Form Nrw Exemption

What is the Form NRW Exemption

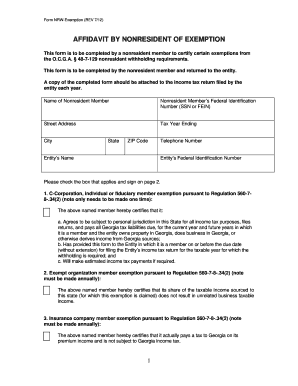

The Georgia Form NRW Exemption is a specific document used to claim exemption from certain taxes or fees in the state of Georgia. This form is essential for individuals or businesses that meet specific criteria and wish to avoid unnecessary financial burdens. Understanding the purpose of this form is crucial for ensuring compliance with state regulations while maximizing potential savings.

How to Use the Form NRW Exemption

Using the Georgia Form NRW Exemption involves several key steps. First, ensure that you meet the eligibility criteria outlined by the state. Next, accurately fill out the form, providing all required information, such as personal identification details and the specific exemptions being claimed. After completing the form, submit it through the appropriate channels, which may include online submission, mailing, or in-person delivery to the relevant state department.

Steps to Complete the Form NRW Exemption

Completing the Georgia Form NRW Exemption requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documentation to support your exemption claim.

- Fill out the form with accurate and complete information, ensuring clarity.

- Review the form for any errors or omissions before submission.

- Submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal Use of the Form NRW Exemption

The legal use of the Georgia Form NRW Exemption is governed by state tax laws. It is essential to ensure that the form is used appropriately to avoid penalties or legal issues. The form must be submitted within the designated timeframes and in accordance with state regulations to maintain its validity. Proper use of this form can protect individuals and businesses from unnecessary tax liabilities.

Eligibility Criteria

To qualify for the Georgia Form NRW Exemption, applicants must meet specific eligibility criteria set forth by the state. These criteria often include factors such as income level, type of business, or particular circumstances that justify the exemption. It is important to thoroughly review these requirements to ensure that your application is valid and that you are entitled to the exemptions being claimed.

Required Documents

When submitting the Georgia Form NRW Exemption, certain documents may be required to support your claim. Commonly required documents include proof of income, business registration details, and any other relevant paperwork that verifies your eligibility for the exemption. Having these documents ready can streamline the submission process and enhance the likelihood of approval.

Quick guide on how to complete form nrw exemption

Complete Form Nrw Exemption effortlessly on any device

Online document management has become prevalent among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the features you need to create, modify, and eSign your documents quickly without holdups. Manage Form Nrw Exemption on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form Nrw Exemption effortlessly

- Obtain Form Nrw Exemption and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Nrw Exemption and guarantee excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form nrw exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are GA NRW exemption instructions?

GA NRW exemption instructions refer to the guidelines provided for exempting certain transactions from regulations in North Rhine-Westphalia. Understanding these instructions is critical for businesses seeking to comply with local laws while using electronic signatures in their documentation. airSlate SignNow provides resources to help navigate these exemption instructions effectively.

-

How can airSlate SignNow assist with GA NRW exemption instructions?

airSlate SignNow offers an intuitive platform that helps businesses manage their eSignature processes while adhering to GA NRW exemption instructions. Our user-friendly interface allows you to create, send, and sign documents effortlessly, ensuring that you meet local compliance requirements. By leveraging our platform, you can streamline your workflows and maintain compliance.

-

Does airSlate SignNow provide support for GA NRW exemption instructions?

Yes, airSlate SignNow provides dedicated support and resources to help you understand GA NRW exemption instructions. Our knowledgeable support team is available to answer your questions and guide you through the compliance process. We also offer online tutorials and documentation to help you stay informed.

-

What features does airSlate SignNow offer for managing exemption documents?

airSlate SignNow includes features specifically designed for managing documents related to GA NRW exemption instructions. These include customizable templates, real-time tracking of signatures, and the ability to set reminders for document completion. With these features, you can ensure a smooth and efficient signing process.

-

Is airSlate SignNow a cost-effective solution for businesses needing GA NRW exemption instructions?

Absolutely. airSlate SignNow is a cost-effective solution that provides businesses with the tools they need to comply with GA NRW exemption instructions without high costs. We offer competitive pricing plans that cater to different business sizes and needs, ensuring you get great value for your investment while maintaining compliance.

-

Can I integrate airSlate SignNow with other tools for better compliance with GA NRW exemption instructions?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to enhance your workflow while managing GA NRW exemption instructions. Whether you use CRMs, document management systems, or collaboration tools, our integrations ensure that all your processes align and comply efficiently. This integration capability allows for a more streamlined approach to document management.

-

Are there any specific benefits of using airSlate SignNow for GA NRW exemption instructions?

Using airSlate SignNow for managing GA NRW exemption instructions brings numerous benefits, including increased productivity, improved document security, and faster turnaround times for signatures. Our platform also allows for easier tracking of compliance, making it simpler for your team to ensure all necessary regulations are met. Overall, it enhances your business operations while keeping you compliant.

Get more for Form Nrw Exemption

- Unavailable check cancellation agency gsa form

- Form 1187 request for payroll deductions for labor afge

- Fillable online opm for labor organization dues cancellation form

- Fillable online store bought pastry shells crusts and fillings are form

- Valuable information for government contractors unanet

- Preaward survey of prospective contractor technical gsa form

- Preaward survey prospective contractor quality gsa form

- Preaward survey prospective form

Find out other Form Nrw Exemption

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple