Form W 8BEN Dom School

What is the Form W-8BEN Dom School

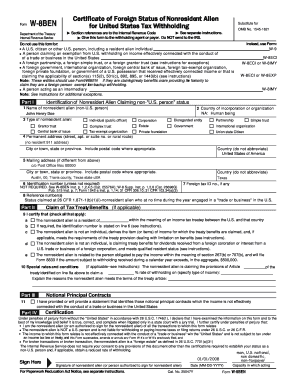

The Form W-8BEN Dom School is a tax document used by foreign individuals and entities to certify their foreign status for tax withholding purposes in the United States. This form is essential for non-resident aliens who receive income from U.S. sources, allowing them to claim reduced withholding rates or exemptions under applicable tax treaties. By completing this form, individuals can ensure that they are not subject to higher tax rates that typically apply to foreign income.

How to use the Form W-8BEN Dom School

Using the Form W-8BEN Dom School involves several straightforward steps. First, the individual must gather necessary information, including their name, country of citizenship, and taxpayer identification number. Next, they fill out the form, ensuring accuracy in all provided details. After completing the form, it must be submitted to the U.S. withholding agent or financial institution that requires it. This submission helps the withholding agent apply the correct tax treatment to the income received.

Steps to complete the Form W-8BEN Dom School

Completing the Form W-8BEN Dom School requires careful attention to detail. Follow these steps:

- Provide your full name and address in the designated fields.

- Indicate your country of citizenship.

- Enter your taxpayer identification number, if applicable.

- Sign and date the form, confirming the accuracy of the information.

Once completed, ensure that the form is submitted to the appropriate party, such as a financial institution or employer, to facilitate proper tax withholding.

Legal use of the Form W-8BEN Dom School

The legal use of the Form W-8BEN Dom School is crucial for compliance with U.S. tax laws. This form serves as a declaration of foreign status, which helps determine the correct withholding tax rates on income earned in the U.S. It is important to ensure that the form is filled out accurately and submitted to the appropriate entities to avoid potential penalties or issues with the Internal Revenue Service (IRS).

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form W-8BEN Dom School. According to these guidelines, the form must be submitted to the withholding agent before any payments are made. Additionally, it is essential to renew the form periodically or whenever there are changes in circumstances that could affect the information provided. Following IRS guidelines ensures that the form is used correctly and helps maintain compliance with tax regulations.

Required Documents

When completing the Form W-8BEN Dom School, certain documents may be required to support the information provided. These may include:

- Proof of foreign status, such as a passport or national identification card.

- Taxpayer identification number from your country of residence.

- Any relevant tax treaty documentation that may apply.

Having these documents ready can facilitate the completion of the form and ensure that all necessary information is accurately reported.

Quick guide on how to complete form w 8ben dom school

Complete Form W 8BEN dom School effortlessly on any device

Managing documents online has gained signNow popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle Form W 8BEN dom School on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to edit and electronically sign Form W 8BEN dom School effortlessly

- Obtain Form W 8BEN dom School and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form W 8BEN dom School and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 8ben dom school

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 8BEN dom School?

Form W 8BEN dom School is a tax form used by foreign individuals to signNow their non-U.S. status for tax purposes. It helps establish that you are not subject to U.S. taxation on certain income, which is especially important for schools and educational institutions dealing with international students.

-

How can airSlate SignNow help with Form W 8BEN dom School?

airSlate SignNow provides a seamless platform for managing and eSigning Form W 8BEN dom School. Our solution simplifies the documentation process, ensuring that schools can collect necessary information efficiently while maintaining compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for Form W 8BEN dom School?

Yes, airSlate SignNow offers various pricing plans depending on your specific needs. We provide cost-effective solutions tailored to institutions that frequently handle Form W 8BEN dom School and other documents, ensuring you get great value for your investment.

-

What features does airSlate SignNow offer for handling Form W 8BEN dom School?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, specifically catering to the needs of managing Form W 8BEN dom School. Additionally, you can track document status and receive real-time notifications on completions.

-

Can airSlate SignNow integrate with other applications for managing Form W 8BEN dom School?

Absolutely! airSlate SignNow supports integration with various applications, including CRM systems and document management tools. This allows for a streamlined workflow when processing Form W 8BEN dom School and enhances your overall operational efficiency.

-

What are the benefits of using airSlate SignNow for Form W 8BEN dom School?

Using airSlate SignNow for Form W 8BEN dom School offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance with tax regulations. Our user-friendly interface also ensures a smooth experience for both administrators and students.

-

How secure is airSlate SignNow when handling Form W 8BEN dom School?

Security is a top priority at airSlate SignNow. We implement high-level encryption and adhere to strict compliance measures to protect your data while handling Form W 8BEN dom School, ensuring that all sensitive information remains confidential.

Get more for Form W 8BEN dom School

- Iowa initial care plan form

- Graduate program in genetics tufts university graduate form

- Form no ogc sf 2003 02

- Employment application pdf missouri form

- University of louisville transcripts 448042292 form

- Style guide university of north carolina form

- Outdoor facility application form ucsc arboretum

- Eop income verification form 516708441

Find out other Form W 8BEN dom School

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement