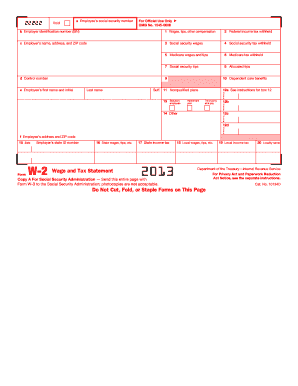

Form W 2 Internal Revenue Service Irs

What makes the form w 2 internal revenue service irs legally binding?

As the world ditches office working conditions, the completion of paperwork more and more takes place electronically. The form w 2 internal revenue service irs isn’t an any different. Dealing with it using electronic means differs from doing this in the physical world.

An eDocument can be regarded as legally binding given that certain requirements are fulfilled. They are especially critical when it comes to stipulations and signatures associated with them. Entering your initials or full name alone will not ensure that the institution requesting the sample or a court would consider it executed. You need a reliable tool, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your form w 2 internal revenue service irs when completing it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make form execution legal and secure. Furthermore, it offers a lot of opportunities for smooth completion security smart. Let's rapidly run through them so that you can be assured that your form w 2 internal revenue service irs remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: key privacy regulations in the USA and Europe.

- Two-factor authentication: adds an extra layer of security and validates other parties identities through additional means, such as an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data safely to the servers.

Submitting the form w 2 internal revenue service irs with airSlate SignNow will give greater confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete form w 2 internal revenue service irs

Complete Form W 2 Internal Revenue Service Irs effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your files quickly and without delays. Handle Form W 2 Internal Revenue Service Irs on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and electronically sign Form W 2 Internal Revenue Service Irs with ease

- Obtain Form W 2 Internal Revenue Service Irs and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with features that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal authority as a traditional ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Form W 2 Internal Revenue Service Irs to ensure excellent communication at all stages of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 2 internal revenue service irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 2 from the Internal Revenue Service (IRS)?

Form W 2 from the Internal Revenue Service (IRS) is a tax form that reports an employee's annual wages and the amount of taxes withheld from their paycheck. Employers are required to provide this form to employees by January 31 of each year, ensuring accurate reporting of income to the IRS.

-

How can airSlate SignNow help with Form W 2 from the IRS?

airSlate SignNow simplifies the process of sending and eSigning Form W 2 from the Internal Revenue Service (IRS). With its user-friendly platform, businesses can quickly prepare, send, and securely store these important tax documents, enhancing workflow efficiency during tax season.

-

Is airSlate SignNow an affordable solution for managing Form W 2 from the IRS?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for businesses of all sizes. This affordability makes it an excellent choice for managing Form W 2 from the Internal Revenue Service (IRS) without compromising on quality and features.

-

What features does airSlate SignNow provide for Form W 2 from the IRS?

airSlate SignNow offers a variety of features for managing Form W 2 from the Internal Revenue Service (IRS), including eSignature functionality, document templates, and tracking capabilities. These features ensure a seamless experience for users when handling important tax documents.

-

Can airSlate SignNow integrate with accounting software for Form W 2 from the IRS?

Absolutely! airSlate SignNow integrates smoothly with various accounting software, making it easier to manage Form W 2 from the Internal Revenue Service (IRS) alongside your financial tracking. This integration helps streamline the tax preparation process and improves overall efficiency.

-

What are the benefits of electronically signing Form W 2 from the IRS with airSlate SignNow?

Using airSlate SignNow for electronically signing Form W 2 from the Internal Revenue Service (IRS) offers numerous benefits, including increased security, faster turnaround times, and reduced paper usage. This electronic approach helps speed up the tax process while ensuring compliance with IRS requirements.

-

How do I get started with airSlate SignNow for Form W 2 from the IRS?

Getting started with airSlate SignNow for managing Form W 2 from the Internal Revenue Service (IRS) is easy. Simply sign up for an account, choose a pricing plan that suits your needs, and you can begin creating and sending your tax documents within minutes.

Get more for Form W 2 Internal Revenue Service Irs

- You should now be able to see the form

- To view toolbars and check forms

- Disposing mind and memory law and legal definitionuslegal inc form

- State of wyoming hereinafter referred to as the trustor whether one or more form

- How to avoid financial tangles american institute for economic form

- Control number ne et20 form

- Form an llc in nevadahow to start an llc

- Individual to a trust form

Find out other Form W 2 Internal Revenue Service Irs

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed