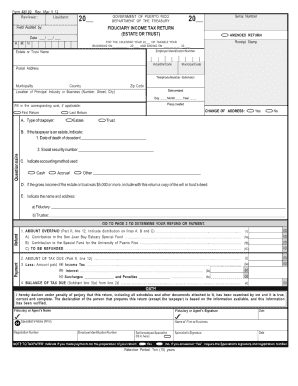

Puerto Rico Form 48080

What is the Puerto Rico Form 48080

The Puerto Rico Form 48080 is a tax form used by individuals and businesses to report income earned in Puerto Rico. This form is essential for ensuring compliance with local tax regulations and helps the Puerto Rico Department of Treasury assess tax liabilities accurately. It is primarily used for reporting specific types of income, including dividends, interest, and royalties, and is crucial for both residents and non-residents who have income sourced from Puerto Rico.

How to use the Puerto Rico Form 48080

Using the Puerto Rico Form 48080 involves several steps to ensure accurate reporting of income. First, gather all necessary financial documents that detail your income sources. Next, fill out the form by entering the required information, such as your name, address, and the types of income being reported. It's important to review the instructions provided with the form to ensure all sections are completed correctly. Once filled out, the form can be submitted either electronically or by mail, depending on your preference and the specific requirements set by the Puerto Rico Department of Treasury.

Steps to complete the Puerto Rico Form 48080

Completing the Puerto Rico Form 48080 requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant income documentation, including W-2s, 1099s, and any other income statements.

- Download the form from the official Puerto Rico Department of Treasury website or obtain a physical copy.

- Fill in your personal information, including your full name, address, and taxpayer identification number.

- Report all applicable income types in the designated sections of the form.

- Double-check your entries for accuracy and completeness.

- Submit the completed form by the specified deadline, either electronically or via mail.

Legal use of the Puerto Rico Form 48080

The Puerto Rico Form 48080 is legally binding when completed and submitted according to the guidelines set forth by the Puerto Rico Department of Treasury. It is important to ensure that all information provided is accurate and truthful, as submitting false information can lead to penalties. The form must be signed and dated by the individual or authorized representative to validate its legal standing. Compliance with local tax laws is essential to avoid any legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Puerto Rico Form 48080 vary depending on the tax year and the type of filer. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. Businesses may have different deadlines based on their fiscal year. It is advisable to check the official Puerto Rico Department of Treasury announcements for any updates or changes to these deadlines to ensure timely compliance.

Required Documents

To successfully complete the Puerto Rico Form 48080, several documents are required. These may include:

- W-2 forms for wages earned in Puerto Rico.

- 1099 forms for various types of income, such as interest and dividends.

- Documentation of any deductions or credits applicable to your tax situation.

- Proof of residency or non-residency status, if applicable.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Quick guide on how to complete puerto rico form 48080

Complete Puerto Rico Form 48080 effortlessly on any gadget

Online document management has gained traction among companies and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documentation, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Puerto Rico Form 48080 on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest way to alter and eSign Puerto Rico Form 48080 effortlessly

- Obtain Puerto Rico Form 48080 and then click Get Form to begin.

- Utilize the resources we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Puerto Rico Form 48080 and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the puerto rico form 48080

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Puerto Rico Form 48080?

The Puerto Rico Form 48080 is a tax form used for reporting income derived from gambling winnings. This form must be completed by individuals who have received gambling winnings in Puerto Rico, and it's essential for ensuring compliance with local tax laws when filing.

-

How can airSlate SignNow help with Puerto Rico Form 48080?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Puerto Rico Form 48080. This streamlines the process for taxpayers, allowing them to complete their legal obligations quickly and efficiently, without the hassle of paper forms.

-

Is there a cost associated with using airSlate SignNow for Puerto Rico Form 48080?

Yes, there is a subscription fee for using airSlate SignNow; however, it is a cost-effective solution for businesses and individuals. The pricing is tiered to fit various needs, making it affordable for anyone needing to manage the Puerto Rico Form 48080 and other important documents.

-

What features does airSlate SignNow offer for handling Puerto Rico Form 48080?

airSlate SignNow offers a variety of features such as secure eSignature capabilities, document templates, and collaboration tools to manage the Puerto Rico Form 48080. These features are designed to enhance productivity and ensure that all signatures and documents are handled efficiently.

-

Can I integrate airSlate SignNow with other software for Puerto Rico Form 48080?

Yes, airSlate SignNow supports numerous integrations with popular software like Google Drive, Dropbox, and CRM systems. This flexibility allows users to seamlessly incorporate the Puerto Rico Form 48080 into their existing workflow, making document management simpler.

-

How does airSlate SignNow ensure the security of the Puerto Rico Form 48080?

airSlate SignNow prioritizes security with features like 256-bit SSL encryption and secure data storage. By utilizing such measures, users can confidently manage and submit their Puerto Rico Form 48080, knowing their sensitive information is protected.

-

Can multiple users collaborate on the Puerto Rico Form 48080 using airSlate SignNow?

Absolutely! airSlate SignNow provides collaborative features that allow multiple users to work on the Puerto Rico Form 48080 simultaneously. This is particularly useful for teams needing to review and finalize documents quickly, enhancing overall efficiency.

Get more for Puerto Rico Form 48080

- Inviter in turkey applicantamp39s iraq c1 e visa application form

- Mmp marriott code form

- Caresource form

- 2016 i 017 rent certificate wisconsin department of revenue revenue wi form

- Pce pre application income and expense worksheet form

- Offer and acceptance form

- County of fort bend power of attorney affidavit form

- Staybridge suites credit card authorization form

Find out other Puerto Rico Form 48080

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF