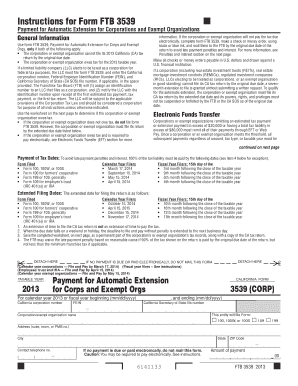

Form Ftb 3539

What is the Form FTB 3539

The Form FTB 3539, also known as the Payment for Automatic Extension for Individuals, is a California state tax form used by individuals who need to request an extension for filing their personal income tax returns. This form allows taxpayers to pay any estimated taxes owed while extending their filing deadline. It is essential for ensuring compliance with California tax laws and avoiding potential penalties for late submissions.

How to use the Form FTB 3539

To use the Form FTB 3539, taxpayers must complete the form by providing their personal information, including name, address, and Social Security number. It is important to accurately estimate the amount of tax owed to avoid underpayment penalties. After completing the form, individuals should submit it along with their payment to the California Franchise Tax Board. This ensures that the extension is processed correctly, allowing additional time to file their tax return.

Steps to complete the Form FTB 3539

Completing the Form FTB 3539 involves several key steps:

- Gather necessary information, including your income details and any deductions.

- Fill out your personal information at the top of the form.

- Estimate your total tax liability for the year.

- Calculate any payments you have already made or credits you can apply.

- Determine the amount you need to pay with your extension request.

- Sign and date the form before submitting it to the Franchise Tax Board.

Legal use of the Form FTB 3539

The legal use of the Form FTB 3539 is governed by California tax laws. By submitting this form, taxpayers are granted an automatic extension to file their income tax return, provided they pay at least 90% of their estimated tax liability. It is crucial to adhere to the guidelines set forth by the California Franchise Tax Board to ensure that the extension is valid and to avoid any penalties associated with late filings.

Filing Deadlines / Important Dates

The filing deadline for the Form FTB 3539 typically aligns with the federal tax deadline, which is usually April 15. However, if that date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to be aware of these dates to ensure timely submission and avoid penalties. Additionally, the form must be submitted by the deadline to qualify for the extension.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Form FTB 3539 through various methods:

- Online: Use the California Franchise Tax Board's online services to submit the form electronically.

- Mail: Print the completed form and send it to the appropriate address provided by the Franchise Tax Board.

- In-Person: Deliver the form directly to a local Franchise Tax Board office if preferred.

Quick guide on how to complete form ftb 3539

Effortlessly prepare Form Ftb 3539 on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage Form Ftb 3539 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form Ftb 3539 without difficulty

- Locate Form Ftb 3539 and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would like to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form Ftb 3539 to guarantee outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ftb 3539

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FTB 3539 and how does it relate to airSlate SignNow?

FTB 3539 is a tax form used in California for the California Compensating Tax Credit. With airSlate SignNow, you can easily eSign and send the FTB 3539 form securely, ensuring compliance and efficiency in handling your tax documents.

-

How can airSlate SignNow simplify the process of filing FTB 3539?

airSlate SignNow streamlines the filing process for FTB 3539 by allowing you to fill out and eSign the document digitally. This eliminates the need for printing, signing, and scanning, saving you time and reducing the risk of errors.

-

Are there any costs associated with using airSlate SignNow for FTB 3539?

airSlate SignNow offers a range of pricing plans to accommodate businesses of all sizes. The cost depends on the features you choose, but it remains a cost-effective solution for managing tasks like eSigning FTB 3539 forms and other documents.

-

What features does airSlate SignNow provide for handling FTB 3539?

airSlate SignNow offers features such as customizable templates, audit trails, and secure cloud storage. These features make it easy to manage and track the status of your FTB 3539 forms, ensuring they are completed and filed on time.

-

Can I integrate airSlate SignNow with other software for FTB 3539?

Yes, airSlate SignNow integrates seamlessly with various applications like CRM and accounting software. This integration allows for a smoother workflow when managing your FTB 3539 filings along with other business documents.

-

What benefits do businesses gain from using airSlate SignNow for FTB 3539?

By using airSlate SignNow for FTB 3539, businesses benefit from increased efficiency, reduced paperwork, and enhanced security. The platform ensures that all documents are signed quickly and stored securely, minimizing the risk of data loss.

-

Is airSlate SignNow user-friendly for preparing FTB 3539 forms?

Absolutely. airSlate SignNow is designed with user experience in mind, making it easy for anyone to prepare FTB 3539 forms. Its intuitive interface allows users to navigate through the document signing process seamlessly.

Get more for Form Ftb 3539

- 3154 colorado ave form

- B307 notice of termination form 2016 2019

- Ralr 1 rider 2018 2019 form

- Crisishousingfund for persons witha seriousmentalillness form

- Fix up program minnesota housing finance agency form

- Emergency amp accessibility loan program form

- Multi tenant registration application city of dallas form

- Post properties application 2010 2019 form

Find out other Form Ftb 3539

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed