Fillable Form 8606

What is the Fillable Form 8606

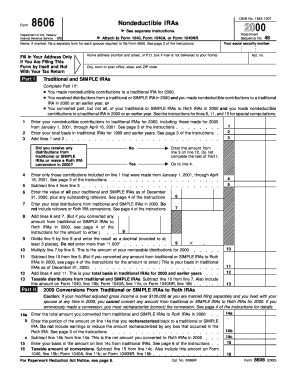

The fillable 2000 Form 8606 is a tax form used in the United States to report non-deductible contributions to traditional Individual Retirement Accounts (IRAs) and to calculate the taxable portion of distributions from these accounts. This form is essential for taxpayers who have made contributions that are not tax-deductible, as it helps ensure accurate reporting of income and tax obligations. The form also plays a critical role in tracking the basis of IRA contributions, which can affect future tax calculations.

How to Use the Fillable Form 8606

To use the fillable 2000 Form 8606, individuals must first gather relevant financial information, including details about IRA contributions and distributions. The form can be filled out electronically, allowing users to enter their information directly into the fields. It is important to follow the instructions carefully, ensuring that all sections are completed accurately. After filling out the form, it can be saved, printed, or submitted electronically, depending on the preferred method of filing.

Steps to Complete the Fillable Form 8606

Completing the fillable 2000 Form 8606 involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report any non-deductible contributions made to your traditional IRA during the tax year.

- Calculate the total basis in your IRA, which is the sum of all non-deductible contributions made over the years.

- Detail any distributions taken from the IRA and determine the taxable amount based on your basis.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Fillable Form 8606

The fillable 2000 Form 8606 is legally binding when completed accurately and submitted to the IRS. It is essential for compliance with tax laws, particularly for those who have made non-deductible contributions to their IRAs. Failure to file this form when required can result in penalties and complications with tax reporting. Therefore, understanding the legal implications of the form is crucial for taxpayers to avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the fillable 2000 Form 8606. Typically, this form is due on the same date as your federal income tax return, which is usually April 15 of the following year. If you require additional time, you may file for an extension, but it is important to ensure that the form is submitted by the extended deadline to avoid penalties. Keeping track of these important dates helps maintain compliance with tax obligations.

Form Submission Methods

The fillable 2000 Form 8606 can be submitted through various methods, including:

- Online Submission: Many taxpayers prefer to file electronically using tax software that supports e-filing.

- Mail: The completed form can be printed and mailed to the appropriate IRS address, which can be found in the form instructions.

- In-Person: Some individuals may choose to deliver their forms directly to their local IRS office.

Quick guide on how to complete fillable form 8606

Effortlessly prepare Fillable Form 8606 on any device

The management of online documents has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed files, as you can locate the right form and securely keep it online. airSlate SignNow provides you with all the necessary tools to quickly create, modify, and eSign your documents without any hassles. Handle Fillable Form 8606 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign Fillable Form 8606 efficiently

- Obtain Fillable Form 8606 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive data using the tools specifically provided by airSlate SignNow for this task.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, either via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, lengthy form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Fillable Form 8606 to ensure excellent communication at every phase of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable form 8606

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fillable 2000 form 8606?

The fillable 2000 form 8606 is a tax form used to report non-deductible contributions to an IRA and to calculate the taxable amount of distributions. This form is essential for individuals who have made contributions to a traditional IRA and need to track their basis in those contributions. Using a fillable version can simplify the process, ensuring accuracy and ease of submission.

-

How can I access the fillable 2000 form 8606?

You can access the fillable 2000 form 8606 through various online tax software platforms, including airSlate SignNow. Our platform allows you to fill out and sign the form digitally, making it convenient to manage your tax documents. Simply visit our website to create your account and start using the fillable form.

-

Is there a cost associated with using the fillable 2000 form 8606 on airSlate SignNow?

airSlate SignNow offers various pricing plans, including a free trial, allowing you to use the fillable 2000 form 8606 without commitment. Our competitive pricing ensures you get a cost-effective solution for all your eSigning needs. Check our pricing page for details on subscription options.

-

What features does airSlate SignNow offer for the fillable 2000 form 8606?

airSlate SignNow provides a user-friendly interface for filling out the 2000 form 8606, with features like document templates, customizable fields, and easy signing options. Additionally, our platform ensures secure storage and sharing of your documents. We also support integration with various software to streamline your workflow.

-

Are there any benefits to using airSlate SignNow for the fillable 2000 form 8606?

Using airSlate SignNow for the fillable 2000 form 8606 enhances your efficiency with its easy-to-navigate interface and quick document turnaround. You can eliminate the hassle of paperwork and mailing, as everything is handled digitally. Our solution allows for better collaboration on tax documents, saving time and increasing accuracy.

-

Can I integrate airSlate SignNow with other tools for the fillable 2000 form 8606?

Yes, airSlate SignNow offers seamless integrations with a variety of tools such as cloud storage services and accounting software. This functionality is particularly useful for users needing to manage multiple tax-related documents, including the fillable 2000 form 8606. You can easily import and export data between applications to streamline your processes.

-

How secure is the information I enter in the fillable 2000 form 8606 on airSlate SignNow?

airSlate SignNow prioritizes the security of your information, employing advanced encryption and secure access protocols to protect data entered into the fillable 2000 form 8606. Our platform complies with legal and industry standards to ensure your documents are safe throughout the eSigning process. You can trust us to maintain the confidentiality of your sensitive information.

Get more for Fillable Form 8606

- Him19000 authorization to disclose protected health information

- Strategies to reduce pregnancy related deaths cdc stacks form

- Additional affected sibling for trio requisition form

- Track daily activity with apple watch apple support form

- Kristofer j jones md orthopaedic surgery sports medicine form

- Cancer form

- Bcia 8016 form instructions

- Cub scout medical form a b 2011

Find out other Fillable Form 8606

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement