Form 1127nyc and

What is the Form 1127nyc And

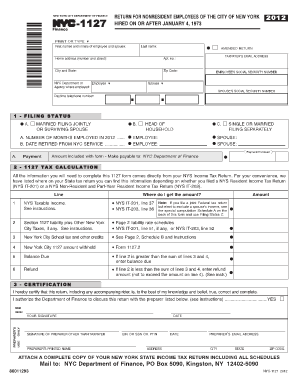

The Form 1127nyc And is a specific document used within the New York City jurisdiction, primarily for tax-related purposes. It serves as a request for an extension of time to file certain tax returns. This form is crucial for taxpayers who need additional time to prepare their submissions while ensuring compliance with local tax regulations. Understanding the purpose and requirements of this form is essential for accurate tax filing and avoiding penalties.

How to use the Form 1127nyc And

Using the Form 1127nyc And involves several steps to ensure proper completion. First, gather all necessary financial documents and information related to your tax situation. Next, fill out the form accurately, providing details such as your name, address, and the specific tax return for which you are requesting an extension. Once completed, review the form for any errors before submission. It is important to submit the form by the required deadline to avoid any potential penalties.

Steps to complete the Form 1127nyc And

Completing the Form 1127nyc And requires careful attention to detail. Follow these steps:

- Obtain the form from the appropriate tax authority or website.

- Fill in your personal information, including your full name, address, and taxpayer identification number.

- Indicate the type of tax return for which you are requesting an extension.

- Provide a brief explanation of why you need the extension.

- Sign and date the form to validate your request.

After completing these steps, ensure that you submit the form through the appropriate channels, whether online, by mail, or in person.

Legal use of the Form 1127nyc And

The legal use of the Form 1127nyc And is governed by New York City tax regulations. It is essential to use this form in accordance with the guidelines set forth by the tax authorities. Submitting the form correctly ensures that you are granted the extension you request, allowing you additional time to file your tax return without incurring penalties. Failure to comply with the legal requirements may result in the denial of your extension request.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1127nyc And are critical to ensure compliance with tax regulations. Typically, the form must be submitted before the original due date of the tax return for which you are requesting an extension. It is important to stay informed about specific deadlines each tax year, as they may vary. Missing these deadlines can lead to penalties and interest on unpaid taxes.

Required Documents

When filling out the Form 1127nyc And, certain documents may be required to support your request. These documents can include:

- Your most recent tax return.

- Any relevant financial statements that justify the need for an extension.

- Identification documents, such as a driver's license or Social Security card.

Having these documents ready can streamline the process and ensure that your request is well-supported.

Quick guide on how to complete form 1127nyc and

Prepare Form 1127nyc And effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Form 1127nyc And on any device with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to edit and eSign Form 1127nyc And with ease

- Locate Form 1127nyc And and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Formulate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and hit the Done button to save your changes.

- Decide how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 1127nyc And to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1127nyc and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1127nyc And and how can it benefit my business?

Form 1127nyc And is a critical document for businesses in New York City that need to file for tax extensions. Utilizing airSlate SignNow allows for seamless eSigning and submission of Form 1127nyc And, enhancing productivity and ensuring compliance with local regulations.

-

How does airSlate SignNow simplify the eSigning process for Form 1127nyc And?

airSlate SignNow streamlines the eSigning process for Form 1127nyc And by providing a user-friendly interface and robust features. Users can easily upload, send, and sign documents, allowing for faster turnaround times without the hassle of printing or mailing.

-

Is there a trial period available for airSlate SignNow when using Form 1127nyc And?

Yes, airSlate SignNow offers a free trial for prospective users to explore its features, including those specific to Form 1127nyc And. This allows businesses to experience firsthand how the platform can enhance their document management and eSigning processes before committing to a paid plan.

-

What types of integrations does airSlate SignNow offer for handling Form 1127nyc And?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Salesforce. This allows users to easily access and manage Form 1127nyc And, ensuring a smooth workflow across different platforms and enhancing overall efficiency.

-

Can I customize the eSigning experience for Form 1127nyc And with airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize the eSigning process for Form 1127nyc And by adding fields, setting signing orders, and incorporating branding elements. This personalization helps enhance the professional appearance of your documents while ensuring compliance.

-

What is the pricing structure for using airSlate SignNow for Form 1127nyc And?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs when managing Form 1127nyc And. Plans typically range from basic packages for small businesses to advanced options for larger enterprises, ensuring that there is a suitable choice for everyone.

-

How secure is airSlate SignNow when handling Form 1127nyc And?

Security is a top priority at airSlate SignNow. With advanced encryption protocols, compliance with various regulatory standards, and robust authentication measures, users can trust that their Form 1127nyc And documents are handled safely and securely.

Get more for Form 1127nyc And

- Ncua federal credit union bylaws online form

- F242 052 000 worker verification form

- Application for washington state career and form

- Employer declaration for ignition interlock device form

- Delaware uc 8 form

- Ncui 506e 2012 form

- Wc043 rejection of coveragedoc connecticut workers compensation commission agency forms

- Colorado affirmation of legal work status 2012 form

Find out other Form 1127nyc And

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure