create and eSign your bank statement letter in a secure environment.

-

How much does it cost to create a bank statement letter with airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Depending on the chosen plan, you can create a bank statement letter as part of your document management at a competitive rate. The cost-effectiveness of our solution ensures that you can manage documents within your budget while maintaining quality.

-

What features does airSlate SignNow provide for creating a bank statement letter?

airSlate SignNow provides a variety of features for creating a bank statement letter, including customizable templates, electronic signatures, and document tracking. Users can streamline the document creation process while ensuring compliance and security. This all-in-one platform reduces the hassle of managing paper documents.

-

Can I edit my bank statement letter after signing it?

Once your bank statement letter is signed, it typically becomes a finalized document. However, with airSlate SignNow, you can create a new version to make any necessary edits. This allows you to maintain an accurate record and avoid confusion when managing your documents.

-

Is my bank statement letter secure with airSlate SignNow?

Yes, security is a top priority with airSlate SignNow. Your bank statement letter and all other documents are protected using industry-standard encryption and secure cloud storage. This ensures that your sensitive information remains confidential and accessible only to authorized users.

-

Can I integrate airSlate SignNow with other tools for creating a bank statement letter?

Absolutely! airSlate SignNow offers integrations with various third-party applications, which makes it easy to create and manage your bank statement letter alongside other workflows. This integration enhances productivity and ensures that all your essential documents are easily accessible.

-

What are the benefits of using airSlate SignNow for my bank statement letter?

Using airSlate SignNow for your bank statement letter provides numerous benefits, including reduced processing time, improved document accuracy, and enhanced legal compliance. The user-friendly interface allows for seamless eSigning, making it easier to manage your financial documents effectively.

Get more for Pdf Frozen Bank Account Letter

- Ics eft client authorisation form

- 790c bapplicationb for a safe haven enterprise visa form

- Syndicate entry form worddoc colemantexas

- Fairway ridge at mariana butte hoa ownerlandlordtenant form

- 48 hour notification bccbfaorgb form

- Book 1 exhibit f attachment 1 bformb ocip s1 colorado bb

- Spd 9909a constipation protocol cowashingtonorus co washington or form

- Montana advance directive forms

Find out other Pdf Frozen Bank Account Letter

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer