Borneo Housing Form

What is the Borneo Housing?

The Borneo Housing refers to a specific type of housing loan designed to assist individuals in purchasing homes in the Borneo region, particularly in Sarawak. This loan is typically offered by financial institutions such as Borneo Housing Mortgage Finance Berhad. It aims to provide accessible financing options for homebuyers, making it easier for them to secure a property. The Borneo Housing loan typically includes various terms and conditions that borrowers must meet to qualify.

How to Obtain the Borneo Housing Loan

Obtaining a Borneo Housing loan involves several steps that potential borrowers should follow. First, it is essential to assess your financial situation and determine how much you can afford to borrow. Next, gather necessary documentation, which may include proof of income, credit history, and identification. After preparing your documents, approach a lender that offers Borneo Housing loans. They will guide you through the application process, which may involve filling out forms and providing additional information. Once your application is submitted, the lender will review it and notify you of their decision.

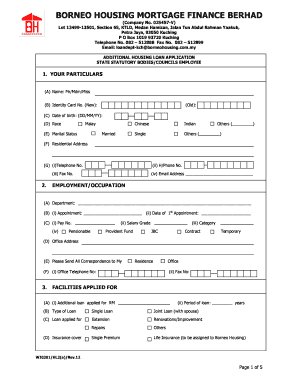

Steps to Complete the Borneo Housing Application

Completing the application for a Borneo Housing loan requires careful attention to detail. Begin by collecting all required documents, including your financial statements and identification. Next, fill out the application form accurately, ensuring all information is up to date. After submitting your application, keep track of its status by maintaining communication with your lender. They may request further information or clarification during the review process. Once approved, you will receive a loan offer outlining the terms and conditions.

Legal Use of the Borneo Housing Loan

The legal use of a Borneo Housing loan is essential for ensuring compliance with local laws and regulations. Borrowers must use the funds for purchasing residential properties as specified in the loan agreement. It is important to understand the legal implications of the loan, including repayment terms and obligations. Failure to comply with these terms can result in penalties or foreclosure. Therefore, it is advisable to consult with a legal professional if you have questions about the legal aspects of your Borneo Housing loan.

Required Documents for the Borneo Housing Loan

When applying for a Borneo Housing loan, specific documents are typically required to support your application. These may include:

- Proof of income, such as pay stubs or tax returns

- Credit report to assess creditworthiness

- Identification documents, including a government-issued ID

- Bank statements to verify financial stability

- Details of the property you intend to purchase

Gathering these documents in advance can help streamline the application process and increase the chances of approval.

Eligibility Criteria for the Borneo Housing Loan

Eligibility for a Borneo Housing loan varies by lender but generally includes several key criteria. Borrowers typically need to demonstrate a stable income and a good credit history. Age and residency status may also play a role in eligibility. Additionally, lenders may require a minimum down payment, which can differ based on the property type and loan amount. Understanding these criteria beforehand can help applicants prepare and improve their chances of securing a loan.

Quick guide on how to complete borneo housing

Effortlessly Prepare Borneo Housing on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Borneo Housing on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The Easiest Way to Edit and eSign Borneo Housing with Ease

- Find Borneo Housing and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and has the same legal standing as a conventional wet ink signature.

- Review the information and click the Done button to store your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device of your choice. Edit and eSign Borneo Housing while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borneo housing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Borneo housing loan?

A Borneo housing loan is a financial product designed to help potential homeowners in Borneo finance the purchase of residential properties. These loans typically offer competitive interest rates and flexible repayment terms, making it easier for individuals to acquire their dream homes in the region.

-

Who is eligible for a Borneo housing loan?

Eligibility for a Borneo housing loan generally depends on several factors, including your income, credit score, and employment status. Most lenders require borrowers to provide proof of income and maintain a healthy credit history to qualify for these loans, ensuring borrowers can meet their repayment obligations.

-

What are the typical interest rates for a Borneo housing loan?

Interest rates for a Borneo housing loan can vary depending on the lender and the specific terms of the loan. Typically, rates can range from 3% to 7%, with fixed or variable options available, allowing borrowers to choose the best option tailored to their financial situation.

-

What documents do I need to apply for a Borneo housing loan?

To apply for a Borneo housing loan, you will typically need to provide identification, proof of income (such as pay stubs or tax returns), bank statements, and details of the property you wish to purchase. Ensuring that all documentation is complete can speed up the approval process.

-

How long does it take to process a Borneo housing loan?

The processing time for a Borneo housing loan can vary from one lender to another, but it generally takes between 2 to 6 weeks. Factors that influence the timeline include the completeness of your application, the paperwork provided, and the lender’s workload.

-

What are the benefits of a Borneo housing loan?

A Borneo housing loan offers numerous benefits, including financing options that make home ownership accessible, flexibility in repayment plans, and potential tax benefits. Additionally, these loans can help you build equity in your property over time, contributing to your long-term financial stability.

-

Are there any fees associated with a Borneo housing loan?

Yes, there can be various fees associated with a Borneo housing loan, such as application fees, processing fees, and valuation fees. It's essential to review the fee structure with your lender to understand all potential costs involved in securing your housing loan.

Get more for Borneo Housing

Find out other Borneo Housing

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter