SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance Commissioner of Revenue 9104 Courthouse Rd PO Box 175 Spotsylvania VA 22553 017 Form

Understanding the SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance

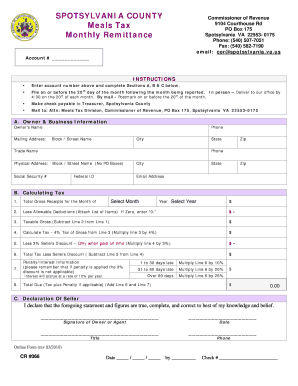

The SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance is a crucial form for businesses operating within Spotsylvania County, Virginia. This form is used to report and remit the meals tax collected from customers. It is essential for compliance with local tax regulations and ensures that businesses contribute to the county's revenue stream. The Commissioner of Revenue oversees the collection and processing of this tax, which is vital for funding local services and infrastructure.

Steps to Complete the SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance

Completing the SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance involves several key steps to ensure accuracy and compliance. First, gather all necessary sales data, including total meals sold and the corresponding tax collected. Next, accurately fill out the form, ensuring that all figures are correct. After completing the form, review it for any errors before submission. Finally, submit the form to the Commissioner of Revenue either online, by mail, or in person, depending on your preference.

Legal Use of the SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance

The SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance is legally binding when completed correctly. It must adhere to the regulations set forth by the local government. The form serves as an official record of the meals tax collected and remitted, which is crucial for both the taxpayer and the county. It is important to ensure that all information is accurate and that the form is submitted by the due date to avoid potential penalties.

Form Submission Methods

There are multiple methods available for submitting the SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance. Businesses can choose to submit the form online through the official county website, ensuring a quick and efficient process. Alternatively, forms can be mailed to the Commissioner of Revenue at the provided address or delivered in person. Each method has its advantages, and businesses should select the one that best suits their operational needs.

Required Documents for Submission

To complete the SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance, certain documents are required. These typically include sales records that detail the total meals sold and the tax collected. It is advisable to maintain accurate records of all transactions to facilitate the completion of the form. Having these documents ready will streamline the process and ensure compliance with local tax laws.

Penalties for Non-Compliance

Failure to comply with the requirements of the SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to adhere to the submission deadlines and ensure that all information provided is accurate to avoid these consequences. Staying informed about local tax regulations can help mitigate the risk of non-compliance.

Key Elements of the SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance

The key elements of the SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance include the total amount of meals sold, the applicable tax rate, and the total tax collected. Additionally, the form requires the business's identification information, including name and address, as well as the signature of the authorized representative. Each of these elements plays a vital role in ensuring the form is processed correctly and in compliance with local regulations.

Quick guide on how to complete spotsylvania county meals tax monthly remittance commissioner of revenue 9104 courthouse rd po box 175 spotsylvania va 22553

Prepare SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance Commissioner Of Revenue 9104 Courthouse Rd PO Box 175 Spotsylvania VA 22553 017 effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It offers a flawless eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance Commissioner Of Revenue 9104 Courthouse Rd PO Box 175 Spotsylvania VA 22553 017 on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to modify and eSign SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance Commissioner Of Revenue 9104 Courthouse Rd PO Box 175 Spotsylvania VA 22553 017 easily

- Locate SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance Commissioner Of Revenue 9104 Courthouse Rd PO Box 175 Spotsylvania VA 22553 017 and select Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you prefer to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance Commissioner Of Revenue 9104 Courthouse Rd PO Box 175 Spotsylvania VA 22553 017 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the spotsylvania county meals tax monthly remittance commissioner of revenue 9104 courthouse rd po box 175 spotsylvania va 22553

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance process?

The SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance process involves submitting your meals tax collections to the Commissioner Of Revenue. You can send the completed forms to 9104 Courthouse Rd PO Box 175 Spotsylvania VA 22553 0175. For any queries or assistance regarding the process, you can contact them via phone at 540 507 7051 or by fax at 540 582 7190.

-

How can I contact the SPOTSYLVANIA COUNTY Commissioner Of Revenue?

To signNow the SPOTSYLVANIA COUNTY Commissioner Of Revenue, you can call their office at 540 507 7051. Alternatively, you can send a fax to 540 582 7190. For any email inquiries, you can signNow out at Cor Spotsylvania.

-

What are the benefits of using airSlate SignNow for SPOTSYLVANIA COUNTY meals tax documents?

Using airSlate SignNow allows for a streamlined and efficient way to manage SPOTSYLVANIA COUNTY meals tax documents. You can easily send and eSign necessary documents securely online, saving time and reducing paper clutter. Our platform ensures compliance with local regulations while improving your workflow.

-

What features does airSlate SignNow offer for tax remittance?

airSlate SignNow offers features like electronic signatures, customizable document templates, and secure storage. These tools help ensure that your SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance documents are prepared accurately and sent on time. Additionally, you can track document status in real-time for better management.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax remittances?

Yes, airSlate SignNow is a cost-effective solution for small businesses handling SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance. Our pricing structures are designed to cater to different business sizes, ensuring that you receive value without breaking the bank. Moreover, the time saved on paperwork can lead to increased productivity.

-

Can I integrate airSlate SignNow with my current accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to manage your financial documents. This integration is particularly useful for ensuring that your SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance aligns with your accounting practices, enhancing both accuracy and efficiency.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow when it comes to handling sensitive documents like the SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance. We employ advanced encryption standards and comply with industry protocols to ensure your information is protected. You can feel confident that your documents are secure with us.

Get more for SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance Commissioner Of Revenue 9104 Courthouse Rd PO Box 175 Spotsylvania VA 22553 017

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497322323 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property ohio form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential ohio form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property ohio form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property ohio form

- Affidavit mechanics lien form

- Ohio termination lease form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497322332 form

Find out other SPOTSYLVANIA COUNTY Meals Tax Monthly Remittance Commissioner Of Revenue 9104 Courthouse Rd PO Box 175 Spotsylvania VA 22553 017

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT