Establishment Form

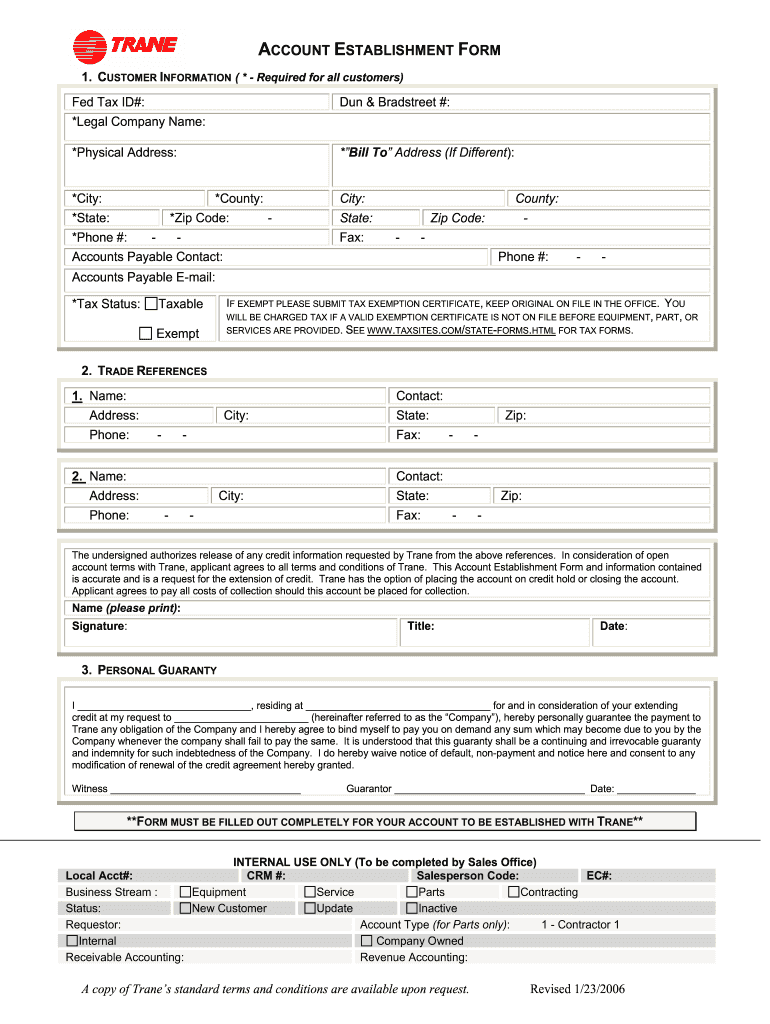

What is the Trane Credit Application?

The Trane credit application is a formal document used by individuals or businesses seeking to establish a credit account with Trane, a leading provider of heating, ventilation, and air conditioning (HVAC) systems. This application allows potential customers to request credit terms for purchasing Trane products and services. The form collects essential information about the applicant, including personal details, business information, and financial history, enabling Trane to assess creditworthiness and make informed decisions regarding credit approval.

How to Use the Trane Credit Application

Using the Trane credit application involves several straightforward steps. First, ensure you have all necessary information at hand, including your business details, financial statements, and references. Next, fill out the application form completely and accurately, providing all requested information. Once completed, review the form for any errors or omissions. Finally, submit the application electronically or via mail, depending on your preference and Trane's submission guidelines. Proper completion and submission of the application are crucial for timely processing.

Steps to Complete the Trane Credit Application

Completing the Trane credit application requires careful attention to detail. Follow these steps for a successful submission:

- Gather Required Information: Collect necessary documents such as tax identification numbers, business licenses, and financial statements.

- Fill Out the Application: Enter accurate information in all fields, ensuring clarity and completeness.

- Review the Application: Check for any errors or missing information that could delay processing.

- Submit the Application: Send the completed form to Trane through the specified method, whether electronically or by mail.

Key Elements of the Trane Credit Application

The Trane credit application includes several key elements that are critical for evaluation. These elements typically encompass:

- Applicant Information: Personal and business details, including name, address, and contact information.

- Financial Information: Data regarding income, assets, liabilities, and credit history.

- References: Contact information for business and personal references who can vouch for the applicant's creditworthiness.

- Signature: A declaration that the information provided is accurate, often requiring a signature to validate the application.

Legal Use of the Trane Credit Application

The Trane credit application is legally binding once signed and submitted. To ensure its validity, applicants must provide truthful information and comply with all relevant laws and regulations. Misrepresentation or false statements can lead to denial of credit or legal repercussions. It is advisable to review the application carefully and consult legal counsel if there are any uncertainties regarding the information required or the implications of signing the application.

Eligibility Criteria for the Trane Credit Application

Eligibility for the Trane credit application typically includes several criteria that applicants must meet. These may include:

- Business Type: Applicants may need to be a registered business entity, such as a corporation, LLC, or partnership.

- Credit History: A satisfactory credit history may be required, demonstrating the ability to manage credit responsibly.

- Financial Stability: Applicants should provide evidence of financial stability, such as income statements or balance sheets.

- References: Providing credible business and personal references can enhance the chances of approval.

Quick guide on how to complete establishment form

Effortlessly Prepare Establishment Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a superb environmentally-friendly substitute for conventional printed and signed documents, enabling you to find the required template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Establishment Form on any platform with the airSlate SignNow apps for Android or iOS, and simplify any document-related task today.

How to Alter and Electronically Sign Establishment Form with Ease

- Obtain Establishment Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your template.

- Select relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred delivery method for your template, whether by email, text message (SMS), invite link, or download it to your computer.

Leave behind concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and electronically sign Establishment Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the establishment form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the trane credit application process?

The trane credit application process is designed to be straightforward and user-friendly. Customers can fill out the application online, providing necessary financial details and business information. Once submitted, the application is reviewed quickly, allowing for faster decisions on credit approval.

-

What are the benefits of using the trane credit application?

Using the trane credit application offers numerous benefits, including streamlined processing and quicker access to credit. Applicants can take advantage of flexible payment options and financing solutions tailored to their needs. Additionally, the application facilitates financial planning for customers considering large HVAC purchases.

-

Is there a cost associated with the trane credit application?

There are no fees to submit the trane credit application itself. However, it's important to review the terms associated with the credit once approved, as interest rates and payment plans may vary based on your creditworthiness. Overall, this makes it a cost-effective solution for obtaining financing.

-

How long does it take to get a response on the trane credit application?

Typically, applicants can expect a response to their trane credit application within a few business days. Most applications are processed quickly to ensure that businesses can proceed with their necessary purchases without delay. This rapid turnaround helps maintain operational efficiency for customers.

-

Can I use the trane credit application for multiple purchases?

Yes, the trane credit application can be utilized for multiple purchases depending on your available credit. Once approved, you can use your established credit limit for various HVAC solutions at different times. This flexibility allows for better financial management of your investments.

-

What features does the trane credit application offer?

The trane credit application features an intuitive online platform for easy submission and tracking. Customers can quickly provide necessary documentation and receive updates throughout the review process. This seamless experience is designed to enhance customer satisfaction and expedite credit acquisition.

-

Are there any eligibility requirements for the trane credit application?

To be eligible for the trane credit application, customers generally need to be businesses with a valid tax ID. Additionally, the company should demonstrate financial stability, which is assessed during the review process. Specific eligibility can vary, so it's recommended to consult the application guidelines for detailed criteria.

Get more for Establishment Form

Find out other Establishment Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors