EMPLOYEE UPDATE FORM Bottom Line Tax Services

What is the EMPLOYEE UPDATE FORM Bottom Line Tax Services

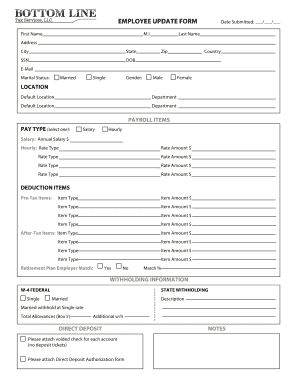

The EMPLOYEE UPDATE FORM Bottom Line Tax Services is a crucial document designed to facilitate the process of updating employee information within an organization. This form typically captures essential details such as changes in personal information, tax withholding preferences, and employment status. By ensuring that all employee data is current, businesses can maintain accurate records for payroll, tax reporting, and compliance with federal and state regulations.

How to use the EMPLOYEE UPDATE FORM Bottom Line Tax Services

Using the EMPLOYEE UPDATE FORM Bottom Line Tax Services is a straightforward process. Employees should first download the form from a reliable source or request it from their HR department. After obtaining the form, employees need to fill in their updated information accurately. Once completed, the form should be submitted according to the company's submission guidelines, which may include electronic submission through a secure portal or physical delivery to the HR department.

Steps to complete the EMPLOYEE UPDATE FORM Bottom Line Tax Services

Completing the EMPLOYEE UPDATE FORM Bottom Line Tax Services involves several key steps:

- Download the form from the designated source.

- Fill in the required fields, including personal details and any changes in employment status.

- Review the information for accuracy to prevent any discrepancies.

- Sign and date the form to validate the updates.

- Submit the completed form as per your organization’s procedures.

Legal use of the EMPLOYEE UPDATE FORM Bottom Line Tax Services

The EMPLOYEE UPDATE FORM Bottom Line Tax Services is legally binding when completed correctly. To ensure its legality, the form must comply with relevant laws, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act, which governs electronic signatures. Additionally, the form should include a signature that verifies the employee's consent to the changes being made, thereby protecting both the employee and the employer in case of any disputes.

Key elements of the EMPLOYEE UPDATE FORM Bottom Line Tax Services

Key elements of the EMPLOYEE UPDATE FORM Bottom Line Tax Services include:

- Employee Identification: Name, employee ID, and contact information.

- Updated Information: Changes in address, phone number, or marital status.

- Tax Information: Adjustments to withholding allowances or filing status.

- Signature and Date: Verification of the information provided by the employee.

Form Submission Methods

Submitting the EMPLOYEE UPDATE FORM Bottom Line Tax Services can typically be done through various methods, including:

- Online Submission: Many organizations allow employees to submit forms electronically via a secure portal.

- Mail: Employees may also send the completed form through postal mail to the HR department.

- In-Person: Delivering the form directly to HR can ensure immediate processing and confirmation.

Quick guide on how to complete employee update form bottom line tax services

Complete EMPLOYEE UPDATE FORM Bottom Line Tax Services effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle EMPLOYEE UPDATE FORM Bottom Line Tax Services on any device with the airSlate SignNow Android or iOS applications and streamline any document-based procedure today.

The simplest way to alter and eSign EMPLOYEE UPDATE FORM Bottom Line Tax Services with ease

- Obtain EMPLOYEE UPDATE FORM Bottom Line Tax Services and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign EMPLOYEE UPDATE FORM Bottom Line Tax Services and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee update form bottom line tax services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EMPLOYEE UPDATE FORM at Bottom Line Tax Services?

The EMPLOYEE UPDATE FORM at Bottom Line Tax Services is a vital document that enables businesses to efficiently update employee information. This form simplifies the process of maintaining current and accurate employee records, ensuring compliance with tax and regulatory requirements.

-

How does the EMPLOYEE UPDATE FORM streamline HR processes?

By using the EMPLOYEE UPDATE FORM from Bottom Line Tax Services, HR departments can automate the information update process, signNowly reducing paperwork and manual errors. This leads to enhanced productivity and allows HR staff to focus on more strategic tasks within the organization.

-

Is the EMPLOYEE UPDATE FORM customizable?

Yes, the EMPLOYEE UPDATE FORM at Bottom Line Tax Services can be customized to meet the specific needs of your organization. You can add sections, modify the layout, and include tailored instructions to ensure it fits seamlessly into your existing HR processes.

-

What are the pricing options for the EMPLOYEE UPDATE FORM?

The pricing for the EMPLOYEE UPDATE FORM from Bottom Line Tax Services is competitive and designed to offer value for businesses of all sizes. For specific pricing inquiries, you can contact our sales team or visit our pricing page to explore flexible plans that suit your budget.

-

What are the key benefits of using the EMPLOYEE UPDATE FORM?

Using the EMPLOYEE UPDATE FORM at Bottom Line Tax Services provides numerous benefits, including improved data accuracy, time-saving efficiencies, and enhanced employee communication. This ensures that your HR processes are compliant and effective, ultimately leading to greater organizational success.

-

Can the EMPLOYEE UPDATE FORM integrate with other software?

Absolutely! The EMPLOYEE UPDATE FORM from Bottom Line Tax Services can integrate seamlessly with popular HR software and payroll systems. This integration allows for a smooth data transfer, helping to maintain accurate employee records across all platforms without additional manual input.

-

How secure is the EMPLOYEE UPDATE FORM considering sensitive information?

The EMPLOYEE UPDATE FORM at Bottom Line Tax Services is built with security in mind. We utilize advanced encryption and secure data handling protocols to protect sensitive employee information, ensuring compliance with data protection regulations and safeguarding your organization’s reputation.

Get more for EMPLOYEE UPDATE FORM Bottom Line Tax Services

Find out other EMPLOYEE UPDATE FORM Bottom Line Tax Services

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later