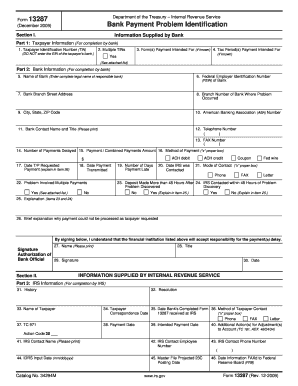

Form 13287 Bank Payment Problem Identification IRS

What is the Form 13287 Bank Payment Problem Identification IRS

The Form 13287, officially known as the Bank Payment Problem Identification form, is utilized by taxpayers to address issues related to bank payments made to the IRS. This form is essential for individuals who have encountered problems with payments, such as those that may have been misapplied or not received by the IRS. By completing this form, taxpayers can formally communicate their concerns and seek resolution from the IRS regarding their payment issues.

How to use the Form 13287 Bank Payment Problem Identification IRS

Using the Form 13287 involves a straightforward process designed to help taxpayers report payment discrepancies. First, gather all relevant information, including payment details and any correspondence with the IRS. Next, accurately fill out the form, ensuring that all sections are completed. Once completed, submit the form to the appropriate IRS address as indicated in the instructions. This submission allows the IRS to investigate the reported issue and respond accordingly.

Steps to complete the Form 13287 Bank Payment Problem Identification IRS

Completing the Form 13287 requires careful attention to detail. Follow these steps for successful completion:

- Download the Form 13287 from the IRS website or obtain a physical copy.

- Provide your personal information, including your name, address, and taxpayer identification number.

- Detail the payment issue you are experiencing, including dates and amounts.

- Attach any supporting documentation that may help clarify your situation.

- Review the form for accuracy before submitting it to ensure all information is correct.

Key elements of the Form 13287 Bank Payment Problem Identification IRS

The Form 13287 consists of several key elements that are crucial for effective communication with the IRS. These include:

- Taxpayer Information: Essential details such as name, address, and taxpayer identification number.

- Payment Details: Information about the payment in question, including date, amount, and payment method.

- Issue Description: A clear explanation of the problem encountered with the payment.

- Supporting Documentation: Any relevant documents that provide evidence of the payment issue.

Legal use of the Form 13287 Bank Payment Problem Identification IRS

The Form 13287 is legally recognized as a formal means of communication with the IRS regarding payment problems. It is essential to ensure that the information provided is accurate and truthful, as any discrepancies may lead to further complications. When submitted correctly, this form can facilitate the resolution of payment issues, allowing taxpayers to maintain compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 13287 can be submitted through various methods, depending on the taxpayer's preference and situation. Options include:

- Mail: Complete the form and send it to the designated IRS address provided in the instructions.

- In-Person: Visit a local IRS office to submit the form directly, ensuring that you have all necessary documentation.

Currently, electronic submission options for this specific form may not be available, so it is important to verify the latest submission guidelines from the IRS.

Quick guide on how to complete form 13287 bank payment problem identification irs

Effortlessly prepare Form 13287 Bank Payment Problem Identification IRS on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to rapidly create, modify, and eSign your documents without delays. Manage Form 13287 Bank Payment Problem Identification IRS on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Form 13287 Bank Payment Problem Identification IRS with ease

- Obtain Form 13287 Bank Payment Problem Identification IRS and click Get Form to begin.

- Leverage the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools available from airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors requiring the reprinting of new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 13287 Bank Payment Problem Identification IRS and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 13287 bank payment problem identification irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 13287 and how is it used?

Form 13287 is a document that assists users in completing specific IRS applications. It simplifies the submission process and ensures necessary information is provided, allowing for a smoother experience. With airSlate SignNow, you can easily send and eSign form 13287, speeding up your filing process.

-

How does airSlate SignNow enhance the signing process for form 13287?

airSlate SignNow offers an intuitive platform that allows users to efficiently eSign form 13287. With features such as templates and automated workflows, you can streamline document management and ensure timely submissions. This signNowly reduces manual effort and enhances productivity.

-

Is there a pricing plan for using airSlate SignNow with form 13287?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage documents like form 13287. You can choose from monthly or annual subscriptions based on your needs. This makes it a cost-effective solution for efficiently handling your eSigning requirements.

-

What are the key features of airSlate SignNow for managing form 13287?

Key features of airSlate SignNow include document templates, real-time tracking, and advanced security measures. These features enable you to easily prepare and manage form 13287, ensuring compliance and smoother processes. Additionally, the user-friendly interface makes it accessible for everyone.

-

Can I integrate airSlate SignNow with other applications for form 13287?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your productivity while managing form 13287. These integrations allow you to connect your existing tools and manage workflows without any disruptions, creating a streamlined experience for users.

-

What benefits do businesses gain from using airSlate SignNow for form 13287?

Using airSlate SignNow for form 13287 offers numerous benefits, including improved efficiency, reduced processing time, and enhanced security for sensitive information. Businesses can accelerate their workflows while ensuring compliance with regulations, ultimately leading to a more effective document management process.

-

How secure is airSlate SignNow when handling form 13287?

airSlate SignNow prioritizes security, utilizing encryption and secure servers to protect your information when handling form 13287. Compliance with industry standards ensures that your documents are safe throughout the eSigning process. This gives users peace of mind when managing sensitive documents.

Get more for Form 13287 Bank Payment Problem Identification IRS

Find out other Form 13287 Bank Payment Problem Identification IRS

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online