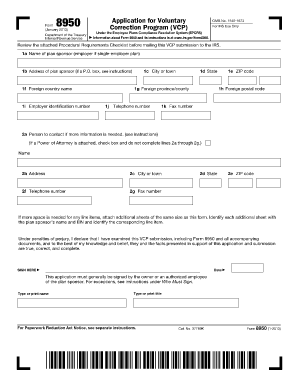

Form 8950

What is the Form 8950

The Form 8950 is an official document used by businesses and individuals in the United States to request a determination of whether a plan meets the requirements for a favorable tax status. This form is particularly relevant for retirement plans and is submitted to the Internal Revenue Service (IRS). Understanding the purpose of Form 8950 is essential for ensuring compliance with tax regulations and for obtaining the necessary approvals for plan qualification.

How to use the Form 8950

Using Form 8950 involves several steps to ensure that the information provided is accurate and complete. The form must be filled out with relevant details about the retirement plan, including the type of plan, the employer's information, and specific plan provisions. It is advisable to review the IRS guidelines carefully before submission to avoid any errors that could delay processing or lead to penalties.

Steps to complete the Form 8950

Completing Form 8950 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the retirement plan, including plan documents and participant details.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS, either electronically or by mail, depending on the specific requirements.

Legal use of the Form 8950

The legal use of Form 8950 is governed by IRS regulations. When completed correctly, the form serves as a formal request for a determination letter from the IRS, confirming that the retirement plan meets the necessary legal requirements. This legal validation is crucial for protecting the tax-exempt status of the plan and ensuring compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for Form 8950 can vary depending on the specific circumstances of the retirement plan. Generally, it is advisable to submit the form as soon as the plan is established or when significant changes occur. Keeping track of important dates helps ensure timely submission and compliance with IRS regulations, which can prevent potential penalties.

Required Documents

When completing Form 8950, several supporting documents may be required to provide context and validation for the information submitted. These documents can include:

- Plan documents that outline the terms and conditions of the retirement plan.

- Employer identification number (EIN) documentation.

- Any amendments or changes made to the plan since its inception.

Who Issues the Form

The Form 8950 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that users have the necessary resources to comply with federal regulations.

Quick guide on how to complete form 8950

Complete Form 8950 seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the features required to generate, modify, and electronically sign your documents rapidly without holdups. Manage Form 8950 on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 8950 effortlessly

- Locate Form 8950 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to store your modifications.

- Choose your preferred method to submit your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from your preferred device. Adjust and eSign Form 8950 to guarantee excellent communication at any point in your form processing journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8950

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8950 and why do I need it?

Form 8950 is a tax form used by organizations to request approval for a specific tax-exempt status. Businesses may need to file this form to ensure compliance with the IRS, and using airSlate SignNow can simplify the eSigning process, making it faster and more efficient.

-

How can airSlate SignNow assist with filing Form 8950?

airSlate SignNow allows users to easily upload and eSign Form 8950, ensuring that all necessary parties can approve the document quickly. With its user-friendly interface, tracking capabilities, and secure storage, it streamlines the entire process of submitting your Form 8950.

-

Is there a cost associated with using airSlate SignNow for Form 8950?

Yes, airSlate SignNow offers various pricing plans suitable for different business needs. Regardless of the plan you choose, it provides a cost-effective solution for managing documents like Form 8950, ensuring you get great value for your investment.

-

What features does airSlate SignNow offer for handling Form 8950?

airSlate SignNow offers features like customizable templates, automated reminders, and multi-party signing, which can signNowly enhance the experience of handling Form 8950. These tools help in ensuring that all signatures are collected in a timely manner, while also maintaining compliance.

-

Can I integrate airSlate SignNow with my existing software to manage Form 8950?

Yes, airSlate SignNow offers seamless integrations with various business applications such as CRM systems and document management software. This capability allows users to streamline their workflow and handle Form 8950 effectively within their existing business processes.

-

How secure is my data when using airSlate SignNow for Form 8950?

Security is a top priority for airSlate SignNow. Your data is protected through advanced encryption methods and strict compliance with security regulations, ensuring that sensitive information related to Form 8950 remains confidential and secure.

-

What benefits will my business experience using airSlate SignNow for Form 8950?

Utilizing airSlate SignNow for Form 8950 can lead to increased efficiency, reduced turnaround times, and better tracking of document statuses. By simplifying the signing process, your team can focus on more critical tasks, boosting productivity and overall satisfaction.

Get more for Form 8950

- In re richard p and devon p no 34751 west virginia form

- Free west virginia revocation of power of attorney form

- Free wyoming power of attorney formspdf templates

- Wyoming vehicle power of attorney form power of attorney

- Durable power of attorney for health care state bar of south form

- Huntington direct deposit form 170574

- Bform 1005b credit app diverse supply solutions

- Voya withdrawal form

Find out other Form 8950

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online