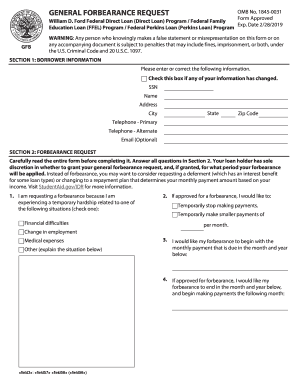

William D Ford Federal Direct Loan Direct Loan Program Form

What is the William D Ford Federal Direct Loan Direct Loan Program

The William D Ford Federal Direct Loan Direct Loan Program is a federal initiative that provides financial assistance to students seeking to fund their education. This program offers various types of loans, including subsidized and unsubsidized loans, to help cover tuition and other related expenses. The loans are issued directly by the U.S. Department of Education, making them a reliable source of funding for eligible students.

How to use the William D Ford Federal Direct Loan Direct Loan Program

Using the William D Ford Federal Direct Loan Direct Loan Program involves several steps. First, students must complete the Free Application for Federal Student Aid (FAFSA) to determine their eligibility. Once approved, students can choose the type of loan that best suits their financial needs. The funds can be used for tuition, fees, room, board, and other school-related costs. It is essential to understand the terms and conditions associated with each loan type to make informed decisions.

Steps to complete the William D Ford Federal Direct Loan Direct Loan Program

Completing the William D Ford Federal Direct Loan Direct Loan Program requires a series of steps:

- Fill out the FAFSA to establish eligibility.

- Review your Student Aid Report (SAR) to confirm the information is accurate.

- Accept the loan offer through your school’s financial aid office.

- Complete entrance counseling to understand your obligations.

- Sign a Master Promissory Note (MPN) agreeing to the loan terms.

Eligibility Criteria

To qualify for the William D Ford Federal Direct Loan Direct Loan Program, students must meet specific eligibility criteria. These include being a U.S. citizen or eligible non-citizen, having a valid Social Security number, and being enrolled at least half-time in an eligible program. Additionally, students must demonstrate financial need for subsidized loans, while unsubsidized loans are available regardless of financial need.

Required Documents

When applying for the William D Ford Federal Direct Loan Direct Loan Program, several documents are necessary to support your application. Key documents include:

- Completed FAFSA form.

- Proof of identity, such as a driver's license or Social Security card.

- Financial documents, including tax returns and income statements.

- School enrollment verification.

Legal use of the William D Ford Federal Direct Loan Direct Loan Program

The legal use of the William D Ford Federal Direct Loan Direct Loan Program is governed by federal regulations. Borrowers must use the loan funds for educational expenses only. Misuse of funds can lead to penalties, including the requirement to repay the loan immediately. It is crucial for borrowers to keep accurate records of their expenses and ensure compliance with all federal guidelines.

Quick guide on how to complete william d ford federal direct loan direct loan program

Prepare William D Ford Federal Direct Loan Direct Loan Program effortlessly on any gadget

Web-based document handling has become widely accepted by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, adjust, and electronically sign your files swiftly without delays. Manage William D Ford Federal Direct Loan Direct Loan Program on any device with airSlate SignNow's Android or iOS applications and simplify any document-oriented task today.

How to adjust and eSign William D Ford Federal Direct Loan Direct Loan Program with ease

- Find William D Ford Federal Direct Loan Direct Loan Program and click on Start Form to begin.

- Make use of the tools we provide to fill out your document.

- Select pertinent sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finished button to apply your modifications.

- Decide how you would like to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign William D Ford Federal Direct Loan Direct Loan Program and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the william d ford federal direct loan direct loan program

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the William D Ford Federal Direct Loan Direct Loan Program?

The William D Ford Federal Direct Loan Direct Loan Program is a federal loan program that provides direct loans from the U.S. Department of Education to help students cover the cost of their education. This program offers various types of loans, including subsidized and unsubsidized loans, which come with flexible repayment options.

-

Who is eligible for the William D Ford Federal Direct Loan Direct Loan Program?

Eligibility for the William D Ford Federal Direct Loan Direct Loan Program typically requires applicants to be enrolled at least half-time in an eligible program at a college or university. Additionally, students must complete the Free Application for Federal Student Aid (FAFSA) to determine their financial need.

-

What are the benefits of the William D Ford Federal Direct Loan Direct Loan Program?

The William D Ford Federal Direct Loan Direct Loan Program offers several advantages, including lower interest rates compared to private loans, flexible repayment options, and the possibility for loan forgiveness for qualifying borrowers. These benefits make it an attractive choice for students seeking financial assistance.

-

How can I apply for the William D Ford Federal Direct Loan Direct Loan Program?

To apply for the William D Ford Federal Direct Loan Direct Loan Program, students must first complete the FAFSA. Once approved, the school will provide the necessary information regarding loan amounts and terms as part of the financial aid package.

-

What is the interest rate for the William D Ford Federal Direct Loan Direct Loan Program?

Interest rates for the William D Ford Federal Direct Loan Direct Loan Program can vary depending on the loan type and the loan disbursement date. It is essential to check the latest rates on the Federal Student Aid website, as they are updated annually.

-

Are there any fees associated with the William D Ford Federal Direct Loan Direct Loan Program?

While there are no origination fees for the William D Ford Federal Direct Loan Direct Loan Program, the loans may include an interest rate that could lead to a higher overall repayment amount. Borrowers should carefully review the terms and conditions associated with their loans.

-

Can I consolidate loans taken out under the William D Ford Federal Direct Loan Direct Loan Program?

Yes, borrowers can consolidate their loans from the William D Ford Federal Direct Loan Direct Loan Program through a Direct Consolidation Loan. This allows borrowers to combine multiple loans into one, simplifying payments and potentially extending the repayment term.

Get more for William D Ford Federal Direct Loan Direct Loan Program

- Aduana mexico online form

- Us customs declaration form

- Rental car loss damage waiver cdw insuranceavis rent form

- Archivio cartelle cliniche gemelli telefono form

- Correction application form

- Tus digital badge earner application and consent form

- Debeka formulare zum ausdrucken

- Novo nordisk patient assistance program form

Find out other William D Ford Federal Direct Loan Direct Loan Program

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online