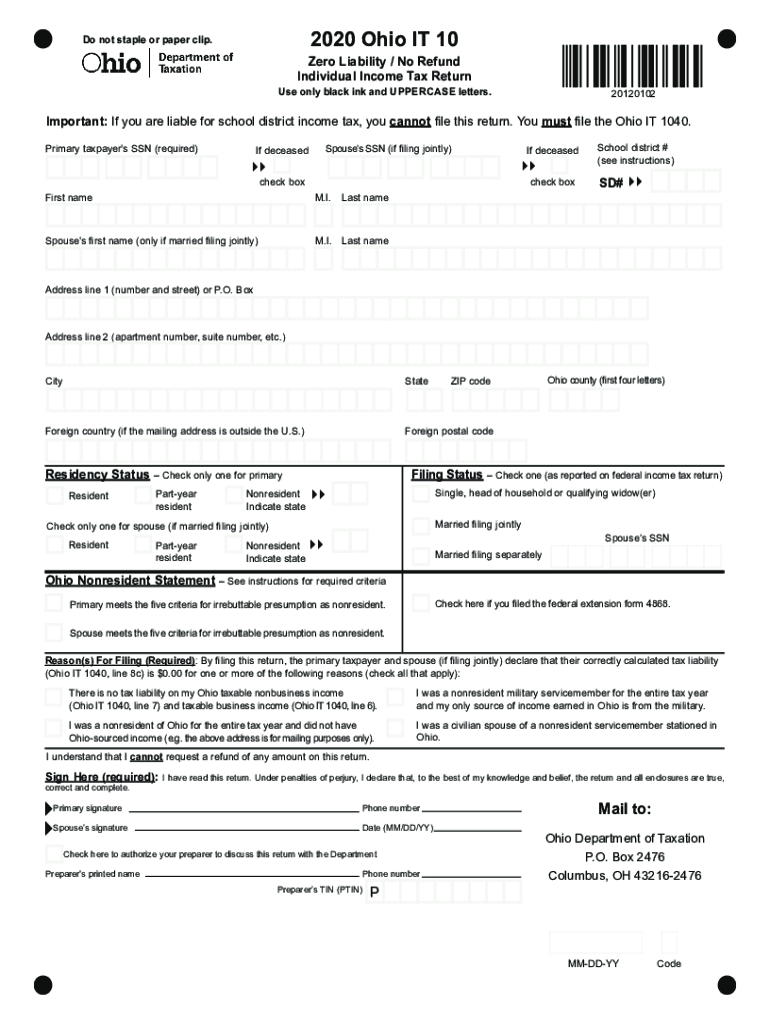

Ohio Tax Forms Printable State Ohio it 1040 Form Ohio Tax Forms Printable State Ohio it 1040 Form Ohio Tax Forms Printable State

Understanding the Ohio Tan Tax

The Ohio tan tax is a specific tax imposed on tanning services within the state. This tax is designed to generate revenue while promoting public health by discouraging excessive tanning. The rate and application of this tax can vary based on local regulations. Businesses providing tanning services must ensure compliance with state tax laws to avoid penalties.

How to Use the Ohio Tan Tax Form

Using the Ohio tan tax form involves several steps to ensure accurate reporting and payment. First, businesses must collect the appropriate tax from customers at the time of service. Next, they need to accurately complete the tax form, detailing the total amount of tanning services provided and the corresponding tax collected. Finally, the completed form should be submitted to the appropriate state agency by the specified deadline.

Steps to Complete the Ohio Tan Tax Form

Completing the Ohio tan tax form requires careful attention to detail. Follow these steps:

- Gather all necessary documentation, including sales records and customer receipts.

- Calculate the total revenue generated from tanning services.

- Determine the total tan tax collected based on the applicable rate.

- Fill out the form accurately, ensuring all figures match your calculations.

- Review the form for any errors before submission.

Legal Use of the Ohio Tan Tax Form

The Ohio tan tax form must be used in accordance with state regulations. This includes submitting the form on time and ensuring that all collected taxes are remitted to the state. Failure to comply with these legal requirements can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines for the Ohio Tan Tax

Timely filing of the Ohio tan tax form is crucial for compliance. The specific deadlines can vary, but businesses typically need to file quarterly or annually, depending on their revenue. It is important to stay informed about these deadlines to avoid late fees and maintain good standing with state tax authorities.

Penalties for Non-Compliance with the Ohio Tan Tax

Non-compliance with the Ohio tan tax regulations can lead to significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action. It is essential for tanning service providers to understand their obligations and ensure timely and accurate reporting to avoid these consequences.

Quick guide on how to complete ohio tax forms printable state ohio it 1040 form ohio tax forms printable state ohio it 1040 form ohio tax forms printable

Effortlessly Create Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a superior eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and without hassle. Manage Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State on any device using airSlate SignNow's Android or iOS applications and streamline your document-driven processes today.

How to Modify and eSign Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State with Ease

- Find Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Modify and eSign Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State and ensure excellent communication at every step of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio tax forms printable state ohio it 1040 form ohio tax forms printable state ohio it 1040 form ohio tax forms printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ohio tan tax and how does it affect my business?

The ohio tan tax is a specific tax regulation related to transactions that occur in Ohio. It is essential for businesses operating in the state to understand its implications on pricing and compliance. By incorporating the ohio tan tax into your financial planning, you can ensure proper adherence to local tax laws and avoid potential penalties.

-

How can airSlate SignNow help me manage the ohio tan tax?

airSlate SignNow provides a seamless platform for sending and eSigning documents that can help you maintain compliance with the ohio tan tax. Our solution allows for easy documentation and record-keeping, ensuring that all transactions reflect the appropriate tax rates. This not only streamlines your workflow but also minimizes errors related to tax calculations.

-

Are there any additional costs associated with using airSlate SignNow for the ohio tan tax?

While airSlate SignNow offers a cost-effective solution, it's important to consider that the ohio tan tax may apply to certain transactions. Additional fees may be based on your specific business needs and frequency of use. We recommend reviewing our pricing plans to find the best option that accommodates both your operational requirements and tax duties.

-

What features does airSlate SignNow offer to support ohio tan tax compliance?

airSlate SignNow includes comprehensive features such as customizable templates, secure document storage, and automatic reminders that assist with compliance regarding the ohio tan tax. These tools help simplify your document workflow while ensuring that you maintain accurate tax records and communications. Our platform also regularly updates to stay compliant with current tax regulations.

-

Can I integrate airSlate SignNow with other accounting software to manage ohio tan tax?

Yes, airSlate SignNow enables integration with various accounting software solutions, allowing you to efficiently manage the ohio tan tax. This integration streamlines your documents with financial records, providing a holistic view of your tax obligations. Effortlessly sync your data and enhance your financial operations with our comprehensive integrations.

-

What benefits does airSlate SignNow provide for businesses dealing with ohio tan tax?

Utilizing airSlate SignNow can lead to signNow benefits for businesses managing the ohio tan tax, such as increased efficiency and reduced manual errors. Our platform automates document workflows, making it easier to track transactions and comply with tax requirements. By choosing airSlate SignNow, you enhance your productivity while ensuring a reliable approach to handling the ohio tan tax.

-

Is there customer support available for questions about ohio tan tax?

Absolutely! airSlate SignNow offers dedicated customer support to address any inquiries regarding the ohio tan tax and its impact on our services. Our team is equipped to guide you through your questions and assist with compliance issues. Whether it's about features or pricing, you can rely on our support team for prompt assistance.

Get more for Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State

- Frontier positive identification form for pending orders

- Residential earthquake risk disclosure statement 2020 edition form

- Fax 780 427 5863 form

- Se vilkr pdf dnb form

- Get and sign form mm5 madrid agreement concerning the

- What is form 4972 tax on lump sum distributions turbotax

- Fillable online form mm5 madrid agreement concerning the

- Request for recheck of usmle score form

Find out other Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State Ohio IT 1040 Form Ohio Tax Forms Printable State

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy