Woonsocket Homestead Exemption Form

What is the Woonsocket Homestead Exemption

The Woonsocket Homestead Exemption is a property tax benefit designed to reduce the taxable value of a primary residence for eligible homeowners. This exemption aims to provide financial relief to residents by lowering their property tax burden. The exemption applies to homeowners who meet specific criteria, including residency requirements and ownership status. By reducing the assessed value of the property, the exemption can significantly decrease the amount of property taxes owed, making homeownership more affordable for many families.

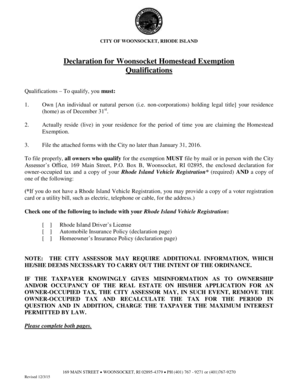

Eligibility Criteria

To qualify for the Woonsocket Homestead Exemption, homeowners must meet several eligibility criteria. Generally, applicants must be the legal owner of the property and use it as their primary residence. Additionally, the homeowner must have lived in the property for a specified period, often at least one year prior to applying for the exemption. Age, disability status, and income levels may also play a role in determining eligibility. It is essential for applicants to review local regulations to ensure they meet all requirements before applying.

Steps to Complete the Woonsocket Homestead Exemption

Completing the Woonsocket Homestead Exemption involves several key steps. First, homeowners should gather necessary documentation, including proof of residency and ownership, such as a deed or tax bill. Next, they need to fill out the exemption application form accurately, ensuring all information is complete and correct. After completing the form, homeowners can submit it either online, by mail, or in person at the appropriate local office. It is crucial to keep a copy of the submitted application for personal records and to follow up on the status of the exemption.

Required Documents

When applying for the Woonsocket Homestead Exemption, homeowners must provide specific documents to support their application. Commonly required documents include:

- Proof of ownership, such as a property deed or tax bill

- Identification, like a driver's license or state ID

- Proof of residency, which may include utility bills or lease agreements

- Any additional documentation required by local regulations

Having these documents ready can streamline the application process and help ensure a successful exemption request.

Form Submission Methods

Homeowners can submit the Woonsocket Homestead Exemption application through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local government website

- Mailing the completed form to the designated office

- In-person submission at the local tax assessor's office

Each method has its advantages, and homeowners should choose the one that best fits their needs while ensuring compliance with submission deadlines.

Legal Use of the Woonsocket Homestead Exemption

The Woonsocket Homestead Exemption is governed by specific legal frameworks that dictate its use and application. Homeowners must adhere to these laws to ensure their exemption is valid. Misrepresentation or failure to meet eligibility requirements can result in penalties, including the revocation of the exemption and potential fines. Understanding the legal implications of the exemption is crucial for homeowners to maintain compliance and benefit from the tax relief it provides.

Quick guide on how to complete woonsocket homestead exemption

Complete Woonsocket Homestead Exemption seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely preserve it online. airSlate SignNow provides you with all the resources necessary to create, amend, and electronically sign your documents swiftly without delays. Manage Woonsocket Homestead Exemption on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

How to modify and electronically sign Woonsocket Homestead Exemption effortlessly

- Locate Woonsocket Homestead Exemption and click on Get Form to begin.

- Leverage the tools we supply to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically provides for this reason.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you choose. Revise and electronically sign Woonsocket Homestead Exemption to guarantee outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the woonsocket homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Woonsocket homestead exemption?

The Woonsocket homestead exemption is a property tax relief program designed to reduce the taxable value of residential properties for qualifying homeowners. This exemption helps lower the overall tax burden, making homeownership more affordable. Understanding the specifics of the Woonsocket homestead exemption can signNowly benefit eligible homeowners.

-

How do I apply for the Woonsocket homestead exemption?

To apply for the Woonsocket homestead exemption, homeowners must submit an application to the local tax assessor's office with necessary documentation proving ownership and residency. It’s important to meet the deadlines set by the city to ensure you receive the exemption for the current tax year. Check the city's official website for detailed instructions and requirements for the application process.

-

What are the eligibility requirements for the Woonsocket homestead exemption?

Eligibility for the Woonsocket homestead exemption typically includes being a homeowner residing in the property as your primary residence. There are additional criteria, such as income limitations and age requirements, that can influence eligibility. It’s advisable to review the guidelines on the city's website or consult with a local tax advisor for personalized assistance.

-

How much can I save with the Woonsocket homestead exemption?

The amount you can save with the Woonsocket homestead exemption depends on various factors, including the assessed value of your property and the specific exemption percentage applied. Homeowners could see a reduction in their annual property taxes, which varies widely based on individual circumstances. It's best to calculate potential savings by referring to your property tax assessments and speaking to the local tax office.

-

Can I stack the Woonsocket homestead exemption with other exemptions?

Yes, in some cases, homeowners may be able to combine the Woonsocket homestead exemption with other tax relief programs. State and local regulations govern the possibiliites for stacking exemptions, so it's essential to check with your local tax assessor. This can maximize your tax savings, benefiting your overall financial situation.

-

Does the Woonsocket homestead exemption renew automatically?

In Woonsocket, the homestead exemption does not automatically renew every year. Homeowners must reapply if there are signNow changes to ownership or occupancy status. Checking in with the assessor's office annually ensures you maintain compliance and retain your exemption status.

-

How does the Woonsocket homestead exemption affect my mortgage?

The Woonsocket homestead exemption may positively impact your mortgage by reducing your property taxes, which can make your monthly payments more manageable. Lenders often consider tax assessments when determining mortgage affordability, so a lower tax burden can improve your financial profile. Speak to your mortgage provider about how the exemption influences your specific mortgage agreement.

Get more for Woonsocket Homestead Exemption

- Massachusetts installments fixed rate promissory note secured by personal property massachusetts form

- Ma note form

- Notice of option for recording massachusetts form

- Life documents 497309885 form

- General durable power of attorney for property and finances or financial effective upon disability massachusetts form

- Essential legal life documents for baby boomers massachusetts form

- Massachusetts general form

- Revocation of general durable power of attorney massachusetts form

Find out other Woonsocket Homestead Exemption

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement