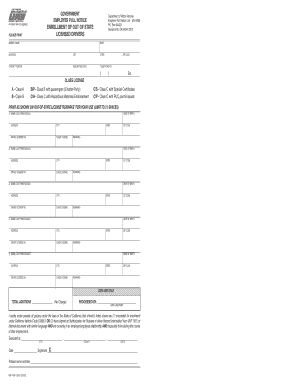

Inf 1103 Form

What is the Inf 1112 Form

The Inf 1112 form is a document used primarily for reporting and managing specific tax-related information within the United States. This form is essential for individuals and businesses that need to comply with federal tax regulations. It serves as a means to provide necessary data to the Internal Revenue Service (IRS) and ensures that taxpayers fulfill their obligations accurately and efficiently.

How to Obtain the Inf 1112 Form

Obtaining the Inf 1112 form is straightforward. Taxpayers can access the form through the official IRS website, where it is available for download in a printable format. Additionally, local IRS offices may provide physical copies of the form. It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to Complete the Inf 1112 Form

Completing the Inf 1112 form involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Fill out the form accurately, ensuring that all required fields are completed.

- Double-check the information for accuracy to prevent errors that could lead to delays.

- Sign and date the form as required.

- Submit the completed form through the appropriate channels, whether online, by mail, or in person.

Legal Use of the Inf 1112 Form

The Inf 1112 form must be used in accordance with IRS guidelines to ensure its legal validity. This includes adhering to deadlines for submission and providing accurate information. Failure to comply with these regulations can result in penalties or legal repercussions. It is crucial for taxpayers to understand the legal implications of their submissions and to maintain proper records for future reference.

Key Elements of the Inf 1112 Form

Several key elements must be included when completing the Inf 1112 form:

- Personal Information: This includes the taxpayer's name, address, and Social Security number.

- Income Details: Accurate reporting of all income sources is essential.

- Deductions and Credits: Any applicable deductions or credits should be clearly stated.

- Signature: The form must be signed by the taxpayer or an authorized representative.

Form Submission Methods

The Inf 1112 form can be submitted through various methods, catering to different preferences and needs:

- Online Submission: Taxpayers can file electronically through the IRS e-file system.

- Mail: The completed form can be mailed to the designated IRS address.

- In-Person: Individuals may also submit the form at local IRS offices for immediate processing.

Quick guide on how to complete inf 1103

Complete Inf 1103 effortlessly on any device

Digital document management has gained increased traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without interruptions. Manage Inf 1103 on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Inf 1103 effortlessly

- Obtain Inf 1103 and then click Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your edits.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Inf 1103 to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inf 1103

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the inf 1112 form and why is it important?

The inf 1112 form is a tax document used by businesses to provide essential financial information to tax authorities. Understanding and correctly filling out the inf 1112 form is crucial for compliance and avoiding potential penalties. airSlate SignNow allows you to manage this process efficiently, ensuring that your documents are signed and submitted accurately.

-

How can airSlate SignNow help with the completion of the inf 1112 form?

airSlate SignNow streamlines the process of filling out the inf 1112 form by providing an intuitive electronic signing platform. With features such as document templates and in-app guidance, you can easily complete the inf 1112 form without fear of errors. Our solution is designed to save you time while ensuring compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the inf 1112 form?

Yes, airSlate SignNow offers a range of pricing plans tailored to meet different business needs. You can choose a plan that fits your budget while accessing powerful features to manage forms like the inf 1112 form. By investing in our solution, you gain a cost-effective way to eSign and manage important documents.

-

What features does airSlate SignNow offer for managing the inf 1112 form?

airSlate SignNow provides a host of features such as document templates, customizable workflows, and real-time tracking that help in managing the inf 1112 form. Moreover, you can collaborate with your team seamlessly, ensuring everyone involved can sign and complete the document efficiently. These features enhance productivity and streamline compliance.

-

Can I integrate airSlate SignNow with other software for the inf 1112 form?

Definitely! airSlate SignNow offers robust integrations with various platforms, making it easy to synchronize your workflow for managing the inf 1112 form. Whether you use accounting software or customer relationship management systems, our integrations ensure a seamless experience and improved document handling.

-

What benefits does airSlate SignNow provide for businesses dealing with the inf 1112 form?

Using airSlate SignNow to manage the inf 1112 form offers numerous benefits, including improved efficiency, reduced errors, and faster turnaround times. Our electronic signing solution simplifies document management, allowing your business to focus on growth rather than paperwork. You can ensure that your inf 1112 form is completed and submitted in a timely manner.

-

How secure is airSlate SignNow when handling the inf 1112 form?

AirSlate SignNow places a high priority on security, providing encryption and secure data storage for your inf 1112 form. This ensures that sensitive information is protected from unauthorized access, giving you peace of mind as you handle important documents. Our platform complies with various industry security standards to safeguard your data.

Get more for Inf 1103

- Senior trip 2018 payment plan wall township public schools www2 wall k12 nj form

- Student listening form

- Chapter 10 dihybrid cross worksheet answer key form

- Downloadable grade 1 8 recommendation form ebisa

- Economics ia cover sheet form

- Chess club sign up sheetpdf mhef mhef form

- Cnn 10 student news worksheet form

- Nshe transcript form

Find out other Inf 1103

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now