PA 33 NH Department of Revenue Administration Revenue Nh Form

What is the PA 33 NH Department Of Revenue Administration Revenue Nh

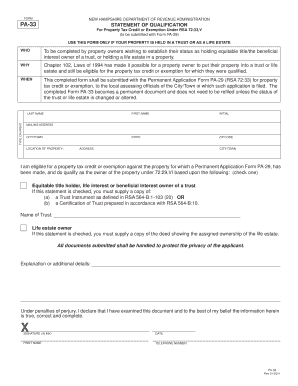

The PA 33 form, issued by the New Hampshire Department of Revenue Administration, is a crucial document used for property tax purposes. This form is specifically designed for reporting the current use of land and property, allowing property owners to apply for tax relief under the Current Use Taxation program. It helps to ensure that properties are assessed fairly based on their actual use rather than their potential market value.

Steps to complete the PA 33 NH Department Of Revenue Administration Revenue Nh

Completing the PA 33 form involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary documentation, including property deeds and previous tax assessments. Next, fill out the form by providing detailed information about the property, including its size, location, and current use. Be sure to review the instructions carefully to avoid any errors. Once completed, sign and date the form before submitting it to the appropriate local authority.

How to use the PA 33 NH Department Of Revenue Administration Revenue Nh

The PA 33 form is utilized primarily by property owners seeking to benefit from New Hampshire's Current Use Taxation program. To use the form effectively, ensure that you meet the eligibility criteria, which typically include owning land that is actively used for agricultural, forest, or conservation purposes. After completing the form, submit it to your local assessing office, where it will be reviewed for approval. This process can help reduce your property tax burden significantly.

Legal use of the PA 33 NH Department Of Revenue Administration Revenue Nh

The legal use of the PA 33 form is governed by New Hampshire state laws regarding property taxation. To be considered legally binding, the form must be filled out accurately and submitted within the designated deadlines. Compliance with state regulations is essential to ensure that the property qualifies for the tax benefits associated with current use. Failure to submit the form correctly may result in penalties or denial of tax relief.

Filing Deadlines / Important Dates

Filing deadlines for the PA 33 form are critical to ensure eligibility for tax relief. Typically, property owners must submit the form by April first of the tax year to qualify for the current use assessment. It is advisable to check with the New Hampshire Department of Revenue Administration for any updates or changes to these deadlines, as they can vary based on local regulations.

Who Issues the Form

The PA 33 form is issued by the New Hampshire Department of Revenue Administration. This state agency is responsible for overseeing property tax assessments and ensuring compliance with relevant tax laws. Property owners can obtain the form directly from the department's website or through local assessing offices, where staff can provide assistance with the application process.

Quick guide on how to complete pa 33 nh department of revenue administration revenue nh

Effortlessly prepare PA 33 NH Department Of Revenue Administration Revenue Nh on any device

Digital document management has become increasingly common among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage PA 33 NH Department Of Revenue Administration Revenue Nh on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign PA 33 NH Department Of Revenue Administration Revenue Nh with ease

- Find PA 33 NH Department Of Revenue Administration Revenue Nh and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to share your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign PA 33 NH Department Of Revenue Administration Revenue Nh and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 33 nh department of revenue administration revenue nh

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 33 NH Department Of Revenue Administration Revenue Nh form?

The PA 33 NH Department Of Revenue Administration Revenue Nh form is a necessary document for businesses operating in New Hampshire, facilitating compliance with state tax laws. airSlate SignNow provides an efficient way to prepare, send, and eSign this form, ensuring smooth submissions without delays.

-

How does airSlate SignNow help with PA 33 NH Department Of Revenue Administration Revenue Nh compliance?

airSlate SignNow simplifies the compliance process with the PA 33 NH Department Of Revenue Administration Revenue Nh by offering templates and streamlined workflows. Our platform ensures that all required information is collected and submitted accurately, helping you avoid penalties.

-

What are the pricing options for using airSlate SignNow for PA 33 NH Department Of Revenue Administration Revenue Nh?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our affordable solutions ensure you can easily manage your paperwork related to the PA 33 NH Department Of Revenue Administration Revenue Nh without breaking the bank.

-

Are there any features that specifically benefit users handling PA 33 NH Department Of Revenue Administration Revenue Nh?

Yes, airSlate SignNow includes specific features such as document templates and bulk sending that cater to users handling the PA 33 NH Department Of Revenue Administration Revenue Nh form. These features help streamline your document management and enhance efficiency.

-

Can I integrate airSlate SignNow with other software while managing PA 33 NH Department Of Revenue Administration Revenue Nh?

Absolutely! airSlate SignNow offers robust integrations with various software applications, allowing you to seamlessly manage the PA 33 NH Department Of Revenue Administration Revenue Nh alongside other business tools. This ensures a cohesive workflow and better productivity.

-

What are the benefits of using airSlate SignNow for eSigning PA 33 NH Department Of Revenue Administration Revenue Nh?

Using airSlate SignNow for eSigning the PA 33 NH Department Of Revenue Administration Revenue Nh brings numerous benefits, such as faster turnaround times and enhanced security. Our platform ensures that your signed documents remain confidential and legally binding.

-

Is there customer support available for assistance with PA 33 NH Department Of Revenue Administration Revenue Nh?

Yes, airSlate SignNow provides dedicated customer support to assist you with any inquiries related to the PA 33 NH Department Of Revenue Administration Revenue Nh. Our knowledgeable team is ready to help you navigate any challenges you might face.

Get more for PA 33 NH Department Of Revenue Administration Revenue Nh

- Associated urologists of nc pa adult patientpop form

- Dr kristofer j jones md locationslos angeles cavitals form

- Consent form

- Mhfa form

- Prior authorization request form intercommunity health network

- Please return the completed student health form including your immunization history the

- Acaria health oncology urology referral form oncology urology referral form

- Acaria health pulmonary arterial hypertenstion referral form pulmonary arterial hypertenstion referral form

Find out other PA 33 NH Department Of Revenue Administration Revenue Nh

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy