Certification of Foreign Source Income University of Pennsylvania Finance Upenn Form

What is the certification of foreign source income?

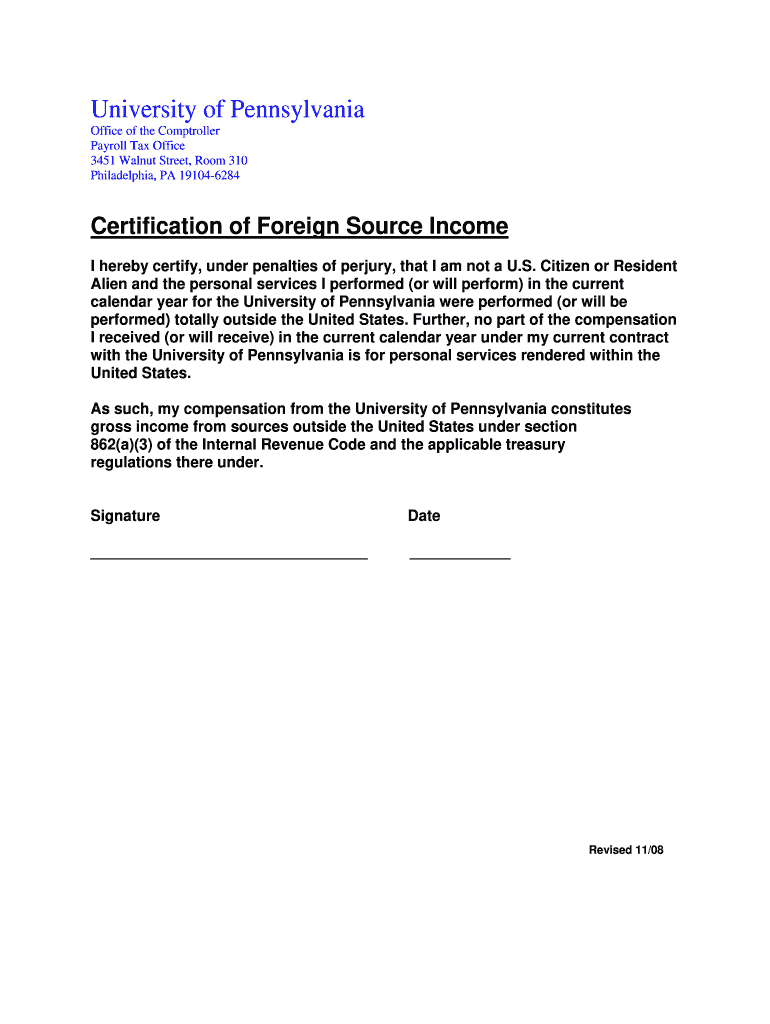

The certification of foreign source income is a formal document issued by the University of Pennsylvania that verifies the income earned by individuals from foreign sources. This certification is crucial for various financial and tax-related purposes, particularly for international students and employees. It serves as proof of income for visa applications, tax filings, and other financial transactions that require verification of foreign income sources.

How to use the certification of foreign source income

To effectively use the certification of foreign source income, individuals should first ensure that the document is accurately completed and reflects the correct income figures. This certification can be presented to financial institutions, tax authorities, or other relevant entities that require proof of foreign income. It is essential to understand the specific requirements of the organization requesting the certification to ensure compliance and acceptance.

Steps to complete the certification of foreign source income

Completing the certification of foreign source income involves several key steps:

- Gather necessary documentation, including income statements and tax forms from foreign employers.

- Fill out the certification form with accurate income details, ensuring all figures are correct.

- Review the completed form for any errors or omissions.

- Obtain required signatures, if necessary, from relevant parties or authorities.

- Submit the certification to the requesting entity, either electronically or in hard copy, as per their guidelines.

Legal use of the certification of foreign source income

The certification of foreign source income is legally recognized when it meets specific criteria. This includes compliance with relevant tax laws and regulations, such as the Internal Revenue Service (IRS) guidelines for reporting foreign income. It is important for individuals to ensure that their certification is accurate and complete to avoid legal complications or penalties related to misrepresentation of income.

Key elements of the certification of foreign source income

Key elements that must be included in the certification of foreign source income are:

- The individual's name and identification details.

- A detailed account of the income earned from foreign sources.

- The currency in which the income is reported.

- Dates of income receipt.

- Signatures of authorized personnel, if applicable.

Required documents for the certification of foreign source income

When applying for the certification of foreign source income, individuals typically need to provide supporting documents, such as:

- Pay stubs or income statements from foreign employers.

- Tax returns filed in the foreign country.

- Any relevant contracts or agreements that outline the terms of employment.

Quick guide on how to complete certification of foreign source income university of pennsylvania finance upenn

Effortlessly prepare Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn on any device

The management of documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to generate, modify, and electronically sign your documents swiftly without holdups. Manage Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn on any platform using airSlate SignNow applications for Android or iOS and enhance any document-related operation today.

The simplest way to modify and electronically sign Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn with ease

- Locate Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a standard wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious searches for forms, or errors that require printing new copies of documents. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How difficult is it to complete masters in computer science from University of Pennsylvania? Do students flunk/drop out due to the high study pressure in UPenn?

They do in fact drop out. One of my roommates, a CSE (computer science and engineering) student dropped out in his first year because he had great difficulty writing a "C" compiler in the "C" programming language. You might help yourself by "auditing" the class (if that's available in the Grad school) or by buying the text book and course pack ahead of time and studying them. Wayne Reses.

-

If poker is your only profession and you have no other sources of income, how do you pay taxes for that in India? Which ITR forms should I fill out?

As per Section 115BB of the Income tax Act, 1961 any income of winnings from any lottery or crossword puzzle or race including horse race or card game and other game of any sort or from gambling or betting of any form or nature whatsoever (which includes income from poker) is taxable at 30% plus education cess of 3% (Total 30.9%). There is not benefit of basic exemption limit but Chapter VIA deductions are available i.e. section 80C, 80 D and other seciton 80- deductions. TDS is also deductible at 30%.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

I'm 21. I lost my dad which was my source of income and I am just a new student in a medical university in a foreign country. I want to study something else because with no finance I'm not really sure of this medicine thing. What should I do?

Medicine is indeed one of the most expensive courses and it's the same everywhere. Have you tried applying for academic scholarships/ study loans from the university? If your passion is really in the medical line, you can actually consider 'cheaper' courses like biomedicine, health science, neurology etc. Though those courses can be slightly cheaper than medicine and the duration of completions will be shorter, the fees will still be a burden if you are unable to get a stable source of income. I guess study loans may be the best for you. Looking forward to hear from you, future doc! No worries, there will be ways to get out of this dilemma and I'm sure the university will cooperate with you provided that they know your condition. :)

Create this form in 5 minutes!

How to create an eSignature for the certification of foreign source income university of pennsylvania finance upenn

How to make an electronic signature for your Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn in the online mode

How to generate an electronic signature for the Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn in Google Chrome

How to make an eSignature for putting it on the Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn in Gmail

How to make an electronic signature for the Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn straight from your smartphone

How to create an electronic signature for the Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn on iOS devices

How to create an electronic signature for the Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn on Android

People also ask

-

What is a certificate of source of income?

A certificate of source of income is a document that verifies the income of an individual or entity. This certificate is often required for financial transactions, loan applications, or taxation purposes. Utilizing airSlate SignNow can streamline the process of obtaining and signing this important certificate.

-

How does airSlate SignNow help with a certificate of source of income?

airSlate SignNow allows users to easily create, send, and eSign a certificate of source of income. With customizable templates, you can quickly draft this document and ensure it meets all necessary legal requirements. This signNowly reduces the time and effort involved in handling such important paperwork.

-

What are the pricing options for using airSlate SignNow for a certificate of source of income?

airSlate SignNow offers several pricing plans tailored to different business needs, starting with affordable options for small businesses. Each plan includes access to essential features for managing documents, including the certificate of source of income. You can choose the plan that fits your needs best and scale as your business grows.

-

Are there any integrations available for airSlate SignNow when creating a certificate of source of income?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRMs. This means you can easily access and manage your certificate of source of income alongside other documents. These integrations enhance your workflow and help maintain organized records.

-

What features does airSlate SignNow provide for managing a certificate of source of income?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage for your certificate of source of income. Additionally, users can automate their workflow with reminders and notifications for signers. These tools make document management efficient and user-friendly.

-

Is it secure to eSign a certificate of source of income with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to protect your documents, including the certificate of source of income. Your data remains confidential and secure while you enjoy the convenience of eSigning from anywhere.

-

Can multiple parties sign a certificate of source of income using airSlate SignNow?

Yes, airSlate SignNow allows multiple parties to sign a certificate of source of income easily. You can invite others to review and eSign the document through a simple link, ensuring everyone involved can complete the process efficiently. This feature is perfect for collaborations involving multiple stakeholders.

Get more for Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn

Find out other Certification Of Foreign Source Income University Of Pennsylvania Finance Upenn

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement