It 21041 Form

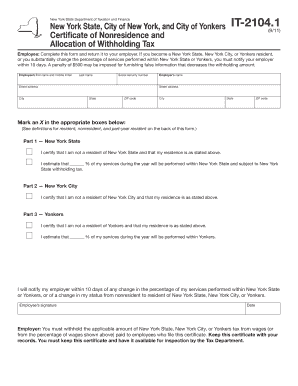

What is the It 21041 Form

The It 21041 Form is a tax document used primarily in the United States for reporting specific income types. It is essential for individuals and businesses to accurately report their earnings to ensure compliance with federal tax regulations. This form is particularly relevant for those who may have income from sources that require special reporting, such as investments or certain business activities.

How to use the It 21041 Form

Using the It 21041 Form involves several key steps. First, gather all necessary financial documents that pertain to the income you need to report. Next, complete the form by accurately entering your income details as required. Make sure to review the instructions carefully to ensure all information is filled out correctly. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the requirements set forth by the IRS.

Steps to complete the It 21041 Form

Completing the It 21041 Form requires careful attention to detail. Follow these steps:

- Collect all relevant income documentation, such as W-2s, 1099s, or other income statements.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your income accurately in the designated sections of the form.

- Double-check your entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the It 21041 Form

The It 21041 Form must be used in accordance with IRS guidelines to ensure its legal validity. It is important to understand that any misreporting or failure to file can lead to penalties. The form serves as an official record of income and must be completed truthfully to comply with federal tax laws. Utilizing a reliable eSignature solution can help ensure that your submission is secure and meets all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the It 21041 Form are crucial to avoid penalties. Typically, the form must be submitted by April fifteenth of the following tax year. However, if you require an extension, you may file for an extension, but it is essential to pay any taxes owed by the original deadline to avoid interest and penalties. Always check the IRS website for any updates on deadlines or changes in tax law that may affect your filing.

Form Submission Methods (Online / Mail / In-Person)

The It 21041 Form can be submitted through various methods to accommodate different preferences. You can file the form online using approved e-filing services, which is often the fastest and most efficient method. Alternatively, you may choose to mail a printed copy of the form to the appropriate IRS address. In-person submissions are generally not available for this form, as the IRS encourages electronic filing to streamline the process.

Quick guide on how to complete it 21041 form

Complete It 21041 Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, alter, and eSign your documents swiftly without difficulties. Manage It 21041 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to edit and eSign It 21041 Form with ease

- Locate It 21041 Form and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with the tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a standard wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, the tiring search for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign It 21041 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 21041 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the It 21041 Form?

The It 21041 Form is a tax form used for reporting certain income and gains in the state of New York. It is essential for taxpayers who need to disclose specific financial information, ensuring compliance with state tax laws. Understanding the It 21041 Form can help individuals and businesses accurately prepare their tax returns.

-

How can airSlate SignNow help with the It 21041 Form?

AirSlate SignNow provides a user-friendly platform to easily fill, sign, and send the It 21041 Form electronically. By leveraging our eSignature feature, you can ensure that your tax documents are submitted quickly and securely. This streamlines the process, helping you focus on other important financial tasks.

-

Is there a cost associated with using airSlate SignNow for the It 21041 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. You can choose a plan that suits your business size and frequency of use, providing an efficient and cost-effective solution for managing the It 21041 Form and other documents. There are no hidden fees, making it simple to budget for compliance needs.

-

What features does airSlate SignNow offer for the It 21041 Form?

AirSlate SignNow includes features such as customizable templates, bulk sending, and automated reminders, all of which enhance your experience with the It 21041 Form. Our platform ensures that you can manage your documents seamlessly while maintaining accuracy and compliance. Additionally, you can track the status of your documents in real time.

-

Can I integrate airSlate SignNow with other applications for the It 21041 Form?

Absolutely! AirSlate SignNow offers integrations with a wide range of applications, which can enhance how you manage the It 21041 Form. By connecting with tools you already use, like accounting software or customer relationship management (CRM) systems, you can streamline your workflow and reduce manual entry errors.

-

What are the benefits of using airSlate SignNow for the It 21041 Form?

Using airSlate SignNow for the It 21041 Form provides numerous benefits, including improved efficiency, enhanced security, and the convenience of electronic signatures. This means you can prepare and submit your tax forms faster and with greater peace of mind. The user-friendly interface ensures that even non-technical users can navigate the process easily.

-

How secure is the airSlate SignNow platform when handling the It 21041 Form?

AirSlate SignNow prioritizes the security of your documents, employing industry-leading encryption protocols to safeguard the It 21041 Form and other sensitive files. We comply with various regulations to ensure that your information remains confidential and protected from unauthorized access. Trust us to handle your vital documents with the utmost care.

Get more for It 21041 Form

Find out other It 21041 Form

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now