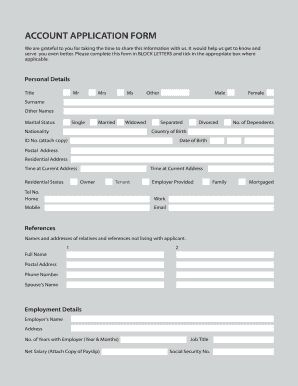

Personal Loan Form

What is the Personal Loan

A personal loan is a type of unsecured loan that individuals can use for various purposes, such as consolidating debt, financing a major purchase, or covering unexpected expenses. Unlike secured loans, personal loans do not require collateral, meaning that borrowers do not need to put up assets like a house or car to obtain the loan. The amount borrowed, interest rates, and repayment terms can vary based on the lender's policies and the borrower's creditworthiness.

Steps to Complete the Personal Loan

Completing a personal loan form involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification, income details, and employment history. Next, fill out the blank personal loan forms template carefully, ensuring all fields are completed accurately. After filling out the form, review it for any errors or omissions. Finally, submit the form electronically or via mail, depending on the lender's submission methods.

Required Documents

When applying for a personal loan, certain documents are typically required to verify your identity and financial status. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport

- Proof of income, such as pay stubs or tax returns

- Bank statements to demonstrate financial stability

- Social Security number for identity verification

Having these documents ready can streamline the application process and improve your chances of approval.

Eligibility Criteria

Eligibility for a personal loan can vary by lender, but there are common criteria that most institutions consider. These typically include:

- A minimum credit score, often ranging from 580 to 700

- Stable income to demonstrate the ability to repay the loan

- A reasonable debt-to-income ratio, usually below 40%

- Age and residency requirements, as borrowers must be at least eighteen years old and a U.S. resident

Meeting these criteria is essential for a successful loan application.

Legal Use of the Personal Loan

The legal use of personal loans is generally broad, allowing borrowers to utilize funds for various purposes. However, it is important to ensure that the intended use complies with the lender's policies and legal regulations. Common legal uses include:

- Debt consolidation to manage multiple debts more effectively

- Home improvements that enhance property value

- Medical expenses that are not covered by insurance

- Education costs for personal development or skill enhancement

Using the loan for illegal activities or gambling may lead to serious legal consequences.

How to Obtain the Personal Loan

Obtaining a personal loan typically involves several straightforward steps. Start by researching different lenders to compare interest rates and terms. Once a suitable lender is identified, complete the blank personal loan forms template with accurate information. After submission, the lender will review your application and may request additional documentation. If approved, you will receive the loan amount, which can be disbursed directly to your bank account or as a check.

Quick guide on how to complete personal loan

Prepare Personal Loan effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Personal Loan on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related operation today.

How to modify and eSign Personal Loan with ease

- Locate Personal Loan and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential details using tools designed by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Leave behind concerns about lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Personal Loan and ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a blank personal loan forms template?

A blank personal loan forms template is a pre-designed document that outlines the necessary information and terms required for personal loans. It helps streamline the application process by providing a structured format that can be easily filled out by borrowers. Using our blank personal loan forms template ensures that all essential details are included, making the lending process more efficient.

-

How can I customize the blank personal loan forms template?

You can easily customize the blank personal loan forms template using the features available in airSlate SignNow. Simply edit the fields, add your company logo, and personalize the terms according to your requirements. This flexibility allows you to create a template that perfectly aligns with your branding and loan policies.

-

Are there any costs associated with using the blank personal loan forms template?

airSlate SignNow offers a variety of pricing plans that include access to the blank personal loan forms template. Depending on the plan you choose, you can benefit from additional features such as eSignature capabilities and document management. Check our pricing page for detailed information on costs and included features.

-

What are the benefits of using the blank personal loan forms template?

The blank personal loan forms template simplifies the loan application process for both lenders and borrowers. It reduces paperwork, speeds up approvals, and minimizes errors by ensuring that all relevant information is captured accurately. Additionally, it enhances professionalism and can improve customer trust.

-

Can I integrate the blank personal loan forms template with other software?

Yes, the blank personal loan forms template can be seamlessly integrated with various software platforms. airSlate SignNow supports integrations with CRM systems, management tools, and other applications to streamline your workflows and improve efficiency. This allows for a smooth transition of data across systems.

-

Is the blank personal loan forms template secure?

Absolutely! The blank personal loan forms template used in airSlate SignNow adheres to strict security protocols to protect sensitive information. With features like encryption and secure access controls, you can ensure that your documents and personal data remain confidential throughout the process.

-

How does the blank personal loan forms template improve the user experience?

The blank personal loan forms template enhances the user experience by providing a straightforward, user-friendly interface. It guides borrowers through the application process, making it simple to fill out and submit necessary information. This ease of use can lead to quicker loan approvals and satisfied customers.

Get more for Personal Loan

- Mississippi motion dismiss 497315356 form

- Answer mississippi 497315357 form

- Mississippi partial 497315358 form

- Motion summary judgment 497315359 form

- Motion summary judgment order 497315360 form

- Request for admissions mississippi 497315361 form

- Offer of judgment mississippi 497315362 form

- Final judgment mississippi 497315363 form

Find out other Personal Loan

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free