Request for Transcript of Tax Return Form

What is the Request For Transcript Of Tax Return

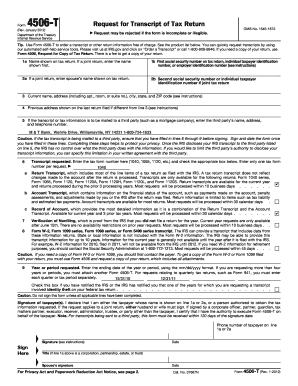

The Request For Transcript Of Tax Return is a formal document used by taxpayers to obtain a summary of their tax return information from the Internal Revenue Service (IRS). This transcript provides a record of the taxpayer's filing status, adjusted gross income, and other relevant details without requiring the submission of the actual tax return. It serves various purposes, including verifying income for loan applications, applying for financial aid, or resolving discrepancies with the IRS.

How to obtain the Request For Transcript Of Tax Return

To obtain the Request For Transcript Of Tax Return, individuals can use the IRS's online services, submit a paper request, or contact the IRS directly. The online method is often the quickest, allowing users to access their transcripts instantly. For paper requests, taxpayers can complete Form 4506-T and mail it to the IRS. Additionally, individuals may call the IRS to request a transcript, though this method may involve longer wait times.

Steps to complete the Request For Transcript Of Tax Return

Completing the Request For Transcript Of Tax Return involves a few straightforward steps. First, determine the type of transcript needed—either a tax return transcript or an account transcript. Next, fill out the appropriate form, such as Form 4506-T, ensuring all personal information is accurate. After that, specify the tax years for which transcripts are requested. Finally, submit the form via the chosen method—online, by mail, or by phone—and wait for the IRS to process the request.

IRS Guidelines

The IRS provides specific guidelines regarding the Request For Transcript Of Tax Return. Taxpayers should be aware of the types of transcripts available, the information included in each, and the time frames for processing requests. Generally, the IRS processes online requests more quickly than paper submissions. Additionally, taxpayers must ensure they provide correct identification details to avoid delays or rejections of their requests.

Required Documents

When submitting the Request For Transcript Of Tax Return, certain documents may be necessary to verify identity. Typically, taxpayers need to provide their Social Security number, date of birth, and address. If requesting transcripts for a business, the Employer Identification Number (EIN) may also be required. Ensuring that all information matches IRS records is crucial for successful processing.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Request For Transcript Of Tax Return. The online method through the IRS website is the fastest, allowing immediate access to transcripts. For those preferring a paper trail, mailing Form 4506-T is an option, though it may take several weeks for processing. In-person requests can be made at local IRS offices, but appointments may be necessary. Each method has its advantages, depending on the urgency and convenience for the taxpayer.

Quick guide on how to complete request for transcript of tax return

Effortlessly Prepare Request For Transcript Of Tax Return on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without any delays. Manage Request For Transcript Of Tax Return on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven operation today.

The easiest way to modify and eSign Request For Transcript Of Tax Return seamlessly

- Obtain Request For Transcript Of Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive data with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal value as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign Request For Transcript Of Tax Return to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for transcript of tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Request For Transcript Of Tax Return using airSlate SignNow?

To Request For Transcript Of Tax Return with airSlate SignNow, simply log in to your account, choose the document you wish to sign, and use our eSignature feature to initiate the request. The process is streamlined for efficiency, ensuring your request is promptly handled. Additionally, you can track the status of your request within the platform.

-

Are there any fees associated with the Request For Transcript Of Tax Return?

Using airSlate SignNow for the Request For Transcript Of Tax Return typically involves a monthly subscription fee, which offers unlimited signing and document management capabilities. We provide various pricing plans to accommodate your business needs, ensuring cost-effectiveness. There are no hidden fees, so you can easily forecast your expenses.

-

What key features does airSlate SignNow offer for requesting tax return transcripts?

AirSlate SignNow provides several key features for the Request For Transcript Of Tax Return, including easy document creation, customizable templates, and secure eSignature options. These features enhance user experience and streamline the process, enabling businesses to manage requests efficiently. Plus, there's robust tracking to ensure your documents are always secure.

-

Can I integrate other applications with airSlate SignNow for my tax return requests?

Yes, airSlate SignNow offers numerous integrations with popular applications, making it easy to manage your Request For Transcript Of Tax Return alongside your other business processes. With integrations like Google Drive and Dropbox, you can streamline workflows and enhance productivity. Custom API access is also available for tailored solutions.

-

What are the benefits of using airSlate SignNow for tax return transcript requests?

Using airSlate SignNow for your Request For Transcript Of Tax Return provides signNow benefits, including increased efficiency and security. The platform allows quick document processing, reducing turnaround time and simplifying compliance. Moreover, users can conveniently collaborate and track requests in real-time.

-

Is airSlate SignNow compliant with legal regulations for tax return requests?

Absolutely! airSlate SignNow is compliant with all major legal regulations related to electronic signatures and document management, ensuring that your Request For Transcript Of Tax Return is legally binding and secure. Our platform undergoes regular audits to maintain compliance with industry standards, providing peace of mind to our users.

-

How can I get support while using airSlate SignNow for requesting transcripts?

AirSlate SignNow provides comprehensive customer support for users making a Request For Transcript Of Tax Return. You can access a robust knowledge base, or contact our dedicated support team via chat, email, or phone for assistance. We’re committed to helping you navigate the platform effortlessly.

Get more for Request For Transcript Of Tax Return

- Studio rental form the rock center for dance

- Editable rent roll form

- Century 21 form

- Cooperative apartment deposit receipt and contract for sale form

- San bernardino county housing authority waiting list form

- 72 hour agreement advantagefilescom form

- Misc competitive market analysis fhlmc 1092 form

- Parents living agreement form

Find out other Request For Transcript Of Tax Return

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free