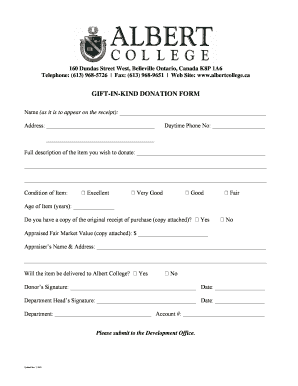

GIFT in KIND DONATION FORM Albert College

What is the gift in kind donation form for Albert College?

The gift in kind donation form for Albert College is a document used to record non-cash contributions made to the institution. These donations can include goods, services, or other tangible items that hold value. The form serves to provide both the donor and the college with a clear record of the donation, which can be essential for tax purposes and organizational transparency. By documenting the details of the contribution, this form helps ensure that all parties understand the nature of the gift and its intended use within the college.

Steps to complete the gift in kind donation form for Albert College

Completing the gift in kind donation form involves several straightforward steps:

- Gather necessary information: Collect details about the item or service being donated, including its description, estimated value, and any relevant receipts or documentation.

- Fill out the form: Provide accurate information in the designated fields of the form. This typically includes the donor's name, contact information, and a detailed description of the gift.

- Sign and date: Both the donor and an authorized representative from Albert College should sign and date the form to validate the donation.

- Submit the form: Return the completed form to the college, either electronically or through traditional mail, as per the institution's guidelines.

Legal use of the gift in kind donation form for Albert College

The legal use of the gift in kind donation form is crucial for ensuring that both the donor and Albert College comply with applicable laws and regulations. This form acts as a legal record of the donation, which can be important for tax deductions and audits. To be legally binding, the form must be accurately completed and signed by both parties. Additionally, it must adhere to IRS guidelines regarding non-cash contributions, which specify that donors may need to obtain a qualified appraisal for items valued above a certain threshold.

IRS guidelines for gift in kind donations

The Internal Revenue Service (IRS) provides specific guidelines for reporting gift in kind donations. Donors are generally required to report the fair market value of the donated items on their tax returns. For items valued at over five thousand dollars, a qualified appraisal may be necessary to substantiate the donation. The IRS also mandates that the donor and the recipient organization maintain proper documentation, including the gift in kind donation form, to support any deductions claimed. Familiarizing oneself with these guidelines can help ensure compliance and maximize potential tax benefits.

Examples of using the gift in kind donation form for Albert College

There are various scenarios in which the gift in kind donation form may be utilized at Albert College. Common examples include:

- Donating equipment: A local business may donate computers or laboratory equipment to enhance educational resources.

- Providing services: A professional may offer their expertise by donating consulting services for college events or projects.

- Gifting supplies: An individual or organization might contribute art supplies, books, or sports equipment to support student activities.

Form submission methods for the gift in kind donation

Albert College typically offers multiple methods for submitting the gift in kind donation form. These methods may include:

- Online submission: Donors can complete and submit the form electronically through the college's designated platform.

- Mail submission: Completed forms can be sent via postal mail to the college's donation office.

- In-person submission: Donors may also choose to deliver the form directly to the college’s administrative office during business hours.

Quick guide on how to complete gift in kind donation form albert college

Complete GIFT IN KIND DONATION FORM Albert College effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow provides you with all the features you need to create, modify, and eSign your documents swiftly without any delays. Manage GIFT IN KIND DONATION FORM Albert College on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign GIFT IN KIND DONATION FORM Albert College with ease

- Obtain GIFT IN KIND DONATION FORM Albert College and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and eSign GIFT IN KIND DONATION FORM Albert College and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gift in kind donation form albert college

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an in kind donation receipt and why do I need one?

An in kind donation receipt is a document provided to donors to acknowledge their non-cash contributions, such as goods or services. It is essential for tax purposes, as it allows donors to claim deductions on their donations. Using airSlate SignNow, you can create and eSign in kind donation receipts efficiently.

-

How does airSlate SignNow facilitate the creation of in kind donation receipts?

airSlate SignNow simplifies the process of creating in kind donation receipts by providing customizable templates that can be tailored to your organization’s needs. Users can easily input donation details and automate the signing process for both the donor and recipient. This saves time and improves accuracy.

-

Are there any costs associated with using airSlate SignNow for in kind donation receipts?

airSlate SignNow offers a variety of pricing plans that cater to different business sizes and needs. While there may be associated costs for premium features, the platform is generally considered a cost-effective solution for managing in kind donation receipts compared to traditional methods. Explore our pricing page for specific details.

-

Can I track the status of my in kind donation receipts with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your in kind donation receipts in real-time. You will receive notifications when documents are opened or signed, ensuring that you can follow up with donors as needed and maintain accurate records.

-

Is it easy to integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow offers integration capabilities with various popular software solutions, such as CRM systems and accounting software. This ensures that your in kind donation receipt processes can be seamlessly connected to other tools you use, enhancing workflow efficiency.

-

What benefits does using airSlate SignNow provide for managing in kind donation receipts?

Using airSlate SignNow to manage in kind donation receipts offers numerous benefits, including improved speed and accuracy in document processing. The platform's electronic signature feature reduces the time spent on paperwork, enabling your organization to focus on what matters most: building strong donor relationships.

-

Can I customize my in kind donation receipt templates using airSlate SignNow?

Yes, airSlate SignNow allows for signNow customization of in kind donation receipt templates. You can add your organization’s logo, specify donation details, and adjust the layout to match your branding, thereby creating a professional appearance that resonates with your donors.

Get more for GIFT IN KIND DONATION FORM Albert College

- Ia deed form

- Quitclaim deed from corporation to llc iowa form

- Quitclaim deed from corporation to corporation iowa form

- Warranty deed from corporation to corporation iowa form

- Quitclaim deed from corporation to two individuals iowa form

- Warranty deed from corporation to two individuals iowa form

- Warranty deed from individual to a trust iowa form

- Warranty deed from husband and wife to a trust iowa form

Find out other GIFT IN KIND DONATION FORM Albert College

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors