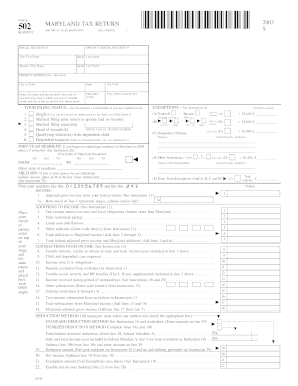

Form 502 Comptroller of the Treasury

What is the Form 2003 502?

The Form 2003 502 is a document issued by the Comptroller of the Treasury, primarily used for specific financial and compliance purposes. This form facilitates the reporting and management of certain financial transactions, ensuring that they adhere to state regulations. Understanding the purpose and requirements of this form is essential for individuals and businesses to maintain compliance and avoid potential penalties.

How to use the Form 2003 502

Using the Form 2003 502 involves several steps to ensure accurate completion and submission. First, gather all necessary information related to the financial transactions you are reporting. This may include details about income, expenses, and any applicable deductions. Next, carefully fill out the form, ensuring that all fields are completed accurately. Once completed, the form can be submitted electronically or via mail, depending on the specific instructions provided by the Comptroller's office.

Steps to complete the Form 2003 502

Completing the Form 2003 502 requires attention to detail. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Gather all relevant financial documents, such as receipts, invoices, and previous tax returns.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check your entries for accuracy and completeness.

- Submit the form as instructed, either electronically or by mail.

Legal use of the Form 2003 502

The Form 2003 502 is legally binding when completed and submitted in accordance with state regulations. To ensure its legal standing, it is crucial to comply with all relevant laws regarding financial reporting and documentation. This includes providing accurate information and adhering to submission deadlines. Failure to comply may result in penalties or legal repercussions.

Key elements of the Form 2003 502

Key elements of the Form 2003 502 include various sections that require detailed financial information. These sections typically cover:

- Identification of the individual or business submitting the form.

- Details of financial transactions being reported.

- Signatures and dates to validate the submission.

Each element plays a critical role in ensuring that the form is complete and compliant with legal standards.

Form Submission Methods

The Form 2003 502 can be submitted through multiple methods, providing flexibility for users. Common submission methods include:

- Online submission through the designated state portal.

- Mailing a physical copy to the appropriate office.

- In-person submission at specified government offices.

Choosing the right submission method can enhance the efficiency of processing your form.

Quick guide on how to complete form 502 comptroller of the treasury

Prepare Form 502 Comptroller Of The Treasury seamlessly on any gadget

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Form 502 Comptroller Of The Treasury on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Form 502 Comptroller Of The Treasury effortlessly

- Locate Form 502 Comptroller Of The Treasury and click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Form 502 Comptroller Of The Treasury and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 502 comptroller of the treasury

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 2003 502 in relation to airSlate SignNow?

The 2003 502 refers to a specific regulatory compliance that airSlate SignNow adheres to, ensuring that all eSigning processes meet industry standards. It plays a crucial role in guaranteeing the legitimacy of electronic signatures, which helps businesses conduct transactions securely.

-

How does airSlate SignNow support the 2003 502 compliance?

airSlate SignNow incorporates features that align with the 2003 502 compliance requirements, such as strong authentication, secure storage, and audit trails. These features help businesses maintain compliance while streamlining their signing processes.

-

What pricing plans does airSlate SignNow offer for eSigning under the 2003 502 standards?

airSlate SignNow provides various pricing plans tailored to different business needs while ensuring compliance with the 2003 502 standards. Each plan is designed to be cost-effective, enabling businesses to choose a solution that fits their budget and requirements.

-

What features of airSlate SignNow help with the eSigning process related to the 2003 502?

Key features of airSlate SignNow that support the 2003 502 include customizable templates, real-time tracking, and cloud integration. These tools enhance the efficiency of the eSigning process while maintaining compliance with regulatory standards.

-

What are the benefits of using airSlate SignNow with respect to 2003 502 compliance?

Using airSlate SignNow ensures that your electronic signatures meet the 2003 502 compliance, providing peace of mind for businesses. The benefits include reduced paperwork, faster turnaround times, and enhanced security for sensitive documents.

-

Can airSlate SignNow integrate with other tools while adhering to the 2003 502 guidelines?

Yes, airSlate SignNow offers seamless integrations with popular software tools while maintaining compliance with the 2003 502 standards. This flexibility enables businesses to streamline their workflows without compromising regulatory compliance.

-

Is customer support available for issues related to the 2003 502 compliance in airSlate SignNow?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any concerns related to the 2003 502 compliance. Their expert team is available to guide you through compliance-related questions and help you fully utilize the platform.

Get more for Form 502 Comptroller Of The Treasury

Find out other Form 502 Comptroller Of The Treasury

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement