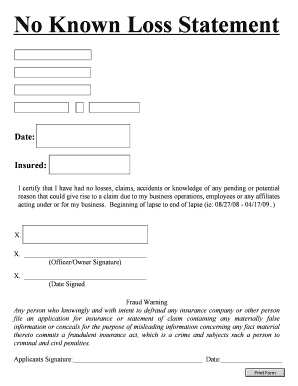

No Known Loss Statement Date Ramsgate Insurance, Inc Form

Understanding the No Known Loss Letter

The no known loss letter is a crucial document in the insurance industry, particularly for businesses and property owners. This letter serves as a formal declaration that the policyholder has not experienced any losses or claims during a specified period. It is often required when applying for new insurance policies or renewing existing ones, as it helps insurers assess risk and determine premium rates. The letter must be clear, concise, and include relevant details such as the policyholder's name, policy number, and the time frame for which the statement applies.

Key Elements of a No Known Loss Letter

When drafting a no known loss letter, certain elements must be included to ensure its validity and effectiveness. These elements typically consist of:

- Policyholder Information: Name and contact details of the individual or business.

- Insurance Policy Details: Policy number and type of coverage.

- Time Frame: Specific dates indicating the period for which no losses have occurred.

- Signature: A signature from an authorized representative to validate the statement.

- Date of Issue: The date when the letter is created.

Steps to Complete the No Known Loss Letter

Filling out a no known loss letter involves several straightforward steps. Following these steps can help ensure that the document is completed accurately:

- Gather all necessary information, including your insurance policy details and any relevant dates.

- Draft the letter, ensuring that it includes all key elements mentioned earlier.

- Review the letter for accuracy and clarity, making sure all information is correct.

- Sign the letter, either electronically or by hand, depending on your submission method.

- Submit the letter to your insurance provider as required, either online or via traditional mail.

Legal Use of the No Known Loss Letter

The no known loss letter holds legal significance in the insurance context. It serves as a formal statement that can be used to establish the absence of claims or losses during the specified period. This can impact the underwriting process and may influence the terms of coverage or premium rates. It is essential to ensure that the letter is truthful and accurate, as providing false information could result in penalties or denial of coverage.

Obtaining a No Known Loss Letter Template

To simplify the process of creating a no known loss letter, many businesses and individuals can benefit from using a template. A no known loss letter template typically includes pre-formatted sections for entering key information, making it easier to ensure that all necessary details are included. Templates can be found online or created using word processing software. It is advisable to customize any template to reflect your specific situation and ensure compliance with your insurance provider's requirements.

Examples of No Known Loss Letters

Reviewing examples of no known loss letters can provide valuable insights into how to structure your own document. These examples often illustrate various formats and styles, highlighting the essential elements that must be included. By examining different samples, you can gain a better understanding of how to effectively communicate your no known loss status to your insurer.

Quick guide on how to complete no known loss statement date ramsgate insurance inc

Complete No Known Loss Statement Date Ramsgate Insurance, Inc seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute to conventional printed and signed papers, enabling you to find the correct template and securely store it online. airSlate SignNow equips you with all the functionalities needed to generate, modify, and eSign your documents rapidly without holdups. Manage No Known Loss Statement Date Ramsgate Insurance, Inc on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

How to modify and eSign No Known Loss Statement Date Ramsgate Insurance, Inc effortlessly

- Find No Known Loss Statement Date Ramsgate Insurance, Inc and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Adjust and eSign No Known Loss Statement Date Ramsgate Insurance, Inc and guarantee excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the no known loss statement date ramsgate insurance inc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a no known loss letter insurance template?

A no known loss letter insurance template is a document confirming that there are no known losses or claims against the insured property. This template streamlines the process of assuring potential insurers or stakeholders that everything is in good standing, which can be crucial for securing new coverage or maintaining existing policies.

-

How can the no known loss letter insurance template benefit my business?

Using a no known loss letter insurance template can help your business demonstrate financial responsibility and transparency. This can build trust with insurers and clients, potentially resulting in lower premiums and better policy terms, as insurers are often more willing to provide coverage to risk-aware businesses.

-

Is the no known loss letter insurance template customizable?

Yes, the no known loss letter insurance template is fully customizable to fit your business's specific needs. You can easily modify the language and sections to reflect accurate details about your property and insurance coverage, ensuring that the document meets regulatory requirements and personal preferences.

-

What features does the airSlate SignNow platform offer for creating the no known loss letter insurance template?

airSlate SignNow offers a user-friendly interface, customizable templates, and eSignature functionality for creating the no known loss letter insurance template. Additionally, it includes collaboration tools, so multiple team members can review and sign off on the document seamlessly, making the whole process efficient and hassle-free.

-

How much does it cost to use the no known loss letter insurance template with airSlate SignNow?

The cost of using the no known loss letter insurance template with airSlate SignNow varies depending on the subscription plan chosen. Pricing starts at a competitive rate that offers pay-as-you-go options, ensuring that businesses of all sizes can afford to streamline their documentation process without breaking the bank.

-

Can I integrate the no known loss letter insurance template with other applications?

Yes, the airSlate SignNow platform supports integrations with various applications, allowing you to streamline workflows. This means you can easily connect your no known loss letter insurance template with CRM systems, cloud storage services, and other tools to enhance productivity and maintain organized records.

-

How long does it take to generate a no known loss letter insurance template?

Generating a no known loss letter insurance template with airSlate SignNow can take just a few minutes. With available pre-built templates and guided prompts, businesses can quickly fill out necessary information and have a compliant, ready-to-sign document in no time.

Get more for No Known Loss Statement Date Ramsgate Insurance, Inc

Find out other No Known Loss Statement Date Ramsgate Insurance, Inc

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement