Cause for Loss Report 2014

What is the Cause For Loss Report

The cause for loss report is a crucial document used to detail the circumstances surrounding a loss event, often related to insurance claims or financial assessments. This report provides a comprehensive account of the incident, including the nature of the loss, the date it occurred, and any relevant details that may assist in the evaluation of the claim. It serves as an official record that can be utilized by insurance companies, legal entities, or financial institutions to determine liability and the appropriate course of action.

Key Elements of the Cause For Loss Report

When completing a cause for loss report, several key elements must be included to ensure its validity and effectiveness. These elements typically include:

- Date and Time: The exact date and time when the loss occurred.

- Description of Loss: A detailed account of what was lost, damaged, or destroyed.

- Location: The specific location where the incident took place.

- Witness Information: Names and contact information of any witnesses to the event.

- Supporting Documentation: Any relevant documents, such as photos, receipts, or police reports, that substantiate the claim.

Steps to Complete the Cause For Loss Report

Completing a cause for loss report involves several important steps to ensure accuracy and compliance. Follow these steps for effective completion:

- Gather all necessary information, including details about the loss and supporting documents.

- Fill out the report clearly, ensuring that all sections are completed accurately.

- Review the report for any errors or omissions before submission.

- Submit the report according to the guidelines provided by the relevant authority or institution.

Legal Use of the Cause For Loss Report

The cause for loss report holds significant legal importance, particularly in the context of insurance claims and litigation. It serves as a formal record that can be presented in legal proceedings to establish the facts surrounding the loss. Ensuring that the report is completed accurately and submitted in a timely manner is essential to uphold its legal standing. Additionally, the report may be subject to audits or reviews by regulatory bodies, making compliance with all relevant laws and regulations critical.

Form Submission Methods

Submitting the cause for loss report can typically be done through various methods, depending on the requirements of the institution or authority involved. Common submission methods include:

- Online Submission: Many organizations allow for digital submission through secure portals, which can expedite the processing of your report.

- Mail: Traditional mail may be required for certain submissions, especially when original signatures are needed.

- In-Person: Some situations may necessitate delivering the report in person, particularly for urgent matters or when additional documentation is required.

Examples of Using the Cause For Loss Report

The cause for loss report can be utilized in various scenarios, including:

- Insurance Claims: To document the details of a loss for property, auto, or liability insurance claims.

- Financial Assessments: To provide evidence of losses for financial reporting or audits.

- Legal Proceedings: To support claims in court or during settlement negotiations.

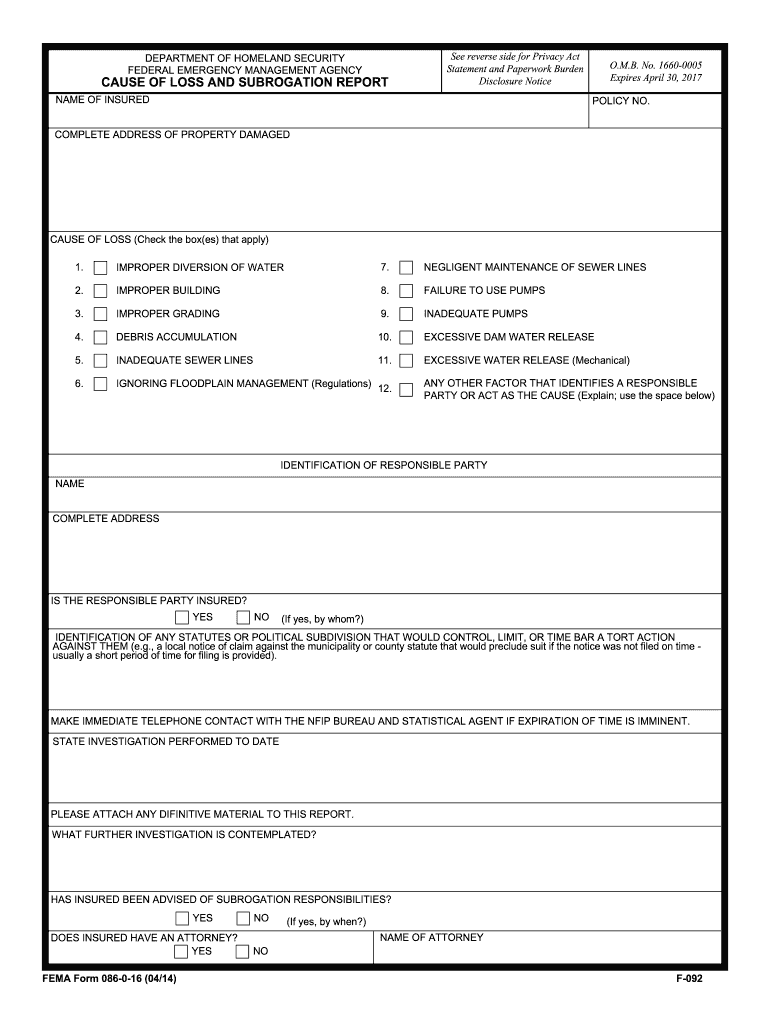

Quick guide on how to complete cause of loss and subrogation report 086 0 16 fema

Explore the easiest method to complete and endorse your Cause For Loss Report

Are you still spending time creating your official documentation on paper instead of online? airSlate SignNow offers a superior way to finalize and endorse your Cause For Loss Report and related forms for public services. Our intelligent electronic signature solution equips you with everything required to handle paperwork efficiently and according to formal standards - robust PDF editing, management, protection, signing, and sharing tools are all conveniently located within an intuitive interface.

There are just a few steps you need to take to complete and endorse your Cause For Loss Report:

- Upload the editable template to the editor using the Get Form button.

- Review what details you need to input in your Cause For Loss Report.

- Navigate between the fields using the Next option to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the fields with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Highlight what is most important or Blackout fields that are no longer relevant.

- Click on Sign to generate a legally valid electronic signature using your preferred method.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Cause For Loss Report in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our solution also provides versatile form sharing options. There’s no need to print your forms when you have to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct cause of loss and subrogation report 086 0 16 fema

FAQs

-

My company pays the TDS for the current financial year and the amount of tax was Rs. 0 because I am in the first slab. Do I still need to fill out an ITR-1 if I have Form 16 from my employer?

Receiving a Form 16 from your employer does not directly imply that you need to file an Income Tax Return. A Return has to be filed if your total income (including salary and any income from say savings bank account interest, interest income on fixed deposits, rental income) is more than the minimum income which is exempt from tax. This minimum exempt income is Rs 2,00,000 for FY 2013-14 and Rs 2,50,000 for FY 2014-15 and FY 2015-16.So you need to sum up the total income earned by you in a financial year and see if you are required to pay tax and file a Return.Return filing has several advantages too -Need a Refund – In case excess TDS has been deducted on your income and you need to claim a refund - in this situation you must file a return to claim the tax refund. For example, even though your total income is below the taxable limit, a bank deducted TDS on your FD interest - to get the refund of this TDS you'll have to file a Return.Need a Loan – When you signNow out to a bank or a financial institution for a loan a house loan or a personal loan - they usually require copies of your IT returns to check your credit worthiness. And therefore, it makes sense to keep your finances in order and file an IT return.Visas - Some countries require copies of your IT returns when they provide you a travel or a work visa.You can read more in detail here Are You required to file an IT Return in India?You'll find a lot of helpful topics here which have been addressed in very simple and easy format ClearTax's Series on Salary Income. Understand Salary Income, Deductions, Form-16Do note that if you file with http://www.cleartax.in you never have to choose which form to file since we do that for you automatically.signNow out to us support@cleartax.in if you need help!

Create this form in 5 minutes!

How to create an eSignature for the cause of loss and subrogation report 086 0 16 fema

How to create an electronic signature for your Cause Of Loss And Subrogation Report 086 0 16 Fema online

How to create an electronic signature for the Cause Of Loss And Subrogation Report 086 0 16 Fema in Google Chrome

How to make an eSignature for putting it on the Cause Of Loss And Subrogation Report 086 0 16 Fema in Gmail

How to create an eSignature for the Cause Of Loss And Subrogation Report 086 0 16 Fema straight from your smartphone

How to generate an eSignature for the Cause Of Loss And Subrogation Report 086 0 16 Fema on iOS devices

How to make an eSignature for the Cause Of Loss And Subrogation Report 086 0 16 Fema on Android OS

People also ask

-

What is a cause for loss report in the context of airSlate SignNow?

A cause for loss report is a document that outlines the reasons behind a loss experienced by a business. Using airSlate SignNow, you can quickly create and eSign these reports, ensuring that all relevant parties are informed and have access to the necessary documentation.

-

How does airSlate SignNow streamline the creation of cause for loss reports?

airSlate SignNow provides templates and a user-friendly interface that simplifies the document creation process. You can easily customize your cause for loss report templates to meet specific business needs, saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for cause for loss reports?

Yes, airSlate SignNow offers competitive pricing plans based on your business size and needs. This cost-effective solution allows you to create and eSign cause for loss reports without breaking your budget.

-

What features does airSlate SignNow offer for managing cause for loss reports?

airSlate SignNow includes features like document tracking, automatic reminders, and secure eSignature collection. These tools help ensure that your cause for loss reports are processed efficiently and received by the right people in a timely manner.

-

Can I integrate airSlate SignNow with other software for better management of cause for loss reports?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enhancing your ability to manage cause for loss reports. This connectivity allows for improved workflows and data sharing across platforms.

-

What are the benefits of using airSlate SignNow for cause for loss reporting?

Using airSlate SignNow for cause for loss reporting increases efficiency, accuracy, and collaboration. The platform's electronic signatures eliminate the need for printing and scanning, making it a fast and eco-friendly solution for document management.

-

Is the airSlate SignNow platform secure for handling sensitive cause for loss reports?

Yes, airSlate SignNow employs top-tier security measures to protect sensitive information in your cause for loss reports. With encryption, secure cloud storage, and compliance with industry standards, you can trust that your documents are safe.

Get more for Cause For Loss Report

- Word yahtzee form

- Retail food store license form

- Oklahoma state board of cosmetology form

- Iso equipment breakdown form the sos buscar

- Scrabble cheat sheet 489404703 form

- English grammar test for class 6 pdf form

- Warranty replacement products atrium form

- Pte academic accommodations request form pearson

Find out other Cause For Loss Report

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors